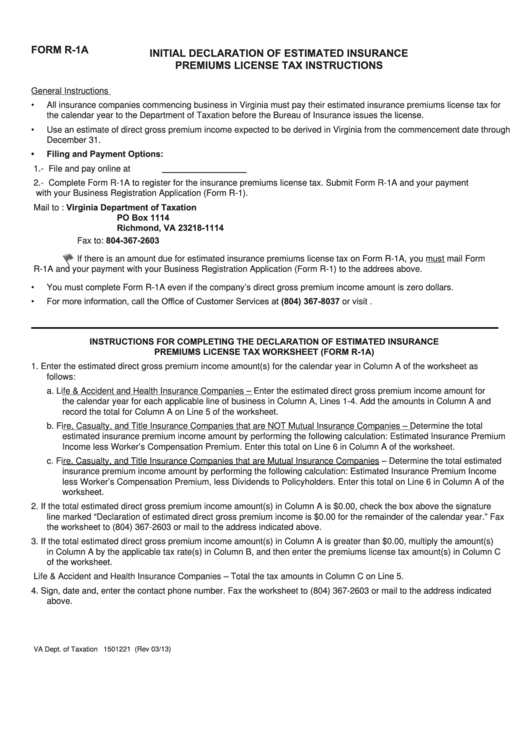

FORM R-1A

INITIAL DECLARATION OF ESTIMATED INSURANCE

PREMIUMS LICENSE TAX INSTRUCTIONS

General Instructions

•

All insurance companies commencing business in Virginia must pay their estimated insurance premiums license tax for

the calendar year to the Department of Taxation before the Bureau of Insurance issues the license.

•

Use an estimate of direct gross premium income expected to be derived in Virginia from the commencement date through

December 31.

•

Filing and Payment Options:

1.- File and pay online at

2.- Complete Form R-1A to register for the insurance premiums license tax. Submit Form R-1A and your payment

with your Business Registration Application (Form R-1).

Virginia Department of Taxation

Mail to :

PO Box 1114

Richmond, VA 23218-1114

804-367-2603

Fax to:

If there is an amount due for estimated insurance premiums license tax on Form R-1A, you must mail Form

R-1A and your payment with your Business Registration Application (Form R-1) to the addrees above.

•

You must complete Form R-1A even if the company’s direct gross premium income amount is zero dollars.

For more information, call the Office of Customer Services at (804) 367-8037 or visit

•

INSTRUCTIONS FOR COMPLETING THE DECLARATION OF ESTIMATED INSURANCE

PREMIUMS LICENSE TAX WORKSHEET (FORM R-1A)

1. Enter the estimated direct gross premium income amount(s) for the calendar year in Column A of the worksheet as

follows:

a. Life & Accident and Health Insurance Companies – Enter the estimated direct gross premium income amount for

the calendar year for each applicable line of business in Column A, Lines 1-4. Add the amounts in Column A and

record the total for Column A on Line 5 of the worksheet.

b. Fire, Casualty, and Title Insurance Companies that are NOT Mutual Insurance Companies – Determine the total

estimated insurance premium income amount by performing the following calculation: Estimated Insurance Premium

Income less Worker’s Compensation Premium. Enter this total on Line 6 in Column A of the worksheet.

c. Fire, Casualty, and Title Insurance Companies that are Mutual Insurance Companies – Determine the total estimated

insurance premium income amount by performing the following calculation: Estimated Insurance Premium Income

less Worker’s Compensation Premium, less Dividends to Policyholders. Enter this total on Line 6 in Column A of the

worksheet.

2. If the total estimated direct gross premium income amount(s) in Column A is $0.00, check the box above the signature

line marked “Declaration of estimated direct gross premium income is $0.00 for the remainder of the calendar year.” Fax

the worksheet to (804) 367-2603 or mail to the address indicated above.

3. If the total estimated direct gross premium income amount(s) in Column A is greater than $0.00, multiply the amount(s)

in Column A by the applicable tax rate(s) in Column B, and then enter the premiums license tax amount(s) in Column C

of the worksheet.

Life & Accident and Health Insurance Companies – Total the tax amounts in Column C on Line 5.

4. Sign, date and, enter the contact phone number. Fax the worksheet to (804) 367-2603 or mail to the address indicated

above.

1

1 2

2