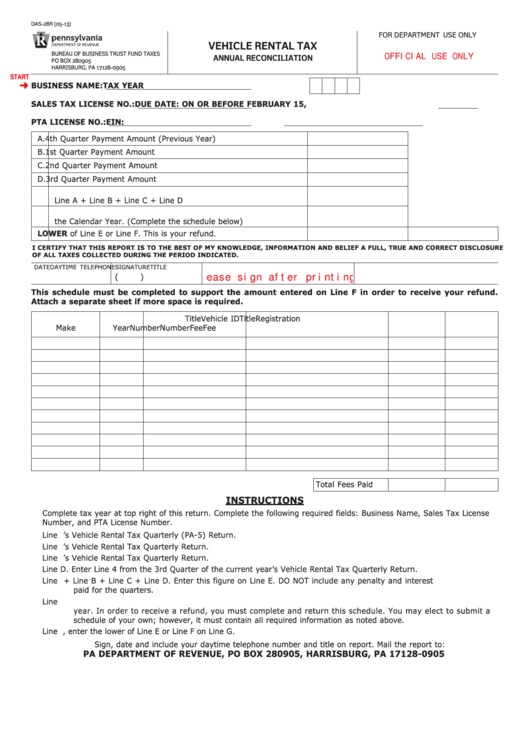

DAS-28R (05-13)

FOR DEPARTMENT USE ONLY

VEHICLE RENTAL TAX

BUREAU OF BUSINESS TRUST FUND TAXES

OFFICIAL USE ONLY

ANNUAL RECONCILIATION

PO BOX 280905

HARRISBURG, PA 17128-0905

START

BUSINESS NAME:

TAX YEAR

SALES TAX LICENSE NO.:

DUE DATE: ON OR BEFORE FEBRUARY 15,

PTA LICENSE NO.:

EIN:

A.

4th Quarter Payment Amount (Previous Year)

B.

1st Quarter Payment Amount

C.

2nd Quarter Payment Amount

D.

3rd Quarter Payment Amount

E.

Total Payment Made in Calendar Year.

Line A + Line B + Line C + Line D

F.

Total Licensing and Title Fees Paid to the Commonwealth During

the Calendar Year. (Complete the schedule below)

G.

Enter the LOWER of Line E or Line F. This is your refund.

I CERTIFY THAT THIS REPORT IS TO THE BEST OF MY KNOWLEDGE, INFORMATION AND BELIEF A FULL, TRUE AND CORRECT DISCLOSURE

OF ALL TAXES COLLECTED DURING THE PERIOD INDICATED.

DATE

DAYTIME TELEPHONE

SIGNATURE

TITLE

Please sign after printing.

(

)

This schedule must be completed to support the amount entered on Line F in order to receive your refund.

Attach a separate sheet if more space is required.

Title

Vehicle ID

Title

Registration

Make

Year

Number

Number

Fee

Fee

Total Fees Paid

INSTRUCTIONS

Complete tax year at top right of this return. Complete the following required fields: Business Name, Sales Tax License

Number, and PTA License Number.

Line A. Enter Line 4 from the 4th Quarter of the previous year’s Vehicle Rental Tax Quarterly (PA-5) Return.

Line B. Enter Line 4 from the 1st Quarter of the current year’s Vehicle Rental Tax Quarterly Return.

Line C. Enter Line 4 from the 2nd Quarter of the current year’s Vehicle Rental Tax Quarterly Return.

Line D. Enter Line 4 from the 3rd Quarter of the current year’s Vehicle Rental Tax Quarterly Return.

Line E. Total Line A + Line B + Line C + Line D. Enter this figure on Line E. DO NOT include any penalty and interest

paid for the quarters.

Line F. Enter the total licensing and registration fees paid to the Commonwealth of Pennsylvania during the calendar

year. In order to receive a refund, you must complete and return this schedule. You may elect to submit a

schedule of your own; however, it must contain all required information as noted above.

Line G. Your refund may not exceed the figure listed on Line E. Therefore, enter the lower of Line E or Line F on Line G.

Sign, date and include your daytime telephone number and title on report. Mail the report to:

PA DEPARTMENT OF REVENUE, PO BOX 280905, HARRISBURG, PA 17128-0905

Reset Entire Form

PRINT FORM

1

1