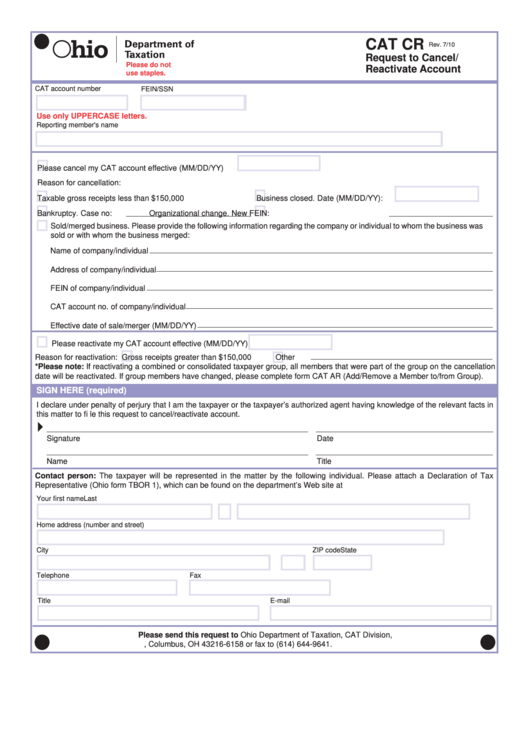

CAT CR

Rev. 7/10

Reset Form

Request to Cancel/

Please do not

Reactivate Account

use staples.

CAT account number

FEIN/SSN

Use only UPPERCASE letters.

Reporting member's name

/

Please cancel my CAT account effective (MM/DD/YY)

Reason for cancellation:

/

Taxable gross receipts less than $150,000

Business closed. Date (MM/DD/YY):

Bankruptcy. Case no:

Organizational change. New FEIN:

Sold/merged business. Please provide the following information regarding the company or individual to whom the business was

sold or with whom the business merged:

Name of company/individual

Address of company/individual

FEIN of company/individual

CAT account no. of company/individual

Effective date of sale/merger (MM/DD/YY)

/

/

Please reactivate my CAT account effective (MM/DD/YY)

Reason for reactivation:

Gross receipts greater than $150,000

Other

*Please note: If reactivating a combined or consolidated taxpayer group, all members that were part of the group on the cancellation

date will be reactivated. If group members have changed, please complete form CAT AR (Add/Remove a Member to/from Group).

SIGN HERE (required)

I declare under penalty of perjury that I am the taxpayer or the taxpayer’s authorized agent having knowledge of the relevant facts in

this matter to fi le this request to cancel/reactivate account.

Signature

Date (MM/DD/YY)

Name

Title

Contact person: The taxpayer will be represented in the matter by the following individual. Please attach a Declaration of Tax

Representative (Ohio form TBOR 1), which can be found on the department’s Web site at tax.ohio.gov.

Your fi rst name

M.I.

Last name

Home address (number and street)

C

C ity

State

ZIP code

Telephone

Fax

Title

E-mail

Please send this request to Ohio Department of Taxation, CAT Division,

P.O. Box 16158, Columbus, OH 43216-6158 or fax to (614) 644-9641.

1

1