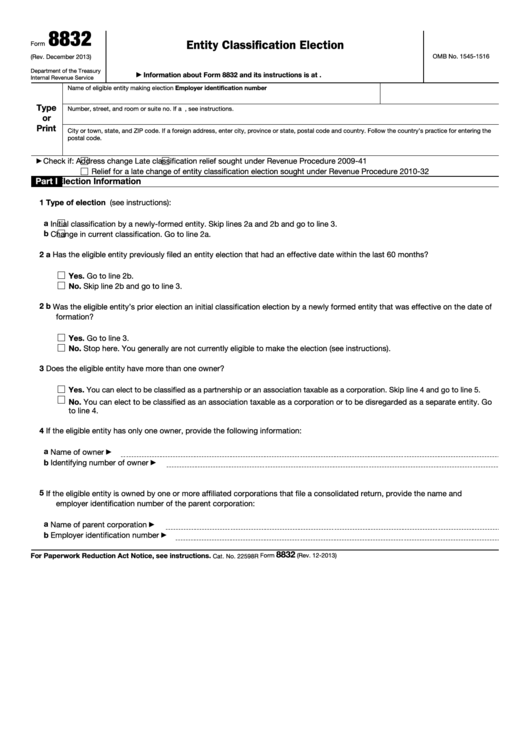

8832

Entity Classification Election

Form

(Rev. December 2013)

OMB No. 1545-1516

Department of the Treasury

Information about Form 8832 and its instructions is at

▶

Internal Revenue Service

Name of eligible entity making election

Employer identification number

Type

Number, street, and room or suite no. If a P.O. box, see instructions.

or

Print

City or town, state, and ZIP code. If a foreign address, enter city, province or state, postal code and country. Follow the country’s practice for entering the

postal code.

Check if:

Address change

Late classification relief sought under Revenue Procedure 2009-41

▶

Relief for a late change of entity classification election sought under Revenue Procedure 2010-32

Part I

Election Information

1

Type of election (see instructions):

a

Initial classification by a newly-formed entity. Skip lines 2a and 2b and go to line 3.

b

Change in current classification. Go to line 2a.

2 a Has the eligible entity previously filed an entity election that had an effective date within the last 60 months?

Yes. Go to line 2b.

No. Skip line 2b and go to line 3.

2 b Was the eligible entity’s prior election an initial classification election by a newly formed entity that was effective on the date of

formation?

Yes. Go to line 3.

No. Stop here. You generally are not currently eligible to make the election (see instructions).

3

Does the eligible entity have more than one owner?

Yes. You can elect to be classified as a partnership or an association taxable as a corporation. Skip line 4 and go to line 5.

No. You can elect to be classified as an association taxable as a corporation or to be disregarded as a separate entity. Go

to line 4.

4

If the eligible entity has only one owner, provide the following information:

a Name of owner

▶

b Identifying number of owner

▶

5

If the eligible entity is owned by one or more affiliated corporations that file a consolidated return, provide the name and

employer identification number of the parent corporation:

a Name of parent corporation

▶

b Employer identification number

▶

8832

For Paperwork Reduction Act Notice, see instructions.

Form

(Rev. 12-2013)

Cat. No. 22598R

1

1 2

2 3

3 4

4 5

5 6

6 7

7