Form 51a229 - Fluidized Bed Combustion Technology Tax Exemption Certificate

ADVERTISEMENT

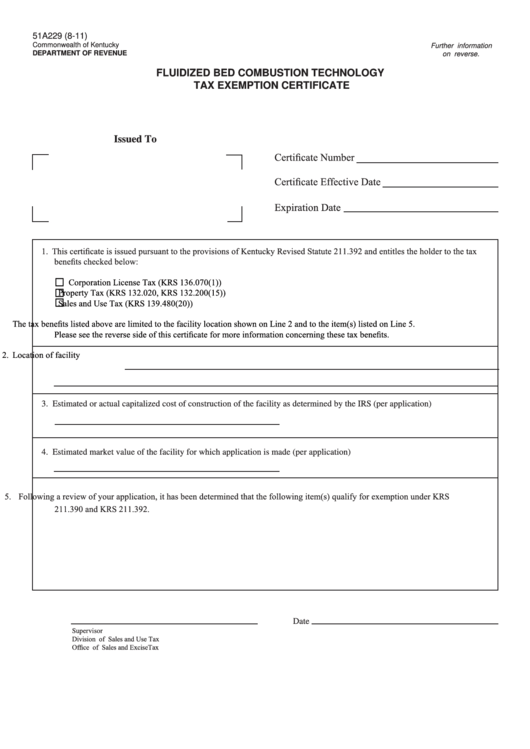

51A229 (8-11)

Commonwealth of Kentucky

Further information

DEPARTMENT OF REVENUE

on reverse.

FLUIDIZED BED COMBUSTION TECHNOLOGY

TAX EXEMPTION CERTIFICATE

Issued To

Certificate Number

Certificate Effective Date

Expiration Date

1. This certificate is issued pursuant to the provisions of Kentucky Revised Statute 211.392 and entitles the holder to the tax

benefits checked below:

Corporation License Tax (KRS 136.070(1))

Property Tax (KRS 132.020, KRS 132.200(15))

Sales and Use Tax (KRS 139.480(20))

The tax benefits listed above are limited to the facility location shown on Line 2 and to the item(s) listed on Line 5.

Please see the reverse side of this certificate for more information concerning these tax benefits.

2. Location of facility

3. Estimated or actual capitalized cost of construction of the facility as determined by the IRS (per application)

4. Estimated market value of the facility for which application is made (per application)

5. Following a review of your application, it has been determined that the following item(s) qualify for exemption under KRS

211.390 and KRS 211.392.

Date

Supervisor

Division of Sales and Use Tax

Office of Sales and ExciseTax

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2