RESET

PRINT

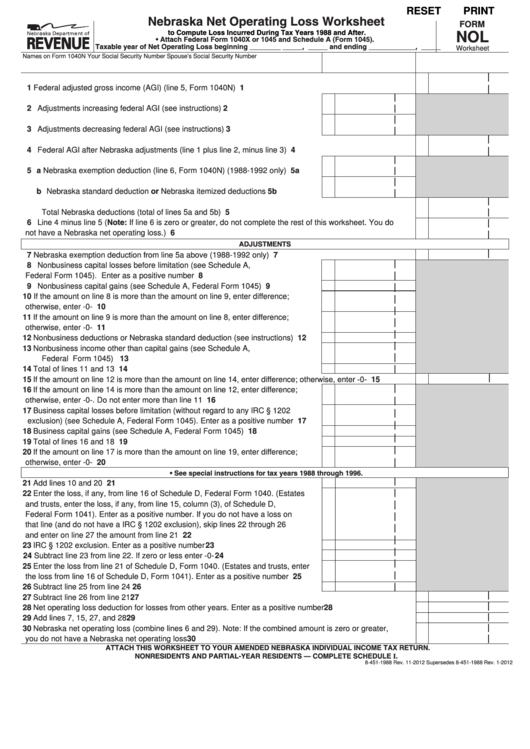

Nebraska Net Operating Loss Worksheet

FORM

to Compute Loss Incurred During Tax Years 1988 and After.

NOL

• Attach Federal Form 1040X or 1045 and Schedule A (Form 1045).

Taxable year of Net Operating Loss beginning _____________, _____ and ending ____________, _____

Worksheet

Names on Form 1040N

Your Social Security Number

Spouse’s Social Security Number

1 Federal adjusted gross income (AGI) (line 5, Form 1040N) .................................................................................. 1

2 Adjustments increasing federal AGI (see instructions) ............................................... 2

3 Adjustments decreasing federal AGI (see instructions) .............................................. 3

4 Federal AGI after Nebraska adjustments (line 1 plus line 2, minus line 3) ............................................................ 4

5 a Nebraska exemption deduction (line 6, Form 1040N) (1988-1992 only) ............... 5a

b Nebraska standard deduction or Nebraska itemized deductions ........................... 5b

Total Nebraska deductions (total of lines 5a and 5b) ............................................................................................ 5

6 Line 4 minus line 5 (Note: If line 6 is zero or greater, do not complete the rest of this worksheet. You do

not have a Nebraska net operating loss.) .............................................................................................................. 6

ADJUSTMENTS

7 Nebraska exemption deduction from line 5a above (1988-1992 only) .................................................................. 7

8 Nonbusiness capital losses before limitation (see Schedule A,

Federal Form 1045). Enter as a positive number .....................................................

8

9 Nonbusiness capital gains (see Schedule A, Federal Form 1045) ............................

9

10 If the amount on line 8 is more than the amount on line 9, enter difference;

otherwise, enter -0- ................................................................................................... 10

11 If the amount on line 9 is more than the amount on line 8, enter difference;

otherwise, enter -0- ................................................................................................... 11

12 Nonbusiness deductions or Nebraska standard deduction (see instructions) ........... 12

13 Nonbusiness income other than capital gains (see Schedule A,

Federal Form 1045) ................................................................................................. 13

14 Total of lines 11 and 13 ............................................................................................. 14

15 If the amount on line 12 is more than the amount on line 14, enter difference; otherwise, enter -0- .................... 15

16 If the amount on line 14 is more than the amount on line 12, enter difference;

otherwise, enter -0-. Do not enter more than line 11 ................................................. 16

17 Business capital losses before limitation (without regard to any IRC § 1202

exclusion) (see Schedule A, Federal Form 1045). Enter as a positive number ........ 17

18 Business capital gains (see Schedule A, Federal Form 1045) .................................. 18

19 Total of lines 16 and 18 ............................................................................................. 19

20 If the amount on line 17 is more than the amount on line 19, enter difference;

otherwise, enter -0- ................................................................................................... 20

• See special instructions for tax years 1988 through 1996.

21 Add lines 10 and 20 ................................................................................................... 21

22 Enter the loss, if any, from line 16 of Schedule D, Federal Form 1040. (Estates

and trusts, enter the loss, if any, from line 15, column (3), of Schedule D,

Federal Form 1041). Enter as a positive number. If you do not have a loss on

that line (and do not have a IRC § 1202 exclusion), skip lines 22 through 26

and enter on line 27 the amount from line 21 ............................................................ 22

23 IRC § 1202 exclusion. Enter as a positive number ..................................................... 23

24 Subtract line 23 from line 22. If zero or less enter -0- ................................................. 24

25 Enter the loss from line 21 of Schedule D, Form 1040. (Estates and trusts, enter

the loss from line 16 of Schedule D, Form 1041). Enter as a positive number .......... 25

26 Subtract line 25 from line 24 ....................................................................................... 26

27 Subtract line 26 from line 21 .................................................................................................................................. 27

28 Net operating loss deduction for losses from other years. Enter as a positive number ......................................... 28

29 Add lines 7, 15, 27, and 28 .................................................................................................................................... 29

30 Nebraska net operating loss (combine lines 6 and 29). Note: If the combined amount is zero or greater,

you do not have a Nebraska net operating loss .................................................................................................... 30

ATTACH THIS WORKSHEET TO YOUR AMENDED NEBRASKA INDIVIDUAL INCOME TAX RETURN.

NONRESIDENTS AND PARTIAL-YEAR RESIDENTS — COMPLETE SCHEDULE I.

8-451-1988 Rev. 11-2012 Supersedes 8-451-1988 Rev. 1-2012

1

1 2

2 3

3