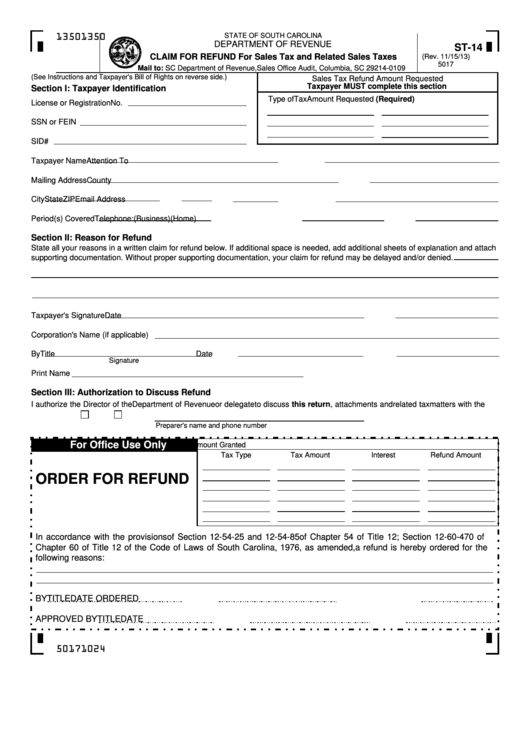

Form St-14 - Claim For Refund For Sales Tax And Related Sales Taxes

ADVERTISEMENT

STATE OF SOUTH CAROLINA

1350

1350

DEPARTMENT OF REVENUE

ST-14

CLAIM FOR REFUND For Sales Tax and Related Sales Taxes

(Rev. 11/15/13)

5017

Mail to: SC Department of Revenue, Sales Office Audit, Columbia, SC 29214-0109

(See Instructions and Taxpayer's Bill of Rights on reverse side.)

Sales Tax Refund Amount Requested

Taxpayer MUST complete this section

Section I: Taxpayer Identification

Type of Tax

Amount Requested (Required)

License or Registration No.

SSN or FEIN

SID#

Taxpayer Name

Attention To

Mailing Address

County

City

State

ZIP

Email Address

Period(s) Covered

Telephone: (Business)

(Home)

Section II: Reason for Refund

State all your reasons in a written claim for refund below. If additional space is needed, add additional sheets of explanation and attach

supporting documentation. Without proper supporting documentation, your claim for refund may be delayed and/or denied.

Taxpayer's Signature

Date

Corporation's Name (if applicable)

By

Title

Date

Signature

Print Name

Section III: Authorization to Discuss Refund

I authorize the Director of the Department of Revenue or delegate to discuss this return, attachments and related tax matters with the

preparer.

Yes

No

Preparer's name and phone number

For Office Use Only

Refund Amount Granted

Tax Type

Tax Amount

Interest

Refund Amount

ORDER FOR REFUND

In accordance with the provisions of Section 12-54-25 and 12-54-85 of Chapter 54 of Title 12; Section 12-60-470 of

Chapter 60 of Title 12 of the Code of Laws of South Carolina, 1976, as amended, a refund is hereby ordered for the

following reasons:

BY

TITLE

DATE ORDERED

APPROVED BY

TITLE

DATE

50171024

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2