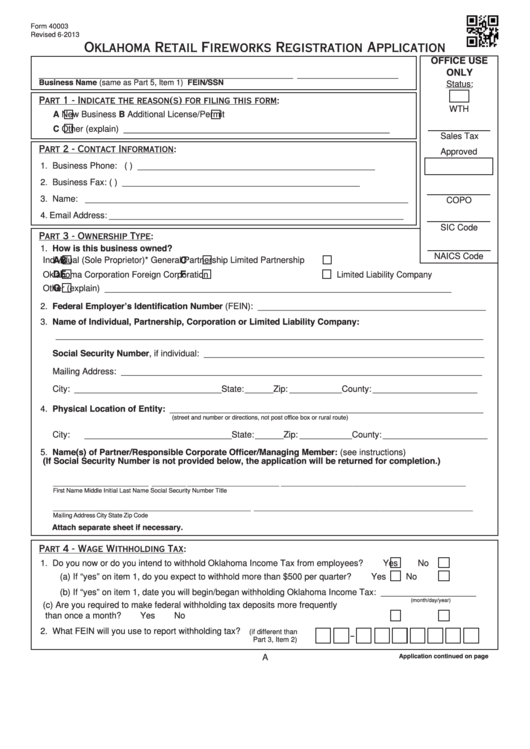

Form 40003

Revised 6-2013

Oklahoma Retail Fireworks Registration Application

OFFICE USE

ONLY

__________________________________________________________

_______________________

Business Name (same as Part 5, Item 1)

FEIN/SSN

Status:

Part 1 - Indicate the reason(s) for filing this form:

WTH

A

New Business

B

Additional License/Permit

C

Other (explain) ________________________________________________________

Sales Tax

Part 2 - Contact Information:

Approved

1. Business Phone: (

) __________________________________________________

2. Business Fax:

(

) __________________________________________________

3. Name: ____________________________________________________________________

COPO

4. Email Address: ______________________________________________________________

SIC Code

Part 3 - Ownership Type:

1. How is this business owned?

C

NAICS Code

A

B

Individual (Sole Proprietor)*

General Partnership

Limited Partnership

D

E

F

Oklahoma Corporation

Foreign Corporation

Limited Liability Company

G

Other (explain) _________________________________________________________________________

2. Federal Employer’s Identification Number (FEIN): ________________________________________________

3. Name of Individual, Partnership, Corporation or Limited Liability Company:

__________________________________________________________________________________________

Social Security Number, if individual: ___________________________________________________________

Mailing Address: ____________________________________________________________________________

City: _______________________________State: ______ Zip: ___________ County: ______________________

4. Physical Location of Entity: __________________________________________________________________

(street and number or directions, not post office box or rural route)

City: _______________________________State: ______ Zip: ___________ County: ______________________

5. Name(s) of Partner/Responsible Corporate Officer/Managing Member: (see instructions)

(If Social Security Number is not provided below, the application will be returned for completion.)

____________________________

__________

___________________________

_____________________

_________________________________

First Name

Middle Initial

Last Name

Social Security Number

Title

__________________________________________________________

_____________________________________

_______

____________________

Mailing Address

City

State

Zip Code

Attach separate sheet if necessary.

Part 4 - Wage Withholding Tax:

1. Do you now or do you intend to withhold Oklahoma Income Tax from employees? .......

Yes

No

(a) If “yes” on item 1, do you expect to withhold more than $500 per quarter? ...........

Yes

No

(b) If “yes” on item 1, date you will begin/began withholding Oklahoma Income Tax: ____________________

(month/day/year)

(c) Are you required to make federal withholding tax deposits more frequently

than once a month? ...............................................................................................

Yes

No

2. What FEIN will you use to report withholding tax?

(if different than

Part 3, Item 2)

Application continued on page B...

A

1

1 2

2 3

3 4

4