CIG 57

Rev. 3/09

Reset Form

P.O. Box 530

Columbus, OH 43216-0530

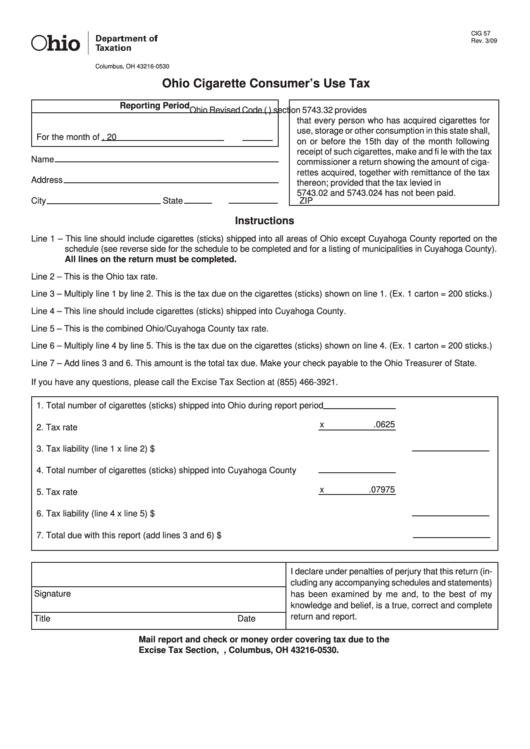

Ohio Cigarette Consumer’s Use Tax

Reporting Period

Ohio Revised Code (R.C.) section 5743.32 provides

that every person who has acquired cigarettes for

use, storage or other consumption in this state shall,

For the month of

, 20

on or before the 15th day of the month following

receipt of such cigarettes, make and fi le with the tax

Name

commissioner a return showing the amount of ciga-

rettes acquired, together with remittance of the tax

Address

thereon; provided that the tax levied in R.C. section

5743.02 and 5743.024 has not been paid.

City

State

ZIP

Instructions

Line 1 – This line should include cigarettes (sticks) shipped into all areas of Ohio except Cuyahoga County reported on the

schedule (see reverse side for the schedule to be completed and for a listing of municipalities in Cuyahoga County).

All lines on the return must be completed.

Line 2 – This is the Ohio tax rate.

Line 3 – Multiply line 1 by line 2. This is the tax due on the cigarettes (sticks) shown on line 1. (Ex. 1 carton = 200 sticks.)

Line 4 – This line should include cigarettes (sticks) shipped into Cuyahoga County.

Line 5 – This is the combined Ohio/Cuyahoga County tax rate.

Line 6 – Multiply line 4 by line 5. This is the tax due on the cigarettes (sticks) shown on line 4. (Ex. 1 carton = 200 sticks.)

Line 7 – Add lines 3 and 6. This amount is the total tax due. Make your check payable to the Ohio Treasurer of State.

If you have any questions, please call the Excise Tax Section at (855) 466-3921.

1. Total number of cigarettes (sticks) shipped into Ohio during report period

x

.0625

2. Tax rate ...................................................................................................

3. Tax liability (line 1 x line 2) ......................................................................................................... $

4. Total number of cigarettes (sticks) shipped into Cuyahoga County .......

x

.07975

5. Tax rate ...................................................................................................

6. Tax liability (line 4 x line 5) ......................................................................................................... $

7. Total due with this report (add lines 3 and 6) ............................................................................. $

I declare under penalties of perjury that this return (in-

cluding any accompanying schedules and statements)

Signature

has been examined by me and, to the best of my

knowledge and belief, is a true, correct and complete

return and report.

Title

Date

Mail report and check or money order covering tax due to the

Excise Tax Section, P.O. Box 530, Columbus, OH 43216-0530.

1

1 2

2