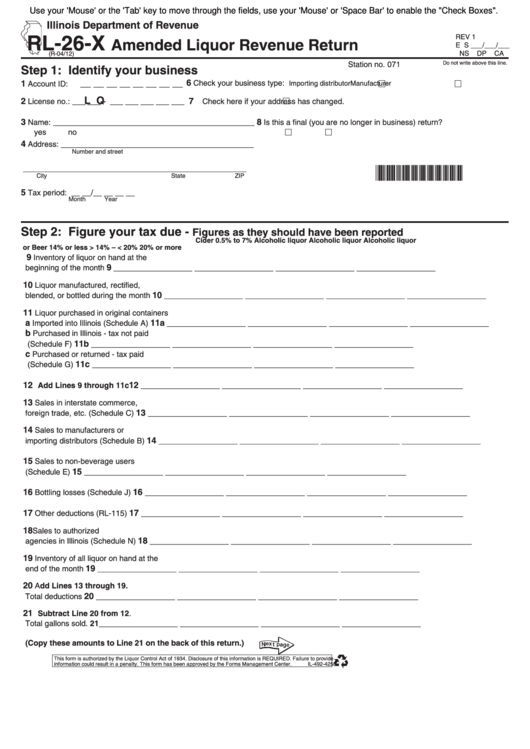

Use your 'Mouse' or the 'Tab' key to move through the fields, use your 'Mouse' or 'Space Bar' to enable the "Check Boxes".

Illinois Department of Revenue

RL-26-X

REV 1

Amended Liquor Revenue Return

E S ___/___/___

NS DP CA

(R-04/12)

Station no. 071

Do not write above this line.

Step 1: Identify your business

1

6

Account ID: __ __ __ __ __ __ __ __

Check your business type:

Importing distributor

Manufacturer

L Q

2

7

License no.: ___ ___ - ___ ___ ___ ___ ___

Check here if your address has changed.

3

8

Name: ______________________________________________

Is this a final (you are no longer in business) return?

yes no

4

Address: ____________________________________________

Number and street

___________________________________________________

*034811110*

City State ZIP

5

Tax period: __ __/__ __ __ __

Month Year

Step 2: Figure your tax due -

Figures as they should have been reported

Cider 0.5% to 7%

Alcoholic liquor

Alcoholic liquor

Alcoholic liquor

or Beer

14% or less

> 14% – < 20%

20% or more

9

Inventory of liquor on hand at the

9

beginning of the month

__________________ __________________ __________________ __________________

1 0

Liquor manufactured, rectified,

10

blended, or bottled during the month

__________________ __________________ __________________ __________________

1 1

Liquor purchased in original containers

a

11a

Imported into Illinois (Schedule A)

__________________ __________________ __________________ __________________

b

Purchased in Illinois - tax not paid

11b

(Schedule F)

__________________ __________________ __________________ __________________

c

Purchased or returned - tax paid

11c

(Schedule G)

__________________ __________________ __________________ __________________

1 2

12

Add Lines 9 through 11c

__________________ __________________ __________________ __________________

1 3

Sales in interstate commerce,

13

foreign trade, etc. (Schedule C)

__________________ __________________ __________________ __________________

1 4

Sales to manufacturers or

14

importing distributors (Schedule B)

__________________ __________________ __________________ __________________

1 5

Sales to non-beverage users

15

(Schedule E)

__________________ __________________ __________________ __________________

1 6

16

Bottling losses (Schedule J)

__________________ __________________ __________________ __________________

1 7

17

Other deductions (RL-115)

__________________ __________________ __________________ __________________

1 8

Sales to authorized U.S. government

18

agencies in Illinois (Schedule N)

__________________ __________________ __________________ __________________

1 9

Inventory of all liquor on hand at the

19

end of the month

__________________ __________________ __________________ __________________

2 0

Add Lines 13 through 19.

20

Total deductions

__________________ __________________ __________________ __________________

2 1

Subtract Line 20 from 12.

21 __________________ __________________ __________________ __________________

Total gallons sold.

(Copy these amounts to Line 21 on the back of this return.)

This form is authorized by the Liquor Control Act of 1934. Disclosure of this information is REQUIRED. Failure to provide

information could result in a penalty. This form has been approved by the Forms Management Center. IL-492-4250

1

1 2

2