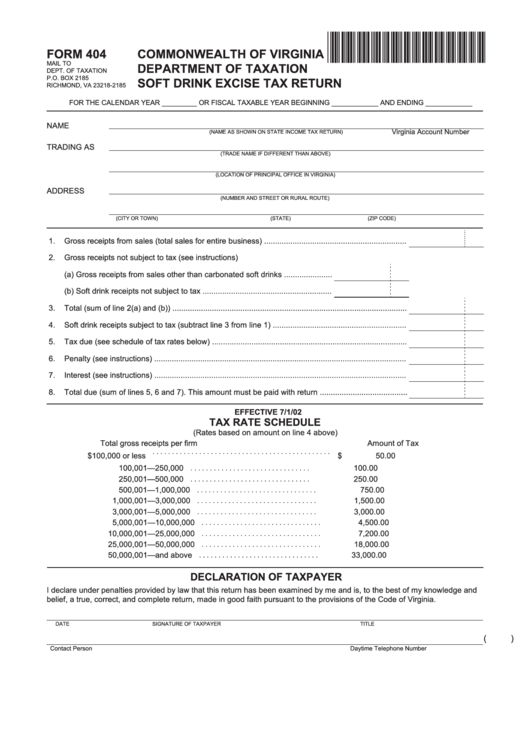

form 404

commonwealth of virginia

mail to

department of taxation

dept. of taxation

p.o. box 2185

soft drink excise tax return

richmond, va 23218-2185

for the calendar year _________ or fiscal taxable year beginning ____________ and ending ____________

name

virginia account number

(name as shown on state income tax return)

trading as

(trade name if different than above)

(location of principal office in virginia)

address

(number and street or rural route)

(city or town)

(state)

(zip code)

1.

gross receipts from sales (total sales for entire business) .................................................................

2.

gross receipts not subject to tax (see instructions)

(a) gross receipts from sales other than carbonated soft drinks ......................

(b) soft drink receipts not subject to tax ...........................................................

3.

total (sum of line 2(a) and (b)) ...........................................................................................................

4.

soft drink receipts subject to tax (subtract line 3 from line 1) .............................................................

5.

tax due (see schedule of tax rates below) .........................................................................................

6.

penalty (see instructions) ...................................................................................................................

7.

interest (see instructions) ...................................................................................................................

8.

total due (sum of lines 5, 6 and 7). this amount must be paid with return ........................................

effective 7/1/02

tax rate schedule

(rates based on amount on line 4 above)

total gross receipts per firm

amount of tax

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

100,000 or less

$

50.00

100,001

—

250,000

100.00

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

250,001

—

500,000

250.00

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

500,001

—

1,000,000

750.00

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1,000,001

—

3,000,000

1,500.00

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3,000,001

—

5,000,000

3,000.00

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5,000,001

—

10,000,000

4,500.00

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10,000,001

—

25,000,000

7,200.00

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

25,000,001

—

50,000,000

18,000.00

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

50,000,001

—

and above

33,000.00

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

declaration of taxpayer

i declare under penalties provided by law that this return has been examined by me and is, to the best of my knowledge and

belief, a true, correct, and complete return, made in good faith pursuant to the provisions of the code of virginia.

date

signature of taxpayer

title

(

)

contact person

daytime telephone number

1

1 2

2