Reset Form

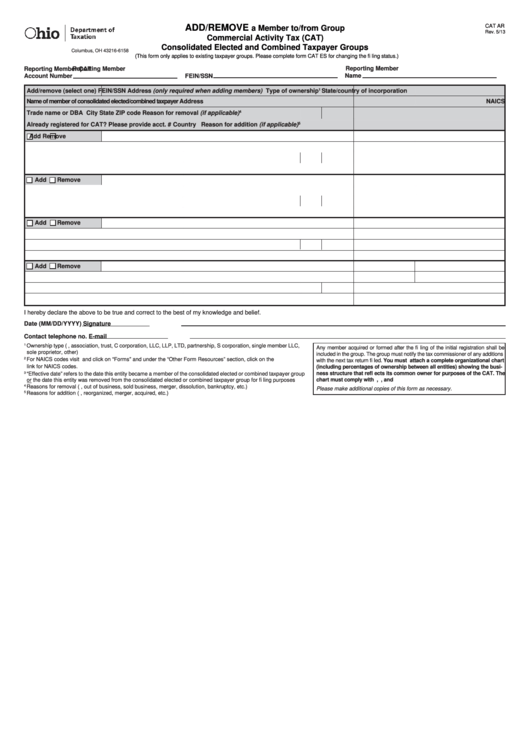

ADD/REMOVE

CAT AR

a Member to/from Group

Rev. 5/13

Commercial Activity Tax (CAT)

P.O. Box 16158

Consolidated Elected and Combined Taxpayer Groups

Columbus, OH 43216-6158

(This form only applies to existing taxpayer groups. Please complete form CAT ES for changing the fi ling status.)

tax.ohio.gov

Reporting Member

Reporting Member CAT

Reporting Member

Name

Account Number

FEIN/SSN

1

Add/remove (select one)

FEIN/SSN

Address (only required when adding members)

Type of ownership

State/country of incorporation

Name of member of consolidated elected/combined taxpayer Address

NAICS code

2

Effective date (MM/DD/YYYY)

3

Trade name or DBA

City

State

ZIP code Reason for removal (if applicable)

4

Already registered for CAT? Please provide acct. #

Country

Reason for addition (if applicable)

5

Add

Remove

Add

Remove

Add

Remove

Add

Remove

I hereby declare the above to be true and correct to the best of my knowledge and belief.

Date (MM/DD/YYYY)

Signature

Contact telephone no.

E-mail

1

Ownership type (e.g., association, trust, C corporation, LLC, LLP, LTD, partnership, S corporation, single member LLC,

Any member acquired or formed after the fi ling of the initial registration shall be

sole proprietor, other)

included in the group. The group must notify the tax commissioner of any additions

2

For NAICS codes visit tax.ohio.gov and click on “Forms” and under the “Other Form Resources” section, click on the

with the next tax return fi led. You must attach a complete organizational chart

link for NAICS codes.

(including percentages of ownership between all entities) showing the busi-

3

ness structure that refl ects its common owner for purposes of the CAT. The

“Effective date” refers to the date this entity became a member of the consolidated elected or combined taxpayer group

chart must comply with R.C. 5751.011, R.C. 5751.012, and O.A.C. 5703-29-02.

or the date this entity was removed from the consolidated elected or combined taxpayer group for fi ling purposes

4

Reasons for removal (e.g., out of business, sold business, merger, dissolution, bankruptcy, etc.)

Please make additional copies of this form as necessary.

5

Reasons for addition (e.g., reorganized, merger, acquired, etc.)

1

1