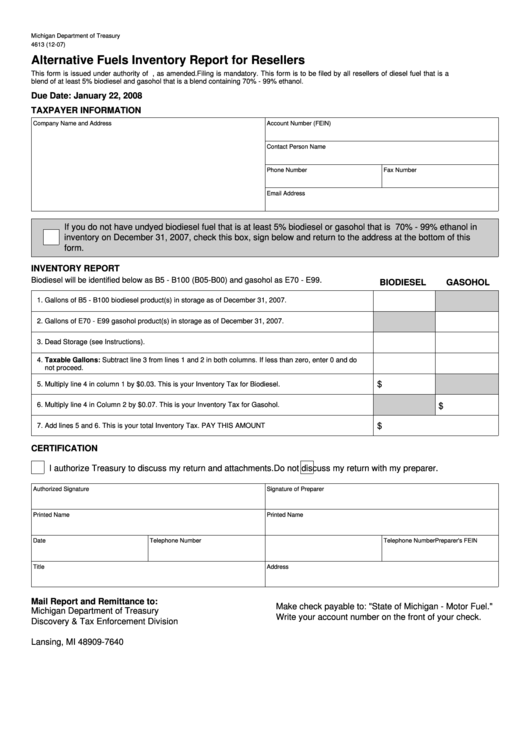

Michigan Department of Treasury

4613 (12-07)

Alternative Fuels Inventory Report for Resellers

This form is issued under authority of P.A. 403 of 2000, as amended. Filing is mandatory. This form is to be filed by all resellers of diesel fuel that is a

blend of at least 5% biodiesel and gasohol that is a blend containing 70% - 99% ethanol.

Due Date: January 22, 2008

TAXPAYER INFORMATION

Company Name and Address

Account Number (FEIN)

Contact Person Name

Phone Number

Fax Number

Email Address

If you do not have undyed biodiesel fuel that is at least 5% biodiesel or gasohol that is 70% - 99% ethanol in

inventory on December 31, 2007, check this box, sign below and return to the address at the bottom of this

form.

INVENTORY REPORT

Biodiesel will be identified below as B5 - B100 (B05-B00) and gasohol as E70 - E99.

BIODIESEL

GASOHOL

1. Gallons of B5 - B100 biodiesel product(s) in storage as of December 31, 2007.

2. Gallons of E70 - E99 gasohol product(s) in storage as of December 31, 2007.

3. Dead Storage (see Instructions).

4. Taxable Gallons: Subtract line 3 from lines 1 and 2 in both columns. If less than zero, enter 0 and do

not proceed.

5. Multiply line 4 in column 1 by $0.03. This is your Inventory Tax for Biodiesel.

$

6. Multiply line 4 in Column 2 by $0.07. This is your Inventory Tax for Gasohol.

$

7. Add lines 5 and 6. This is your total Inventory Tax. PAY THIS AMOUNT

$

CERTIFICATION

I authorize Treasury to discuss my return and attachments.

Do not discuss my return with my preparer.

Authorized Signature

Signature of Preparer

Printed Name

Printed Name

Date

Telephone Number

Preparer's FEIN

Telephone Number

Title

Address

Mail Report and Remittance to:

Make check payable to: "State of Michigan - Motor Fuel."

Michigan Department of Treasury

Write your account number on the front of your check.

Discovery & Tax Enforcement Division

P.O. Box 30140

Lansing, MI 48909-7640

1

1 2

2