Instructions For Form Das-29 - Resident Stamp Affixing Agency Monthly Report Of Cigarettes And Cigarette Tax Stamps Page 3

ADVERTISEMENT

DAS-29 (12-12)

Page 3

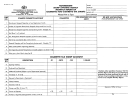

5. RETURNED TO MANUFACTURER

9. TOTAL

Enter total in Column 2: Add Lines 5 thru 8.

Enter the quantity of Pennsylvania tax stamped cigarettes

and/or stampable little cigars returned to the manufacturer.

10. AVAILABLE FOR SALE

Enter the quantity of Pennsylvania tax stamped cigarettes

6. DESTROYED OR STOLEN

and/or stampable little cigars available for sale: Line 4 minus

Enter the quantity of Pennsylvania tax stamped cigarettes

Line 9.

and/or stampable little cigars destroyed or stolen.

11. SALES IN PENNSYLVANIA

7. OTHER DISPOSITIONS

Enter the quantity of Pennsylvania tax stamped cigarettes

Enter the quantity and explain the disposition of Pennsylvania

and/or stampable little cigars sold in Pennsylvania during the

tax stamped cigarettes and/or stampable little cigars by any

month. Total monthly sales to wholesalers must be itemized

other means.

on Schedule F, REV-1047.

8. CLOSING INVENTORY

12. SALES OVER (OR UNDER)

Enter the quantity of Pennsylvania tax stamped cigarettes

Enter the amount of sales over (or under). Sales over –

and/or stampable little cigars in inventory at the end of

Line 11 in excess of Line 10. Sales under – Line 10 in excess

the month.

of Line 11.

SCHEDULE A – UNSTAMPED CIGARETTES RECEIVED FROM MANUFACTURERS

Enter the gross quantity of unstamped cigarettes and/or stampable little cigars purchased from each manufacturer as shown on manufacturers’

sales invoice. From Column 4, Schedule A-1, REV-1048 and/or REV-1048-A.

SCHEDULE A-1

REV-1048

CIGARETTES RECEIVED FROM MANUFACTURER DURING MONTH

A separate schedule must be prepared for each manufacturer. Prepare in duplicate. Submit original with the report and maintain copy for

your records.

Enter the date, name of Cigarette Stamping Agency and name of cigarette manufacturer.

Column 1 – Invoice Date

Carry totals for each manufacturer to Schedule A on

REV-1030.

Manufacturer’s invoice or credit voucher date. A separate

line should be used for each invoice.

Column 5 – Credits

Enter the quantity of cigarettes (unstamped cigarettes for

Column 2 – Invoice Number

other states) returned to the manufacturer and/or

Manufacturer’s invoice or credit voucher number.

unstamped cigarettes lost in transit, damaged or refused, or

cigarettes that were partially cancelled from manufacturer’s

Column 3 – Date Received

pre-billed invoice prior to shipment.

Enter the date cigarettes were actually received.

The exception is a manufacturer’s “Account Adjustment

Column 4 – Number of Unstamped Cigarettes

Credit Voucher” to offset a completely cancelled pre-billed

Enter the gross quantity of unstamped cigarettes billed by the

invoice.

manufacturer regardless of the quantity received or

quantity paid.

Each credit must be supported by a monetary or account

adjustment voucher from the manufacturer or a monetary

An exception is a manufacturer’s pre-billed invoice for an

claim adjustment from the transportation company.

order that was completely cancelled by the purchaser prior

to shipment.

If the report is due and the credit or claim has not been

received, enter only the quantity of cigarettes. Carry total

Maintain the completely cancelled manufacturer’s invoice for

credits from Column 5 to Section 1 of the report and enter

your records.

them in their respective category on Line 10 thru 14.

SCHEDULE A-1

REV-1048 - A

LITTLE CIGARS RECEIVED FROM MANUFACTURER DURING MONTH

Use this schedule to report stampable little cigars only. Little cigars packed similar to a package of cigarettes containing 20 to 25 sticks in a

pack are defined as stampable little cigars.

A separate schedule must be prepared for each manufacturer. Prepare in duplicate. Submit original with the report and maintain a copy for

your records.

Enter the date, name of Cigarette Stamping Agency and the name of the manufacturer.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4