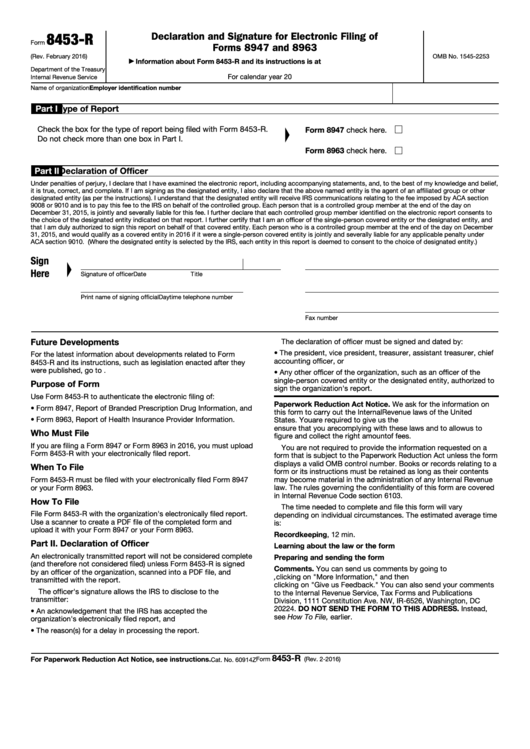

8453-R

Declaration and Signature for Electronic Filing of

Form

Forms 8947 and 8963

(Rev. February 2016)

OMB No. 1545-2253

Information about Form 8453-R and its instructions is at

▶

Department of the Treasury

For calendar year 20

Internal Revenue Service

Name of organization

Employer identification number

Part I

Type of Report

Check the box for the type of report being filed with Form 8453-R.

Form 8947 check here.

Do not check more than one box in Part I.

Form 8963 check here.

Part II

Declaration of Officer

Under penalties of perjury, I declare that I have examined the electronic report, including accompanying statements, and, to the best of my knowledge and belief,

it is true, correct, and complete. If I am signing as the designated entity, I also declare that the above named entity is the agent of an affiliated group or other

designated entity (as per the instructions). I understand that the designated entity will receive IRS communications relating to the fee imposed by ACA section

9008 or 9010 and is to pay this fee to the IRS on behalf of the controlled group. Each person that is a controlled group member at the end of the day on

December 31, 2015, is jointly and severally liable for this fee. I further declare that each controlled group member identified on the electronic report consents to

the choice of the designated entity indicated on that report. I further certify that I am an officer of the single-person covered entity or the designated entity, and

that I am duly authorized to sign this report on behalf of that covered entity. Each person who is a controlled group member at the end of the day on December

31, 2015, and would qualify as a covered entity in 2016 if it were a single-person covered entity is jointly and severally liable for any applicable penalty under

ACA section 9010. (Where the designated entity is selected by the IRS, each entity in this report is deemed to consent to the choice of designated entity.)

Sign

Here

Signature of officer

Date

Title

Print name of signing official

Daytime telephone number

Fax number

Future Developments

The declaration of officer must be signed and dated by:

• The president, vice president, treasurer, assistant treasurer, chief

For the latest information about developments related to Form

accounting officer, or

8453-R and its instructions, such as legislation enacted after they

were published, go to

• Any other officer of the organization, such as an officer of the

single-person covered entity or the designated entity, authorized to

Purpose of Form

sign the organization's report.

Use Form 8453-R to authenticate the electronic filing of:

Paperwork Reduction Act Notice. We ask for the information on

• Form 8947, Report of Branded Prescription Drug Information, and

this form to carry out the Internal Revenue laws of the United

• Form 8963, Report of Health Insurance Provider Information.

States. You are required to give us the information. We need it to

ensure that you are complying with these laws and to allow us to

Who Must File

figure and collect the right amount of fees.

If you are filing a Form 8947 or Form 8963 in 2016, you must upload

You are not required to provide the information requested on a

Form 8453-R with your electronically filed report.

form that is subject to the Paperwork Reduction Act unless the form

displays a valid OMB control number. Books or records relating to a

When To File

form or its instructions must be retained as long as their contents

may become material in the administration of any Internal Revenue

Form 8453-R must be filed with your electronically filed Form 8947

or your Form 8963.

law. The rules governing the confidentiality of this form are covered

in Internal Revenue Code section 6103.

How To File

The time needed to complete and file this form will vary

File Form 8453-R with the organization's electronically filed report.

depending on individual circumstances. The estimated average time

Use a scanner to create a PDF file of the completed form and

is:

upload it with your Form 8947 or your Form 8963.

Recordkeeping .

.

.

.

.

.

.

.

.

.

.

. 1 hr., 12 min.

Part II. Declaration of Officer

Learning about the law or the form

.

.

.

.

.

.

. 12 min.

An electronically transmitted report will not be considered complete

Preparing and sending the form

.

.

.

.

.

.

.

. 13 min.

(and therefore not considered filed) unless Form 8453-R is signed

Comments. You can send us comments by going to

by an officer of the organization, scanned into a PDF file, and

, clicking on "More Information," and then

transmitted with the report.

clicking on "Give us Feedback." You can also send your comments

The officer's signature allows the IRS to disclose to the

to the Internal Revenue Service, Tax Forms and Publications

transmitter:

Division, 1111 Constitution Ave. NW, IR-6526, Washington, DC

20224. DO NOT SEND THE FORM TO THIS ADDRESS. Instead,

• An acknowledgement that the IRS has accepted the

see How To File, earlier.

organization's electronically filed report, and

• The reason(s) for a delay in processing the report.

8453-R

For Paperwork Reduction Act Notice, see instructions.

Form

(Rev. 2-2016)

Cat. No. 60914Z

1

1