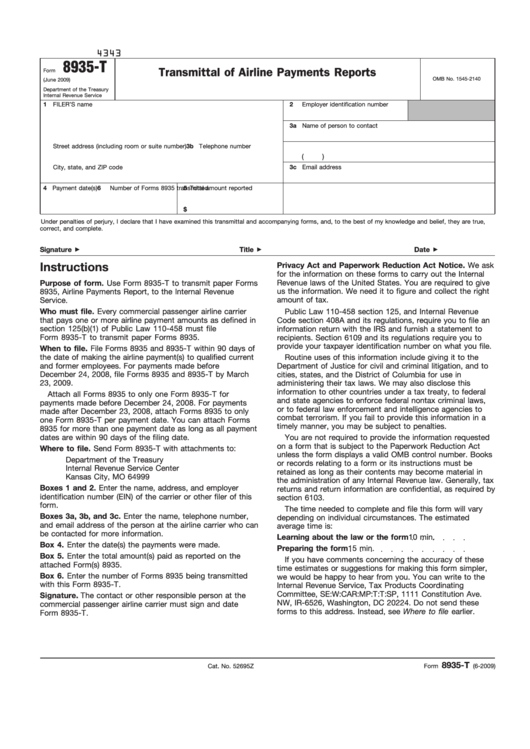

4343

8935-T

Transmittal of Airline Payments Reports

Form

OMB No. 1545-2140

(June 2009)

Department of the Treasury

Internal Revenue Service

1

FILER’S name

2

Employer identification number

3a Name of person to contact

Street address (including room or suite number)

3b Telephone number

(

)

City, state, and ZIP code

3c Email address

4 Payment date(s)

5 Total amount reported

6

Number of Forms 8935 transmitted

$

Under penalties of perjury, I declare that I have examined this transmittal and accompanying forms, and, to the best of my knowledge and belief, they are true,

correct, and complete.

Signature

Title

Date

Privacy Act and Paperwork Reduction Act Notice. We ask

Instructions

for the information on these forms to carry out the Internal

Revenue laws of the United States. You are required to give

Purpose of form. Use Form 8935-T to transmit paper Forms

us the information. We need it to figure and collect the right

8935, Airline Payments Report, to the Internal Revenue

amount of tax.

Service.

Who must file. Every commercial passenger airline carrier

Public Law 110-458 section 125, and Internal Revenue

that pays one or more airline payment amounts as defined in

Code section 408A and its regulations, require you to file an

section 125(b)(1) of Public Law 110-458 must file

information return with the IRS and furnish a statement to

Form 8935-T to transmit paper Forms 8935.

recipients. Section 6109 and its regulations require you to

provide your taxpayer identification number on what you file.

When to file. File Forms 8935 and 8935-T within 90 days of

the date of making the airline payment(s) to qualified current

Routine uses of this information include giving it to the

and former employees. For payments made before

Department of Justice for civil and criminal litigation, and to

December 24, 2008, file Forms 8935 and 8935-T by March

cities, states, and the District of Columbia for use in

23, 2009.

administering their tax laws. We may also disclose this

information to other countries under a tax treaty, to federal

Attach all Forms 8935 to only one Form 8935-T for

and state agencies to enforce federal nontax criminal laws,

payments made before December 24, 2008. For payments

or to federal law enforcement and intelligence agencies to

made after December 23, 2008, attach Forms 8935 to only

combat terrorism. If you fail to provide this information in a

one Form 8935-T per payment date. You can attach Forms

timely manner, you may be subject to penalties.

8935 for more than one payment date as long as all payment

dates are within 90 days of the filing date.

You are not required to provide the information requested

on a form that is subject to the Paperwork Reduction Act

Where to file. Send Form 8935-T with attachments to:

unless the form displays a valid OMB control number. Books

Department of the Treasury

or records relating to a form or its instructions must be

Internal Revenue Service Center

retained as long as their contents may become material in

Kansas City, MO 64999

the administration of any Internal Revenue law. Generally, tax

Boxes 1 and 2. Enter the name, address, and employer

returns and return information are confidential, as required by

identification number (EIN) of the carrier or other filer of this

section 6103.

form.

The time needed to complete and file this form will vary

Boxes 3a, 3b, and 3c. Enter the name, telephone number,

depending on individual circumstances. The estimated

and email address of the person at the airline carrier who can

average time is:

be contacted for more information.

Learning about the law or the form

10 min.

Box 4. Enter the date(s) the payments were made.

Preparing the form

15 min.

Box 5. Enter the total amount(s) paid as reported on the

If you have comments concerning the accuracy of these

attached Form(s) 8935.

time estimates or suggestions for making this form simpler,

Box 6. Enter the number of Forms 8935 being transmitted

we would be happy to hear from you. You can write to the

with this Form 8935-T.

Internal Revenue Service, Tax Products Coordinating

Committee, SE:W:CAR:MP:T:T:SP, 1111 Constitution Ave.

Signature. The contact or other responsible person at the

NW, IR-6526, Washington, DC 20224. Do not send these

commercial passenger airline carrier must sign and date

forms to this address. Instead, see Where to file earlier.

Form 8935-T.

8935-T

Cat. No. 52695Z

Form

(6-2009)

1

1