Shareholder'S Instructions For Schedule K-1 (100s) - 2013

ADVERTISEMENT

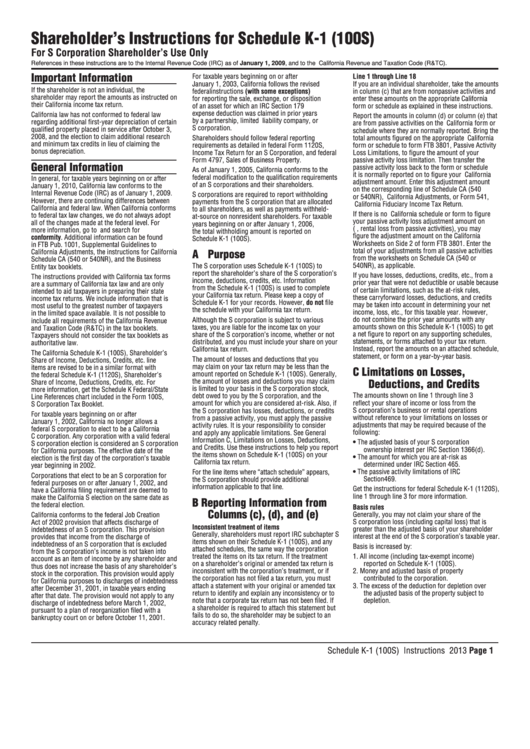

Shareholder’s Instructions for Schedule K-1 (100S)

For S Corporation Shareholder’s Use Only

References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2009, and to the California Revenue and Taxation Code (R&TC).

Important Information

For taxable years beginning on or after

Line 1 through Line 18

January 1, 2003, California follows the revised

If you are an individual shareholder, take the amounts

If the shareholder is not an individual, the

federal instructions (with some exceptions)

in column (c) that are from nonpassive activities and

shareholder may report the amounts as instructed on

for reporting the sale, exchange, or disposition

enter these amounts on the appropriate California

their California income tax return.

of an asset for which an IRC Section 179

form or schedule as explained in these instructions.

expense deduction was claimed in prior years

California law has not conformed to federal law

Report the amounts in column (d) or column (e) that

by a partnership, limited liability company, or

regarding additional first-year depreciation of certain

are from passive activities on the California form or

S corporation.

qualified property placed in service after October 3,

schedule where they are normally reported. Bring the

2008, and the election to claim additional research

Shareholders should follow federal reporting

total amounts figured on the appropriate California

and minimum tax credits in lieu of claiming the

requirements as detailed in federal Form 1120S, U.S.

form or schedule to form FTB 3801, Passive Activity

bonus depreciation.

Income Tax Return for an S Corporation, and federal

Loss Limitations, to figure the amount of your

Form 4797, Sales of Business Property.

passive activity loss limitation. Then transfer the

General Information

passive activity loss back to the form or schedule

As of January 1, 2005, California conforms to the

it is normally reported on to figure your California

federal modification to the qualification requirements

In general, for taxable years beginning on or after

adjustment amount. Enter this adjustment amount

of an S corporations and their shareholders.

January 1, 2010, California law conforms to the

on the corresponding line of Schedule CA (540

Internal Revenue Code (IRC) as of January 1, 2009.

S corporations are required to report withholding

or 540NR), California Adjustments, or Form 541,

However, there are continuing differences between

payments from the S corporation that are allocated

California Fiduciary Income Tax Return.

California and federal law. When California conforms

to all shareholders, as well as payments withheld-

If there is no California schedule or form to figure

to federal tax law changes, we do not always adopt

at-source on nonresident shareholders. For taxable

your passive activity loss adjustment amount on

all of the changes made at the federal level. For

years beginning on or after January 1, 2006,

(i.e., rental loss from passive activities), you may

more information, go to ftb.ca.gov and search for

the total withholding amount is reported on

figure the adjustment amount on the California

conformity. Additional information can be found

Schedule K-1 (100S).

Worksheets on Side 2 of form FTB 3801. Enter the

in FTB Pub. 1001, Supplemental Guidelines to

total of your adjustments from all passive activities

A Purpose

California Adjustments, the instructions for California

from the worksheets on Schedule CA (540 or

Schedule CA (540 or 540NR), and the Business

540NR), as applicable.

