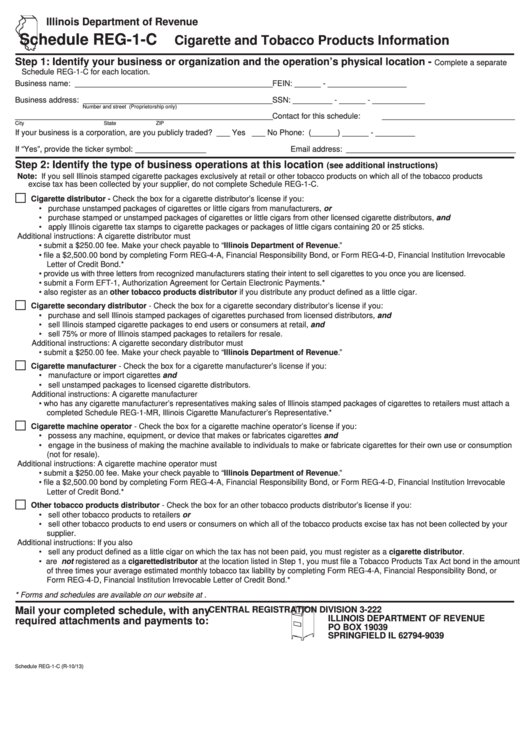

Illinois Department of Revenue

Schedule REG-1-C

Cigarette and Tobacco Products Information

Step 1: Identify your business or organization and the operation’s physical location -

Complete a separate

Schedule REG-1-C for each location.

Business name: _____________________________________________

FEIN: ______ - __________________

Business address: ___________________________________________

SSN: _________ - ______ - ____________

Number and street

(Proprietorship only)

__________________________________________________________

Contact for this schedule: ______________________________

City

State

ZIP

If your business is a corporation, are you publicly traded? ___ Yes ___ No

Phone: (______) ______ - _________

If “Yes”, provide the ticker symbol: ________________

Email address: ______________________________________

Step 2: Identify the type of business operations at this location

(see additional instructions)

Note: If you sell Illinois stamped cigarette packages exclusively at retail or other tobacco products on which all of the tobacco products

excise tax has been collected by your supplier, do not complete Schedule REG-1-C.

Cigarette distributor - Check the box for a cigarette distributor’s license if you:

• purchase unstamped packages of cigarettes or little cigars from manufacturers, or

• purchase stamped or unstamped packages of cigarettes or little cigars from other licensed cigarette distributors, and

• apply Illinois cigarette tax stamps to cigarette packages or packages of little cigars containing 20 or 25 sticks.

Additional instructions: A cigarette distributor must

• submit a $250.00 fee. Make your check payable to “Illinois Department of Revenue.”

• file a $2,500.00 bond by completing Form REG-4-A, Financial Responsibility Bond, or Form REG-4-D, Financial Institution Irrevocable

Letter of Credit Bond.*

• provide us with three letters from recognized manufacturers stating their intent to sell cigarettes to you once you are licensed.

• submit a Form EFT-1, Authorization Agreement for Certain Electronic Payments.*

• also register as an other tobacco products distributor if you distribute any product defined as a little cigar.

Cigarette secondary distributor - Check the box for a cigarette secondary distributor’s license if you:

• purchase and sell Illinois stamped packages of cigarettes purchased from licensed distributors, and

• sell Illinois stamped cigarette packages to end users or consumers at retail, and

• sell 75% or more of Illinois stamped packages to retailers for resale.

Additional instructions: A cigarette secondary distributor must

• submit a $250.00 fee. Make your check payable to “Illinois Department of Revenue.”

Cigarette manufacturer - Check the box for a cigarette manufacturer’s license if you:

• manufacture or import cigarettes and

• sell unstamped packages to licensed cigarette distributors.

Additional instructions: A cigarette manufacturer

• who has any cigarette manufacturer’s representatives making sales of Illinois stamped packages of cigarettes to retailers must attach a

completed Schedule REG-1-MR, Illinois Cigarette Manufacturer’s Representative.*

Cigarette machine operator - Check the box for a cigarette machine operator’s license if you:

• possess any machine, equipment, or device that makes or fabricates cigarettes and

• engage in the business of making the machine available to individuals to make or fabricate cigarettes for their own use or consumption

(not for resale).

Additional instructions: A cigarette machine operator must

• submit a $250.00 fee. Make your check payable to “Illinois Department of Revenue.”

• file a $2,500.00 bond by completing Form REG-4-A, Financial Responsibility Bond, or Form REG-4-D, Financial Institution Irrevocable

Letter of Credit Bond.*

Other tobacco products distributor - Check the box for an other tobacco products distributor’s license if you:

• sell other tobacco products to retailers or

• sell other tobacco products to end users or consumers on which all of the tobacco products excise tax has not been collected by your

supplier.

Additional instructions: If you also

• sell any product defined as a little cigar on which the tax has not been paid, you must register as a cigarette distributor.

• are not registered as a cigarette distributor at the location listed in Step 1, you must file a Tobacco Products Tax Act bond in the amount

of three times your average estimated monthly tobacco tax liability by completing Form REG-4-A, Financial Responsibility Bond, or

Form REG-4-D, Financial Institution Irrevocable Letter of Credit Bond.*

* Forms and schedules are available on our website at tax.illinois.gov.

Mail your completed schedule, with any

CENTRAL REGISTRATION DIVISION 3-222

ILLINOIS DEPARTMENT OF REVENUE

required attachments and payments to:

PO BOX 19039

SPRINGFIELD IL 62794-9039

Schedule REG-1-C (R-10/13)

1

1