Reset Form

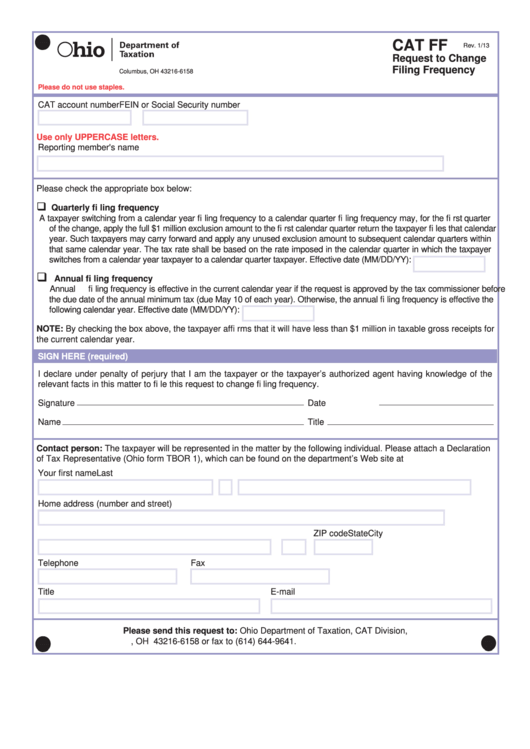

CAT FF

Rev. 1/13

Request to Change

P.O. Box 16158

Filing Frequency

Columbus, OH 43216-6158

Please do not use staples.

CAT account number

FEIN or Social Security number

Use only UPPERCASE letters.

Reporting member's name

Please check the appropriate box below:

Quarterly fi ling frequency

A taxpayer switching from a calendar year fi ling frequency to a calendar quarter fi ling frequency may, for the fi rst quarter

of the change, apply the full $1 million exclusion amount to the fi rst calendar quarter return the taxpayer fi les that calendar

year. Such taxpayers may carry forward and apply any unused exclusion amount to subsequent calendar quarters within

that same calendar year. The tax rate shall be based on the rate imposed in the calendar quarter in which the taxpayer

switches from a calendar year taxpayer to a calendar quarter taxpayer. Effective date (MM/DD/YY):

Annual fi ling frequency

Annual fi ling frequency is effective in the current calendar year if the request is approved by the tax commissioner before

the due date of the annual minimum tax (due May 10 of each year). Otherwise, the annual fi ling frequency is effective the

following calendar year. Effective date (MM/DD/YY):

NOTE: By checking the box above, the taxpayer affi rms that it will have less than $1 million in taxable gross receipts for

the current calendar year.

SIGN HERE (required)

I declare under penalty of perjury that I am the taxpayer or the taxpayer’s authorized agent having knowledge of the

relevant facts in this matter to fi le this request to change fi ling frequency.

Signature

Date (MM/DD/YY)

Name

Title

Contact person: The taxpayer will be represented in the matter by the following individual. Please attach a Declaration

of Tax Representative (Ohio form TBOR 1), which can be found on the department’s Web site at tax.ohio.gov.

Your fi rst name

M.I.

Last name

Home address (number and street)

City

State

ZIP code

Telephone

Fax

Title

E-mail

Please send this request to: Ohio Department of Taxation, CAT Division,

P.O. Box 16158 Columbus, OH 43216-6158 or fax to (614) 644-9641.

1

1