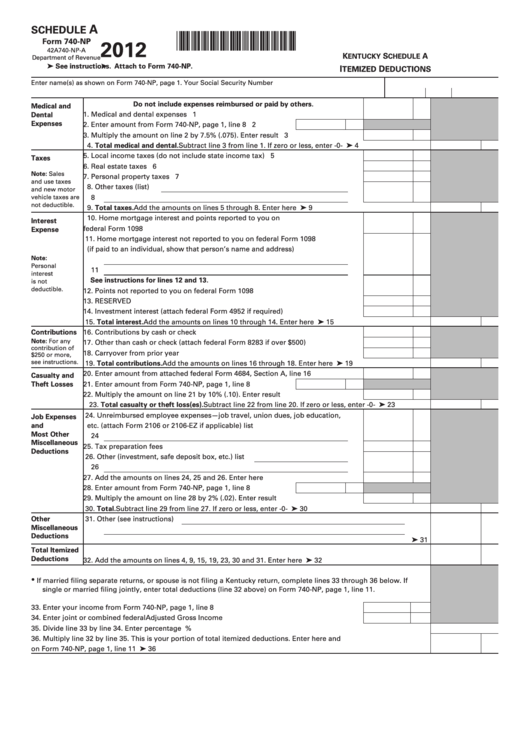

A

SCHEDULE

*1200030014*

Form 740-NP

2012

42A740-NP-A

K

S

A

ENTUCKY

CHEDULE

Department of Revenue

➤ See instructions.

➤ Attach to Form 740-NP.

I

D

TEMIZED

EDUCTIONS

Enter name(s) as shown on Form 740-NP, page 1.

Your Social Security Number

Do not include expenses reimbursed or paid by others.

Medical and

1. Medical and dental expenses .............................................................................

1

Dental

Expenses

2. Enter amount from Form 740-NP, page 1, line 8 ............

2

3. Multiply the amount on line 2 by 7.5% (.075). Enter result ..............................

3

4. Total medical and dental. Subtract line 3 from line 1. If zero or less, enter -0- .............................. ➤ 4

5. Local income taxes (do not include state income tax) .....................................

5

Taxes

6. Real estate taxes ..................................................................................................

6

Note: Sales

7. Personal property taxes ......................................................................................

7

and use taxes

8. Other taxes (list)

and new motor

8

vehicle taxes are

not deductible.

9. Total taxes. Add the amounts on lines 5 through 8. Enter here ...................................................... ➤ 9

10. Home mortgage interest and points reported to you on

Interest

federal Form 1098 ................................................................................................ 10

Expense

11. Home mortgage interest not reported to you on federal Form 1098

(if paid to an individual, show that person’s name and address)

Note:

Personal

11

interest

See instructions for lines 12 and 13.

is not

deductible.

12. Points not reported to you on federal Form 1098 ............................................ 12

13. RESERVED ............................................................................................................ 13

14. Investment interest (attach federal Form 4952 if required) .............................. 14

15. Total interest. Add the amounts on lines 10 through 14. Enter here .............................................. ➤ 15

Contributions

16. Contributions by cash or check .......................................................................... 16

Note: For any

17. Other than cash or check (attach federal Form 8283 if over $500) .................. 17

contribution of

18. Carryover from prior year ................................................................................... 18

$250 or more,

see instructions.

19. Total contributions. Add the amounts on lines 16 through 18. Enter here .................................... ➤ 19

20. Enter amount from attached federal Form 4684, Section A, line 16 ............... 20

Casualty and

Theft Losses

21. Enter amount from Form 740-NP, page 1, line 8 ............ 21

22. Multiply the amount on line 21 by 10% (.10). Enter result ............................... 22

23. Total casualty or theft loss(es). Subtract line 22 from line 20. If zero or less, enter -0- ................ ➤ 23

24. Unreimbursed employee expenses—job travel, union dues, job education,

Job Expenses

and

etc. (attach Form 2106 or 2106-EZ if applicable) list

Most Other

24

Miscellaneous

25. Tax preparation fees ............................................................................................ 25

Deductions

26. Other (investment, safe deposit box, etc.) list

26

27. Add the amounts on lines 24, 25 and 26. Enter here ........................................ 27

28. Enter amount from Form 740-NP, page 1, line 8 ............ 28

29. Multiply the amount on line 28 by 2% (.02). Enter result ................................. 29

30. Total. Subtract line 29 from line 27. If zero or less, enter -0- ........................................................... ➤ 30

Other

31. Other (see instructions)

Miscellaneous

Deductions

➤ 31

Total Itemized

Deductions

32. Add the amounts on lines 4, 9, 15, 19, 23, 30 and 31. Enter here .................................................... ➤ 32

•

If married filing separate returns, or spouse is not filing a Kentucky return, complete lines 33 through 36 below. If

single or married filing jointly, enter total deductions (line 32 above) on Form 740-NP, page 1, line 11.

33. Enter your income from Form 740-NP, page 1, line 8 .................................................................... 33

34. Enter joint or combined federal Adjusted Gross Income ............................................................... 34

35. Divide line 33 by line 34. Enter percentage ......................................................................................................................... 35

%

36. Multiply line 32 by line 35. This is your portion of total itemized deductions. Enter here and

on Form 740-NP, page 1, line 11 ...................................................................................................................................... ➤ 36

1

1