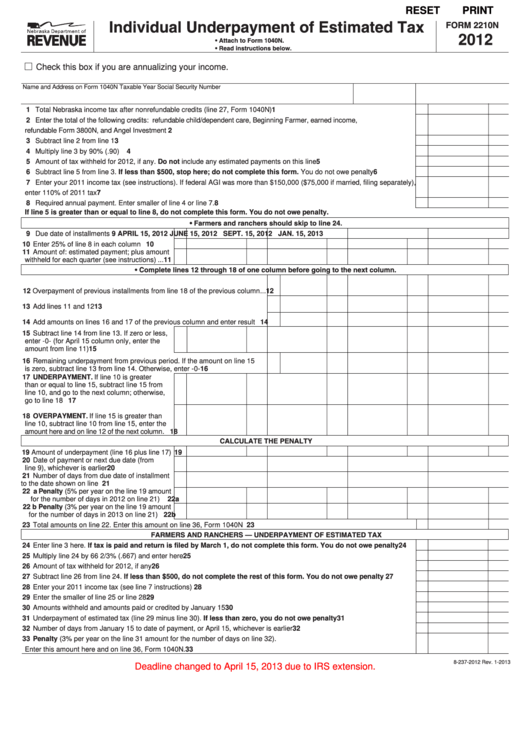

RESET

PRINT

Individual Underpayment of Estimated Tax

FORM 2210N

2012

• Attach to Form 1040N.

• Read instructions below.

Check this box if you are annualizing your income.

Name and Address on Form 1040N

Taxable Year

Social Security Number

1 Total Nebraska income tax after nonrefundable credits (line 27, Form 1040N) ............................................................................

1

2 Enter the total of the following credits: refundable child/dependent care, Beginning Farmer, earned income,

refundable Form 3800N, and Angel Investment .............................................................................................................................

2

3 Subtract line 2 from line 1 ..............................................................................................................................................................

3

4 Multiply line 3 by 90% (.90) ...........................................................................................................................................................

4

5 Amount of tax withheld for 2012, if any. Do not include any estimated payments on this line ......................................................

5

6 Subtract line 5 from line 3. If less than $500, stop here; do not complete this form. You do not owe penalty .........................

6

7 Enter your 2011 income tax (see instructions). If federal AGI was more than $150,000 ($75,000 if married, filing separately),

enter 110% of 2011 tax .................................................................................................................................................................

7

8 Required annual payment. Enter smaller of line 4 or line 7. ..........................................................................................................

8

If line 5 is greater than or equal to line 8, do not complete this form. You do not owe penalty.

• Farmers and ranchers should skip to line 24.

9 Due date of installments .................................

9

APRIL 15, 2012

JUNE 15, 2012

SEPT. 15, 2012

JAN. 15, 2013

10 Enter 25% of line 8 in each column ................ 10

11 Amount of: estimated payment; plus amount

withheld for each quarter (see instructions) ... 11

• Complete lines 12 through 18 of one column before going to the next column.

12 Overpayment of previous installments from line 18 of the previous column ... 12

13 Add lines 11 and 12 ........................................................................................ 13

14 Add amounts on lines 16 and 17 of the previous column and enter result ..... 14

15 Subtract line 14 from line 13. If zero or less,

enter -0- (for April 15 column only, enter the

amount from line 11) ...................................... 15

16 Remaining underpayment from previous period. If the amount on line 15

is zero, subtract line 13 from line 14. Otherwise, enter -0- ............................. 16

17 UNDERPAYMENT. If line 10 is greater

than or equal to line 15, subtract line 15 from

line 10, and go to the next column; otherwise,

go to line 18 .................................................... 17

18 OVERPAYMENT. If line 15 is greater than

line 10, subtract line 10 from line 15, enter the

amount here and on line 12 of the next column . 18

CALCULATE THE PENALTY

19 Amount of underpayment (line 16 plus line 17) 19

20 Date of payment or next due date (from

line 9), whichever is earlier ............................. 20

21 Number of days from due date of installment

to the date shown on line 20........................... 21

22 a Penalty (5% per year on the line 19 amount

for the number of days in 2012 on line 21)

22a

22 b Penalty (3% per year on the line 19 amount

22b

for the number of days in 2013 on line 21)

23 Total amounts on line 22. Enter this amount on line 36, Form 1040N ......................................................................................... 23

FARMERS AND RANCHERS — UNDERPAYMENT OF ESTIMATED TAX

24 Enter line 3 here. If tax is paid and return is filed by March 1, do not complete this form. You do not owe penalty ........... 24

25 Multiply line 24 by 66 2/3% (.667) and enter here ......................................................................................................................... 25

26 Amount of tax withheld for 2012, if any ......................................................................................................................................... 26

27 Subtract line 26 from line 24. If less than $500, do not complete the rest of this form. You do not owe penalty .................. 27

28 Enter your 2011 income tax (see line 7 instructions)..................................................................................................................... 28

29 Enter the smaller of line 25 or line 28 ............................................................................................................................................ 29

30 Amounts withheld and amounts paid or credited by January 15 ................................................................................................... 30

31 Underpayment of estimated tax (line 29 minus line 30). If less than zero, you do not owe penalty .......................................... 31

32 Number of days from January 15 to date of payment, or April 15, whichever is earlier ................................................................ 32

33 Penalty (3% per year on the line 31 amount for the number of days on line 32).

Enter this amount here and on line 36, Form 1040N. .................................................................................................................... 33

8-237-2012 Rev. 1-2013

Deadline changed to April 15, 2013 due to IRS extension.

1

1 2

2 3

3