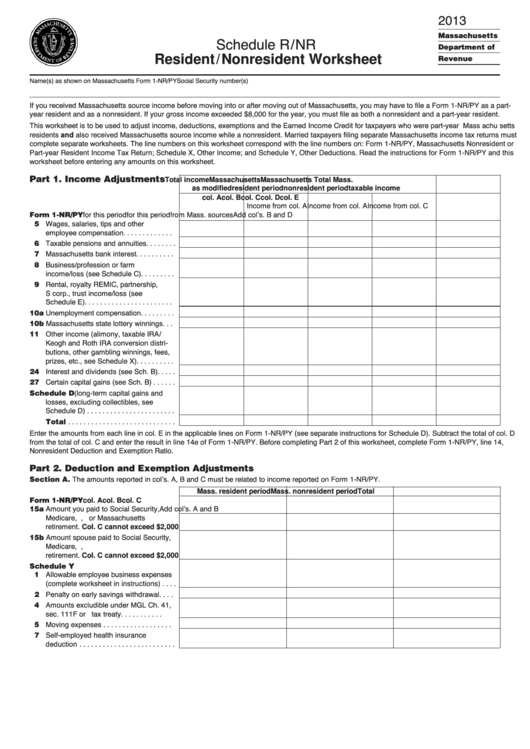

2013

Schedule R/NR

Massachusetts

Department of

Resident/Nonresident Worksheet

Revenue

Name(s) as shown on Massachusetts Form 1-NR/PY

Social Security number(s)

If you received Massachusetts source income before moving into or after moving out of Massachusetts, you may have to file a Form 1-NR/PY as a part-

year resident and as a nonresident. If your gross income exceeded $8,000 for the year, you must file as both a nonresident and a part-year resident.

This worksheet is to be used to adjust income, deductions, exemptions and the Earned Income Credit for taxpayers who were part-year Mass achu setts

residents and also received Massachusetts source income while a nonresident. Married taxpayers filing separate Massachusetts income tax returns must

complete separate worksheets. The line numbers on this worksheet correspond with the line numbers on: Form 1-NR/PY, Massachusetts Nonresident or

Part-year Resident Income Tax Return; Schedule X, Other Income; and Schedule Y, Other Deductions. Read the instructions for Form 1-NR/PY and this

worksheet before entering any amounts on this worksheet.

Part 1. Income Adjustments

Total income

Massachusetts

Massachusetts

Total Mass.

as modified

resident period

nonresident period

taxable income

Income from col. A Income from col. A Income from col. C

col. A

col. B

col. C

col. D

col. E

for this period

for this period

from Mass. sources Add col’s. B and D

15 Wages, salaries, tips and other

Form 1-NR/PY

employee compensation . . . . . . . . . . . . .

16 Taxable pensions and annuities. . . . . . . .

17 Massachusetts bank interest . . . . . . . . . .

18 Business/profession or farm

income/loss (see Schedule C). . . . . . . . .

19 Rental, royalty REMIC, partnership,

S corp., trust income/loss (see

Schedule E) . . . . . . . . . . . . . . . . . . . . . . .

10a Unemployment compensation . . . . . . . . .

10b Massachusetts state lottery winnings . . .

11 Other income (alimony, taxable IRA/

Keogh and Roth IRA conversion distri-

butions, other gambling winnings, fees,

prizes, etc., see Schedule X) . . . . . . . . . .

24 Interest and dividends (see Sch. B). . . . .

27 Certain capital gains (see Sch. B) . . . . . .

Schedule D (long-term capital gains and

losses, excluding collectibles, see

Schedule D) . . . . . . . . . . . . . . . . . . . . . . .

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Enter the amounts from each line in col. E in the applicable lines on Form 1-NR/PY (see separate instructions for Schedule D). Subtract the total of col. D

from the total of col. C and enter the result in line 14e of Form 1-NR/PY. Before completing Part 2 of this worksheet, complete Form 1-NR/PY, line 14,

Nonresident Deduction and Exemption Ratio.

Part 2. Deduction and Exemption Adjustments

Section A. The amounts reported in col’s. A, B and C must be related to income reported on Form 1-NR/PY.

Mass. resident period

Mass. nonresident period

Total

15a Amount you paid to Social Security,

Add col’s. A and B

Form 1-NR/PY

col. A

col. B

col. C

Medicare, R.R., U.S. or Massachusetts

retirement. Col. C cannot exceed $2,000

15b Amount spouse paid to Social Security,

Medicare, R.R., U.S. or Massachusetts

retirement. Col. C cannot exceed $2,000

11 Allowable employee business expenses

Schedule Y

(complete worksheet in instructions) . . . .

12 Penalty on early savings withdrawal . . . .

14 Amounts excludible under MGL Ch. 41,

sec. 111F or U.S. tax treaty . . . . . . . . . . .

15 Moving expenses . . . . . . . . . . . . . . . . . .

17 Self-employed health insurance

deduction . . . . . . . . . . . . . . . . . . . . . . . . .

1

1 2

2