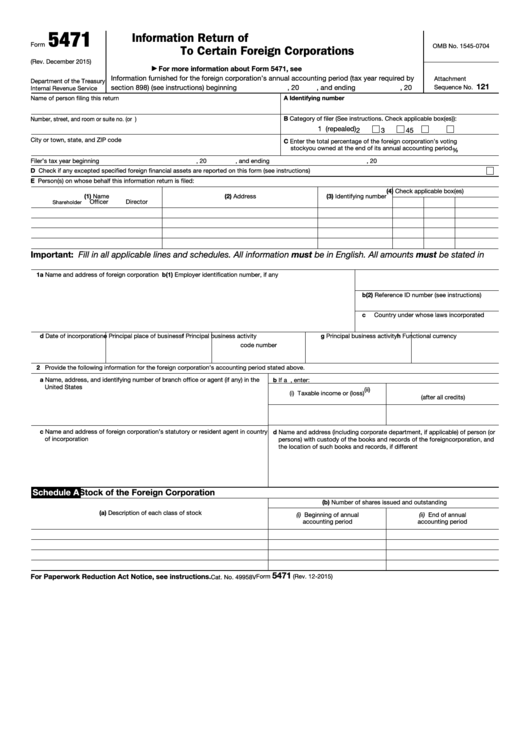

5471

Information Return of U.S. Persons With Respect

Form

OMB No. 1545-0704

To Certain Foreign Corporations

(Rev. December 2015)

For more information about Form 5471, see

▶

Information furnished for the foreign corporation’s annual accounting period (tax year required by

Attachment

Department of the Treasury

121

section 898) (see instructions) beginning

, 20

, and ending

, 20

Sequence No.

Internal Revenue Service

Name of person filing this return

A Identifying number

B Category of filer (See instructions. Check applicable box(es)):

Number, street, and room or suite no. (or P.O. box number if mail is not delivered to street address)

1 (repealed)

2

3

4

5

City or town, state, and ZIP code

C Enter the total percentage of the foreign corporation’s voting

stock you owned at the end of its annual accounting period

%

Filer’s tax year beginning

, 20

, and ending

, 20

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

D Check if any excepted specified foreign financial assets are reported on this form (see instructions)

E Person(s) on whose behalf this information return is filed:

(4) Check applicable box(es)

(1) Name

(2) Address

(3) Identifying number

Officer

Director

Shareholder

Important: Fill in all applicable lines and schedules. All information must be in English. All amounts must be stated in

U.S. dollars unless otherwise indicated.

1a Name and address of foreign corporation

b(1) Employer identification number, if any

b(2) Reference ID number (see instructions)

c

Country under whose laws incorporated

d Date of incorporation

e Principal place of business

f Principal business activity

g Principal business activity

h Functional currency

code number

2 Provide the following information for the foreign corporation’s accounting period stated above.

a Name, address, and identifying number of branch office or agent (if any) in the

b If a U.S. income tax return was filed, enter:

United States

(ii) U.S. income tax paid

(i) Taxable income or (loss)

(after all credits)

c Name and address of foreign corporation’s statutory or resident agent in country

d Name and address (including corporate department, if applicable) of person (or

of incorporation

persons) with custody of the books and records of the foreign corporation, and

the location of such books and records, if different

Schedule A

Stock of the Foreign Corporation

(b) Number of shares issued and outstanding

(a) Description of each class of stock

(i) Beginning of annual

(ii) End of annual

accounting period

accounting period

5471

For Paperwork Reduction Act Notice, see instructions.

Form

(Rev. 12-2015)

Cat. No. 49958V

1

1 2

2 3

3 4

4