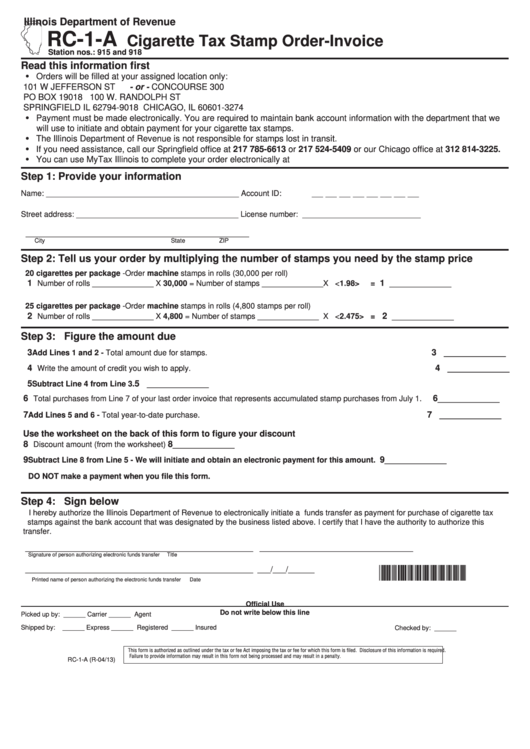

Illinois Department of Revenue

RC-1-A

Cigarette Tax Stamp Order-Invoice

Station nos.: 915 and 918

Read this information first

• Orders will be filled at your assigned location only:

101 W JEFFERSON ST

- or -

CONCOURSE 300

PO BOX 19018

100 W. RANDOLPH ST

SPRINGFIELD IL 62794-9018

CHICAGO, IL 60601-3274

• Payment must be made electronically. You are required to maintain bank account information with the department that we

will use to initiate and obtain payment for your cigarette tax stamps.

• The Illinois Department of Revenue is not responsible for stamps lost in transit.

• If you need assistance, call our Springfield office at 217 785-6613 or 217 524-5409 or our Chicago office at 312 814-3225.

• You can use MyTax Illinois to complete your order electronically at tax.illinois.gov.

Step 1: Provide your information

Name: ____________________________________________

Account ID: __ __ __ __ __ __ __ __

Street address: _____________________________________

License number: ___________________________

_______________________________________________

City

State

ZIP

Step 2: Tell us your order by multiplying the number of stamps you need by the stamp price

20 cigarettes per package - Order machine stamps in rolls (30,000 per roll)

1

1 _____________

Number of rolls ______________ X 30,000 = Number of stamps ______________X <1.98>

=

25 cigarettes per package - Order machine stamps in rolls (4,800 stamps per roll)

2

2 _____________

Number of rolls ______________ X 4,800 = Number of stamps ______________ X <2.475> =

Step 3: Figure the amount due

3

3 _____________

Add Lines 1 and 2 - Total amount due for stamps.

4

4 _____________

Write the amount of credit you wish to apply.

5

5 _____________

Subtract Line 4 from Line 3.

6

6 _____________

Total purchases from Line 7 of your last order invoice that represents accumulated stamp purchases from July 1.

7

7 _____________

Add Lines 5 and 6 - Total year-to-date purchase.

Use the worksheet on the back of this form to figure your discount

8

8 _____________

Discount amount (from the worksheet)

9

9 _____________

Subtract Line 8 from Line 5 - We will initiate and obtain an electronic payment for this amount.

DO NOT make a payment when you file this form.

Step 4: Sign below

I hereby authorize the Illinois Department of Revenue to electronically initiate a funds transfer as payment for purchase of cigarette tax

stamps against the bank account that was designated by the business listed above. I certify that I have the authority to authorize this

transfer.

____________________________________________________

___________________________________

Signature of person authorizing electronic funds transfer

Title

*343121110*

____________________________________________________

___/___/______

Printed name of person authorizing the electronic funds transfer

Date

Official Use

Do not write below this line

Picked up by:

______ Carrier

______ Agent

Shipped by:

______ Express

______ Registered

______ Insured

Checked by:

______

This form is authorized as outlined under the tax or fee Act imposing the tax or fee for which this form is filed. Disclosure of this information is required.

Failure to provide information may result in this form not being processed and may result in a penalty.

RC-1-A (R-04/13)

1

1 2

2