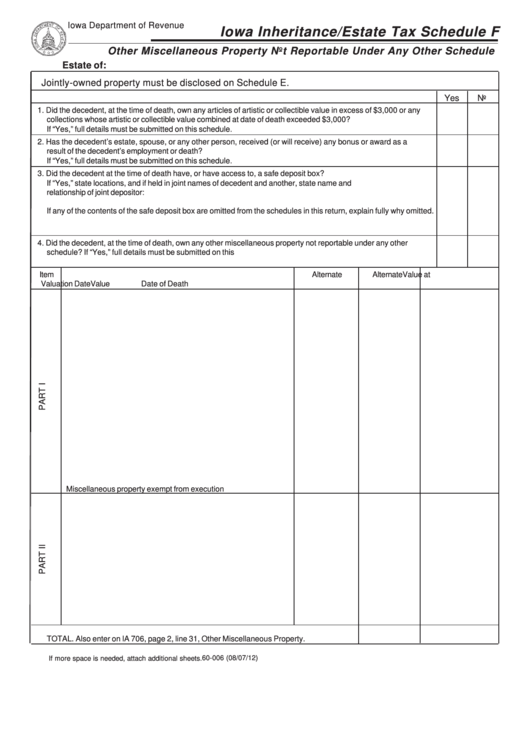

Form Iowa Inheritance/estate Tax Schedule F - Other Miscellaneous Property Not Reportable Under Any Other Schedule - 2012

ADVERTISEMENT

Iowa Department of Revenue

Iowa Inheritance/Estate Tax Schedule F

Other Miscellaneous Property Not Reportable Under Any Other Schedule

Estate of:

Jointly-owned property must be disclosed on Schedule E.

Yes

No

1. Did the decedent, at the time of death, own any articles of artistic or collectible value in excess of $3,000 or any

collections whose artistic or collectible value combined at date of death exceeded $3,000? .....................................

If “Yes,” full details must be submitted on this schedule.

2. Has the decedent’s estate, spouse, or any other person, received (or will receive) any bonus or award as a

result of the decedent’s employment or death? .........................................................................................................

If “Yes,” full details must be submitted on this schedule.

3. Did the decedent at the time of death have, or have access to, a safe deposit box? .................................................

If “Yes,” state locations, and if held in joint names of decedent and another, state name and

relationship of joint depositor:

If any of the contents of the safe deposit box are omitted from the schedules in this return, explain fully why omitted.

4. Did the decedent, at the time of death, own any other miscellaneous property not reportable under any other

schedule? If “Yes,” full details must be submitted on this schedule. ..........................................................................

Item

Alternate

Alternate

Value at

No.

Description

Valuation Date

Value

Date of Death

Miscellaneous property exempt from execution

TOTAL. Also enter on IA 706, page 2, line 31, Other Miscellaneous Property. .....................

60-006 (08/07/12)

If more space is needed, attach additional sheets.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1