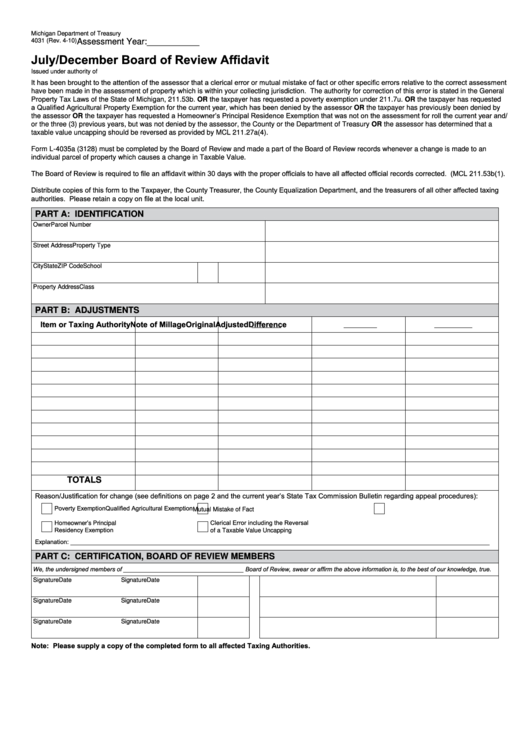

Michigan Department of Treasury

4031 (Rev. 4-10)

Assessment Year:___________

July/December Board of Review Affidavit

Issued under authority of P.A. 206 of 1893. Filing is mandatory.

It has been brought to the attention of the assessor that a clerical error or mutual mistake of fact or other specific errors relative to the correct assessment

have been made in the assessment of property which is within your collecting jurisdiction. The authority for correction of this error is stated in the General

Property Tax Laws of the State of Michigan, 211.53b. OR the taxpayer has requested a poverty exemption under 211.7u. OR the taxpayer has requested

a Qualified Agricultural Property Exemption for the current year, which has been denied by the assessor OR the taxpayer has previously been denied by

the assessor OR the taxpayer has requested a Homeowner’s Principal Residence Exemption that was not on the assessment for roll the current year and/

or the three (3) previous years, but was not denied by the assessor, the County or the Department of Treasury OR the assessor has determined that a

taxable value uncapping should be reversed as provided by MCL 211.27a(4).

Form L-4035a (3128) must be completed by the Board of Review and made a part of the Board of Review records whenever a change is made to an

individual parcel of property which causes a change in Taxable Value.

The Board of Review is required to file an affidavit within 30 days with the proper officials to have all affected official records corrected. (MCL 211.53b(1).

Distribute copies of this form to the Taxpayer, the County Treasurer, the County Equalization Department, and the treasurers of all other affected taxing

authorities. Please retain a copy on file at the local unit.

PART A: IDENTIFICATION

Owner

Parcel Number

Street Address

Property Type

City

State

ZIP Code

School

Property Address

Class

PART B: ADJUSTMENTS

Item or Taxing Authority

Note of Millage

Original

Adjusted

Difference

TOTALS

Reason/Justification for change (see definitions on page 2 and the current year’s State Tax Commission Bulletin regarding appeal procedures):

Poverty Exemption

Qualified Agricultural Exemption

Mutual Mistake of Fact

Clerical Error including the Reversal

Homeowner’s Principal

Residency Exemption

of a Taxable Value Uncapping

Explanation: ___________________________________________________________________________________________________________________________

PART C: CERTIFICATION, BOARD OF REVIEW MEMBERS

We, the undersigned members of ____________________________________ Board of Review, swear or affirm the above information is, to the best of our knowledge, true.

Signature

Date

Signature

Date

Signature

Date

Signature

Date

Signature

Date

Signature

Date

Note: Please supply a copy of the completed form to all affected Taxing Authorities.

1

1 2

2