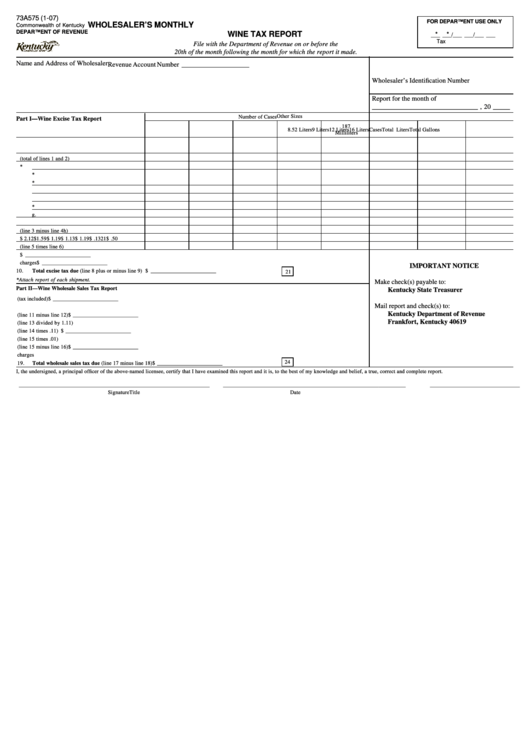

73A575 (1-07)

FOR DEPARTMENT USE ONLY

WHOLESALER’S MONTHLY

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

WINE TAX REPORT

*

*

___ ___ / ___ ___ / ___ ___

Tax

Mo.

Yr.

File with the Department of Revenue on or before the

20th of the month following the month for which the report it made.

Name and Address of Wholesaler

Revenue Account Number ____________________

Wholesaler’s Identification Number

Report for the month of

_______________________________ , 20 _____

Other Sizes

Number of Cases

Part I—Wine Excise Tax Report

187

16 Liters

12 Liters

9 Liters

8.52 Liters

Cases

Total Liters

Total Gallons

Milliliters

1.

Wine received from all sources

2.

Inventory at beginning of month

3.

Total wine available (total of lines 1 and 2)

4.

a. Exports*

b. Wine returned to vendors*

c. Wine delivered to other KY wholesalers*

d. Tax paid wine returned by KY retailers

e. Inventory at end of month

f. Sales to federal government*

g.

h. Total of lines a through g

5.

Balance subject to tax (line 3 minus line 4h)

6.

Excise tax rate

$

2.12

$

1.59

$

1.19

$

1.13

$

1.19

$

.1321

$

.50

7.

Tax applicable (line 5 times line 6)

8.

Total of all items on line 7 ...................................................................................................................................................... $ ________________________

9.

Miscellaneous credits and charges ......................................................................................................................................... $ ________________________

IMPORTANT NOTICE

10.

Total excise tax due (line 8 plus or minus line 9) ......................................................................................................

$ ________________________

21

*Attach report of each shipment.

Make check(s) payable to:

Part II—Wine Wholesale Sales Tax Report

Kentucky State Treasurer

11.

Gross receipts from sales of wine reported on line 5 of Part I above (tax included) ..........................................................

$ ________________________

Mail report and check(s) to:

12.

Receipts of wine reported from small farm wineries ............................................................................................................

________________________

Kentucky Department of Revenue

13.

Net receipts (line 11 minus line 12) ......................................................................................................................................

$ ________________________

Frankfort, Kentucky 40619

14.

Taxable receipts (line 13 divided by 1.11) ............................................................................................................................

________________________

15.

Gross tax applicable (line 14 times .11) ................................................................................................................................

$ ________________________

16.

Collection and reporting fee (line 15 times .01) ...................................................................................................................

________________________

17.

Net tax due (line 15 minus line 16) .......................................................................................................................................

$ ________________________

18.

Miscellaneous credits and charges .......................................................................................................................................

________________________

24

19.

Total wholesale sales tax due (line 17 minus line 18) ...............................................................................................

$ ________________________

I, the undersigned, a principal officer of the above-named licensee, certify that I have examined this report and it is, to the best of my knowledge and belief, a true, correct and complete report.

______________________________________________________________________

___________________________________________________________________

_________________________________

Signature

Title

Date

1

1 2

2