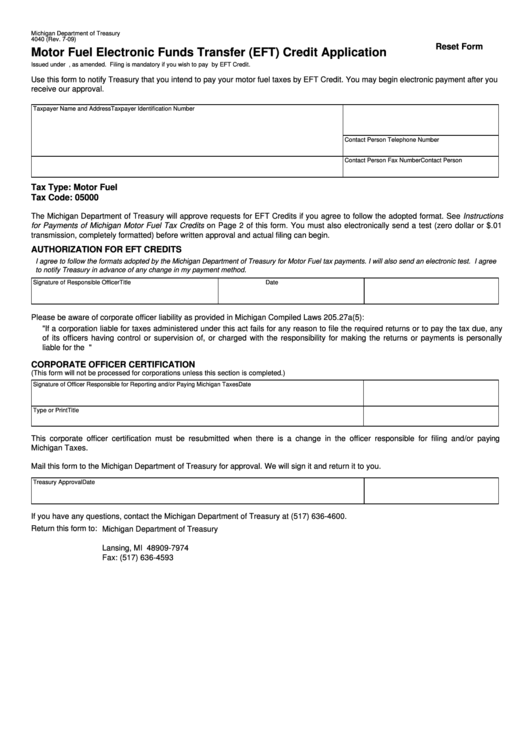

Michigan Department of Treasury

4040 (Rev. 7-09)

Reset Form

Motor Fuel Electronic Funds Transfer (EFT) Credit Application

Issued under P.A. 122 of 1991, as amended. Filing is mandatory if you wish to pay by EFT Credit.

Use this form to notify Treasury that you intend to pay your motor fuel taxes by EFT Credit. You may begin electronic payment after you

receive our approval.

Taxpayer Name and Address

Taxpayer Identification Number

Contact Person Telephone Number

Contact Person

Contact Person Fax Number

Tax Type: Motor Fuel

Tax Code: 05000

The Michigan Department of Treasury will approve requests for EFT Credits if you agree to follow the adopted format. See Instructions

for Payments of Michigan Motor Fuel Tax Credits on Page 2 of this form. You must also electronically send a test (zero dollar or $.01

transmission, completely formatted) before written approval and actual filing can begin.

AUTHORIZATION FOR EFT CREDITS

I agree to follow the formats adopted by the Michigan Department of Treasury for Motor Fuel tax payments. I will also send an electronic test. I agree

to notify Treasury in advance of any change in my payment method.

Signature of Responsible Officer

Title

Date

Please be aware of corporate officer liability as provided in Michigan Compiled Laws 205.27a(5):

"If a corporation liable for taxes administered under this act fails for any reason to file the required returns or to pay the tax due, any

of its officers having control or supervision of, or charged with the responsibility for making the returns or payments is personally

liable for the failure..........."

CORPORATE OFFICER CERTIFICATION

(This form will not be processed for corporations unless this section is completed.)

Signature of Officer Responsible for Reporting and/or Paying Michigan Taxes

Date

Type or Print

Title

This corporate officer certification must be resubmitted when there is a change in the officer responsible for filing and/or paying

Michigan Taxes.

Mail this form to the Michigan Department of Treasury for approval. We will sign it and return it to you.

Treasury Approval

Date

If you have any questions, contact the Michigan Department of Treasury at (517) 636-4600.

Return this form to:

Michigan Department of Treasury

P.O. Box 30474

Lansing, MI 48909-7974

Fax: (517) 636-4593

1

1 2

2