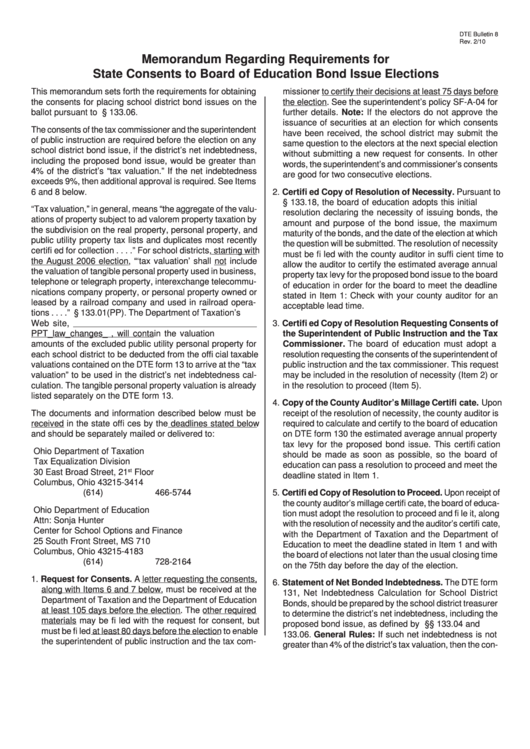

Memorandum Regarding Requirements For State Consents To Board Of Education Bond Issue Elections

ADVERTISEMENT

DTE Bulletin 8

Rev. 2/10

Memorandum Regarding Requirements for

State Consents to Board of Education Bond Issue Elections

This memorandum sets forth the requirements for obtaining

missioner to certify their decisions at least 75 days before

the consents for placing school district bond issues on the

the election. See the superintendent’s policy SF-A-04 for

ballot pursuant to R.C. § 133.06.

further details. Note: If the electors do not approve the

issuance of securities at an election for which consents

The consents of the tax commissioner and the superintendent

have been received, the school district may submit the

of public instruction are required before the election on any

same question to the electors at the next special election

school district bond issue, if the district’s net indebtedness,

without submitting a new request for consents. In other

including the proposed bond issue, would be greater than

words, the superintendent’s and commissioner’s consents

4% of the district’s “tax valuation.” If the net indebtedness

are good for two consecutive elections.

exceeds 9%, then additional approval is required. See Items

6 and 8 below.

2. Certifi ed Copy of Resolution of Necessity. Pursuant to

R.C. § 133.18, the board of education adopts this initial

“Tax valuation,” in general, means “the aggregate of the valu-

resolution declaring the necessity of issuing bonds, the

ations of property subject to ad valorem property taxation by

amount and purpose of the bond issue, the maximum

the subdivision on the real property, personal property, and

maturity of the bonds, and the date of the election at which

public utility property tax lists and duplicates most recently

the question will be submitted. The resolution of necessity

certifi ed for collection . . . .” For school districts, starting with

must be fi led with the county auditor in suffi cient time to

the August 2006 election, “‘tax valuation’ shall not include

allow the auditor to certify the estimated average annual

the valuation of tangible personal property used in business,

property tax levy for the proposed bond issue to the board

telephone or telegraph property, interexchange telecommu-

of education in order for the board to meet the deadline

nications company property, or personal property owned or

stated in Item 1: Check with your county auditor for an

leased by a railroad company and used in railroad opera-

acceptable lead time.

tions . . . .” R.C. § 133.01(PP). The Department of Taxation’s

Web site,

3. Certifi ed Copy of Resolution Requesting Consents of

PPT_law_changes_070303.stm, will contain the valuation

the Superintendent of Public Instruction and the Tax

amounts of the excluded public utility personal property for

Commissioner. The board of education must adopt a

each school district to be deducted from the offi cial taxable

resolution requesting the consents of the superintendent of

valuations contained on the DTE form 13 to arrive at the “tax

public instruction and the tax commissioner. This request

valuation” to be used in the district’s net indebtedness cal-

may be included in the resolution of necessity (Item 2) or

culation. The tangible personal property valuation is already

in the resolution to proceed (Item 5).

listed separately on the DTE form 13.

4. Copy of the County Auditor’s Millage Certifi cate. Upon

The documents and information described below must be

receipt of the resolution of necessity, the county auditor is

received in the state offi ces by the deadlines stated below

required to calculate and certify to the board of education

and should be separately mailed or delivered to:

on DTE form 130 the estimated average annual property

tax levy for the proposed bond issue. This certifi cation

Ohio Department of Taxation

should be made as soon as possible, so the board of

Tax Equalization Division

education can pass a resolution to proceed and meet the

30 East Broad Street, 21

st

Floor

deadline stated in Item 1.

Columbus, Ohio 43215-3414

(614) 466-5744

5. Certifi ed Copy of Resolution to Proceed. Upon receipt of

the county auditor’s millage certifi cate, the board of educa-

Ohio Department of Education

tion must adopt the resolution to proceed and fi le it, along

Attn: Sonja Hunter

with the resolution of necessity and the auditor’s certifi cate,

Center for School Options and Finance

with the Department of Taxation and the Department of

25 South Front Street, MS 710

Education to meet the deadline stated in Item 1 and with

Columbus, Ohio 43215-4183

the board of elections not later than the usual closing time

(614) 728-2164

on the 75th day before the day of the election.

1. Request for Consents. A letter requesting the consents,

6. Statement of Net Bonded Indebtedness. The DTE form

along with Items 6 and 7 below, must be received at the

131, Net Indebtedness Calculation for School District

Department of Taxation and the Department of Education

Bonds, should be prepared by the school district treasurer

at least 105 days before the election. The other required

to determine the district’s net indebtedness, including the

materials may be fi led with the request for consent, but

proposed bond issue, as defi ned by R.C. §§ 133.04 and

must be fi led at least 80 days before the election to enable

133.06. General Rules: If such net indebtedness is not

the superintendent of public instruction and the tax com-

greater than 4% of the district’s tax valuation, then the con-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2