The S corporation uses Schedule K-1 (100S) to

Entity tax booklets.

report the shareholder’s share of the S corporation’s

If you have losses, deductions, credits, etc., from a

The instructions provided with California tax forms

income, deductions, credits, etc. Information

prior year that were not deductible or usable because

are a summary of California tax law and are only

from the Schedule K-1 (100S) is used to complete

of certain limitations, such as the at-risk rules,

intended to aid taxpayers in preparing their state

your California tax return. Please keep a copy of

these carryforward losses, deductions, and credits

income tax returns. We include information that is

Schedule K-1 for your records. However, do not file

may be taken into account in determining your net

most useful to the greatest number of taxpayers

the schedule with your California tax return.

income, loss, etc., for this taxable year. However,

in the limited space available. It is not possible to

do not combine the prior year amounts with any

Although the S corporation is subject to various

include all requirements of the California Revenue

amounts shown on this Schedule K-1 (100S) to get

taxes, you are liable for the income tax on your

and Taxation Code (R&TC) in the tax booklets.

a net figure to report on any supporting schedules,

share of the S corporation’s income, whether or not

Taxpayers should not consider the tax booklets as

statements, or forms attached to your tax return.

distributed, and you must include your share on your

authoritative law.

Instead, report the amounts on an attached schedule,

California tax return.

The California Schedule K-1 (100S), Shareholder’s

statement, or form on a year-by-year basis.

The amount of losses and deductions that you

Share of Income, Deductions, Credits, etc. line

may claim on your tax return may be less than the

items are revised to be in a similar format with

C Limitations on Losses,

amount reported on Schedule K-1 (100S). Generally,

the federal Schedule K-1 (1120S), Shareholder’s

the amount of losses and deductions you may claim

Deductions, and Credits

Share of Income, Deductions, Credits, etc. For

is limited to your basis in the S corporation stock,

more information, get the Schedule K Federal/State

The amounts shown on line 1 through line 3

debt owed to you by the S corporation, and the

Line References chart included in the Form 100S,

amount for which you are considered at-risk. Also, if

reflect your share of income or loss from the

S Corporation Tax Booklet.

S corporation’s business or rental operations

the S corporation has losses, deductions, or credits

For taxable years beginning on or after

without reference to your limitations on losses or

from a passive activity, you must apply the passive

January 1, 2002, California no longer allows a

activity rules. It is your responsibility to consider

adjustments that may be required because of the

federal S corporation to elect to be a California

following:

and apply any applicable limitations. See General

C corporation. Any corporation with a valid federal

Information C, Limitations on Losses, Deductions,

•

The adjusted basis of your S corporation

S corporation election is considered an S corporation

and Credits. Use these instructions to help you report

ownership interest per IRC Section 1366(d).

for California purposes. The effective date of the

the items shown on Schedule K-1 (100S) on your

•

The amount for which you are at-risk as

election is the first day of the corporation’s taxable

California tax return.

determined under IRC Section 465.

year beginning in 2002.

•

The passive activity limitations of IRC

For the line items where “attach schedule” appears,

Corporations that elect to be an S corporation for

Section 469.

the S corporation should provide additional

federal purposes on or after January 1, 2002, and

information applicable to that line.

Get the instructions for federal Schedule K-1 (1120S),

have a California filing requirement are deemed to

line 1 through line 3 for more information.

make the California S election on the same date as

B Reporting Information from

the federal election.

Basis rules

Columns (c), (d), and (e)

Generally, you may not claim your share of the

California conforms to the federal Job Creation

S corporation loss (including capital loss) that is

Act of 2002 provision that affects discharge of

Inconsistent treatment of items

greater than the adjusted basis of your shareholder

indebtedness of an S corporation. This provision

Generally, shareholders must report IRC subchapter S

interest at the end of the S corporation’s taxable year.

provides that income from the discharge of

items shown on their Schedule K-1 (100S), and any

indebtedness of an S corporation that is excluded

Basis is increased by:

attached schedules, the same way the corporation

from the S corporation’s income is not taken into

treated the items on its tax return. If the treatment

1. All income (including tax-exempt income)

account as an item of income by any shareholder and

on a shareholder’s original or amended tax return is

reported on Schedule K-1 (100S).

thus does not increase the basis of any shareholder’s

inconsistent with the corporation’s treatment, or if

2. Money and adjusted basis of property

stock in the corporation. This provision would apply

the corporation has not filed a tax return, you must

contributed to the corporation.

for California purposes to discharges of indebtedness

attach a statement with your original or amended tax

3. The excess of the deduction for depletion over

after December 31, 2001, in taxable years ending

return to identify and explain any inconsistency or to

the adjusted basis of the property subject to

after that date. The provision would not apply to any

note that a corporate tax return has not been filed. If

depletion.

discharge of indebtedness before March 1, 2002,

a shareholder is required to attach this statement but

pursuant to a plan of reorganization filed with a

fails to do so, the shareholder may be subject to an

bankruptcy court on or before October 11, 2001.

accuracy related penalty.

Schedule K-1 (100S) Instructions 2013 Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4