Form Rpd-41352 - County Gaming Tax Credit Claim Form

ADVERTISEMENT

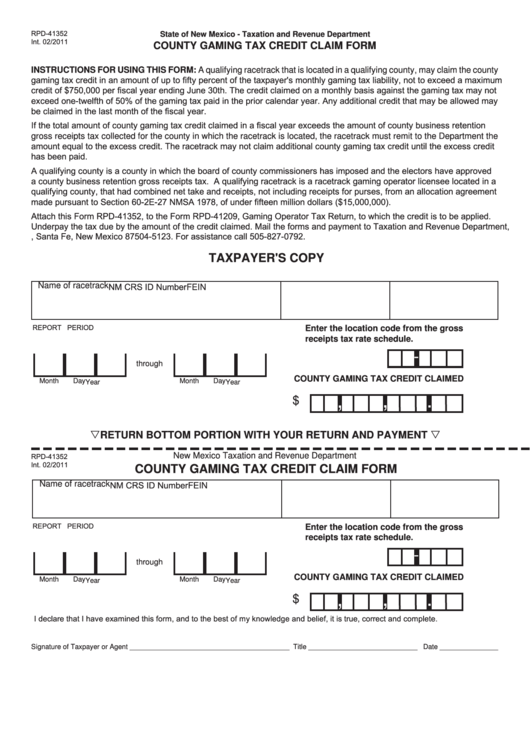

RPD-41352

State of New Mexico - Taxation and Revenue Department

Int. 02/2011

COUNTY GAMING TAX CREDIT CLAIM FORM

INSTRUCTIONS FOR USING THIS FORM: A qualifying racetrack that is located in a qualifying county, may claim the county

gaming tax credit in an amount of up to fifty percent of the taxpayer's monthly gaming tax liability, not to exceed a maximum

credit of $750,000 per fiscal year ending June 30th. The credit claimed on a monthly basis against the gaming tax may not

exceed one-twelfth of 50% of the gaming tax paid in the prior calendar year. Any additional credit that may be allowed may

be claimed in the last month of the fiscal year.

If the total amount of county gaming tax credit claimed in a fiscal year exceeds the amount of county business retention

gross receipts tax collected for the county in which the racetrack is located, the racetrack must remit to the Department the

amount equal to the excess credit. The racetrack may not claim additional county gaming tax credit until the excess credit

has been paid.

A qualifying county is a county in which the board of county commissioners has imposed and the electors have approved

a county business retention gross receipts tax. A qualifying racetrack is a racetrack gaming operator licensee located in a

qualifying county, that had combined net take and receipts, not including receipts for purses, from an allocation agreement

made pursuant to Section 60-2E-27 NMSA 1978, of under fifteen million dollars ($15,000,000).

Attach this Form RPD-41352, to the Form RPD-41209, Gaming Operator Tax Return, to which the credit is to be applied.

Underpay the tax due by the amount of the credit claimed. Mail the forms and payment to Taxation and Revenue Department,

P.O. Box 25123, Santa Fe, New Mexico 87504-5123. For assistance call 505-827-0792.

TAXPAYER'S COPY

NM CRS ID Number

Name of racetrack

FEIN

REPORT PERIOD

Enter the location code from the gross

receipts tax rate schedule.

-

through

COUNTY GAMING TAX CREDIT CLAIMED

Month

Day

Month

Day

Year

Year

.

,

,

$

RETURN BOTTOM PORTION WITH YOUR RETURN AND PAYMENT

RPD-41352

New Mexico Taxation and Revenue Department

Int. 02/2011

COUNTY GAMING TAX CREDIT CLAIM FORM

NM CRS ID Number

Name of racetrack

FEIN

REPORT PERIOD

Enter the location code from the gross

receipts tax rate schedule.

-

through

COUNTY GAMING TAX CREDIT CLAIMED

Month

Day

Month

Day

Year

Year

.

,

,

$

I declare that I have examined this form, and to the best of my knowledge and belief, it is true, correct and complete.

Signature of Taxpayer or Agent _________________________________________ Title ____________________________ Date _______________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1