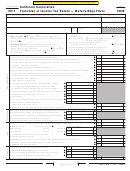

Schedule M-1 Reconciliation of Income (Loss) per Books With Income (Loss) per Return.

If the corporation completed federal Schedule M-3 (Form 1120/1120-F), see instructions .

7 Income recorded on books this year not

1 Net income per books . . . . . . . . . . . . . . . . . . . . .

included in this return (itemize)

2 Federal income tax . . . . . . . . . . . . . . . . . . . . . . . .

a Tax-exempt interest .$_______________

3 Excess of capital losses over capital gains . . . . . .

b Other . . . . . . . . . . . . $_______________

4 Taxable income not recorded on books this year

c Total . Add line 7a and line 7b . . . . . . . .

(itemize) _________________________________

_______________________________

8 Deductions in this return not charged

5 Expenses recorded on books this year not deducted

against book income this year (itemize)

in this return (itemize)

a Depreciation . . . . .$_________________

a Depreciation . . $_________________________

b State tax refunds .$_________________

b State taxes . . . . $_________________________

c Other . . . . . . . . . . $_________________

c Travel and

d Total . Add line 8a through line 8c . . . .

entertainment . $_________________________

9 Total . Add line 7c and line 8d . . . . . . . . . . . .

d Other . . . . . . . . $_________________________

10 Net income per return .

e Total . Add line 5a through line 5d . . . . . . . . . .

Subtract line 9 from line 6 . . . . . . . . . . . . . .

6 Total . Add line 1 through line 5e . . . . . . . . . . . . . . . .

Schedule M-2

Analysis of Unappropriated Retained Earnings per Books (Side 5, Schedule L, line 24)

1 Balance at beginning of year . . . . . . . . . . . . . . . .

5 Distributions: a Cash . . . . . . . . . . . . . .

b Stock . . . . . . . . . . . . . .

2 Net income per books . . . . . . . . . . . . . . . . . . . . .

c Property . . . . . . . . . . .

3 Other increases (itemize) ____________________

6 Other decreases (itemize) ______________

________________________________________

________________________________

________________________________________

7 Total . Add line 5 and line 6 . . . . . . . . . . . . . .

______________________________________

8 Balance at end of year .

4 Total . Add line 1 through line 3 . . . . . . . . . . . . . . . .

Subtract line 7 from line 4 . . . . . . . . . . . .

Schedule D California Capital Gains and Losses

Part I Short-Term Capital Gains and Losses – Assets Held One Year or Less. Use additional sheet(s) if necessary .

(a)

(b)

(c)

(d)

(e)

(f)

Date sold

Kind of property and description

Date acquired

Gross sales

Cost or other

Gain (loss)

(mm/dd/yyyy)

(Example, 100 shares of Z Co .)

(mm/dd/yyyy)

price

basis plus

(d) less (e)

expense of sale

1

00

00

00

00

00

2 Short-term capital gain from installment sales from form FTB 3805E, line 26 or line 37 . . . . . . . . . . . . . . . . . . . . . . . . . .

2

00

3 Unused capital loss carryover from 2012 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

00

4 Net short-term capital gain (loss) . Combine line 1 through line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

00

Part II Long-Term Capital Gains and Losses – Assets Held More Than One Year. Use additional sheet(s) if necessary .

5

00

00

00

00

00

6 Enter gain from Schedule D-1, line 9 and/or any capital gain distributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

00

7 Long-term capital gain from installment sales from form FTB 3805E, line 26 or line 37 . . . . . . . . . . . . . . . . . . . . . . . . . .

7

00

8 Net long-term capital gain (loss) . Combine line 5 through line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

00

9 Enter excess of net short-term capital gain (line 4) over net long-term capital loss (line 8) . . . . . . . . . . . . . . . . . . . . . . . .

9

00

10 Net capital gain . Enter excess of net long-term capital gain (line 8) over net short-term capital loss (line 4) . . . . . . . . . . .

10

00

11 Total lines 9 and 10 . Enter here and on Form 100W, Side 1, line 5 .

If losses exceed gains, carry forward losses to 2014 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

00

Side 6 Form 100W

2013

C1

3626133

1

1 2

2 3

3 4

4 5

5 6

6