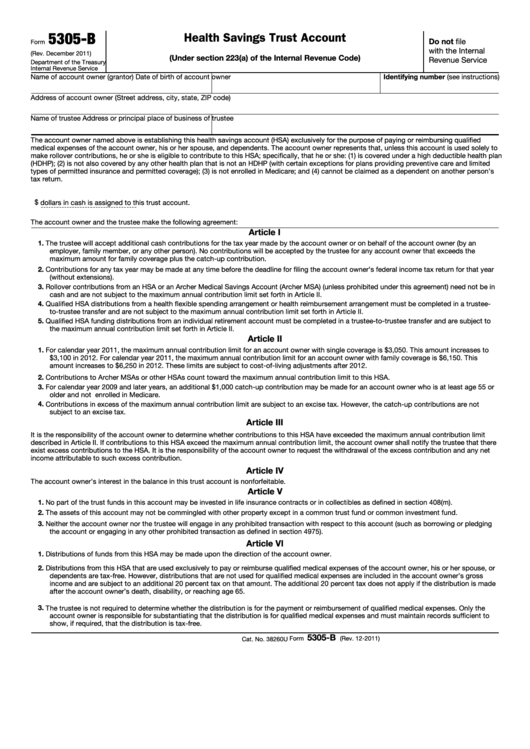

5305-B

Health Savings Trust Account

Do not file

Form

with the Internal

(Rev. December 2011)

(Under section 223(a) of the Internal Revenue Code)

Revenue Service

Department of the Treasury

Internal Revenue Service

Identifying number (see instructions)

Name of account owner (grantor)

Date of birth of account owner

Address of account owner (Street address, city, state, ZIP code)

Name of trustee

Address or principal place of business of trustee

The account owner named above is establishing this health savings account (HSA) exclusively for the purpose of paying or reimbursing qualified

medical expenses of the account owner, his or her spouse, and dependents. The account owner represents that, unless this account is used solely to

make rollover contributions, he or she is eligible to contribute to this HSA; specifically, that he or she: (1) is covered under a high deductible health plan

(HDHP); (2) is not also covered by any other health plan that is not an HDHP (with certain exceptions for plans providing preventive care and limited

types of permitted insurance and permitted coverage); (3) is not enrolled in Medicare; and (4) cannot be claimed as a dependent on another person’s

tax return.

$

dollars in cash is assigned to this trust account.

The account owner and the trustee make the following agreement:

Article I

1. The trustee will accept additional cash contributions for the tax year made by the account owner or on behalf of the account owner (by an

employer, family member, or any other person). No contributions will be accepted by the trustee for any account owner that exceeds the

maximum amount for family coverage plus the catch-up contribution.

2. Contributions for any tax year may be made at any time before the deadline for filing the account owner’s federal income tax return for that year

(without extensions).

3. Rollover contributions from an HSA or an Archer Medical Savings Account (Archer MSA) (unless prohibited under this agreement) need not be in

cash and are not subject to the maximum annual contribution limit set forth in Article II.

4. Qualified HSA distributions from a health flexible spending arrangement or health reimbursement arrangement must be completed in a trustee-

to-trustee transfer and are not subject to the maximum annual contribution limit set forth in Article II.

5. Qualified HSA funding distributions from an individual retirement account must be completed in a trustee-to-trustee transfer and are subject to

the maximum annual contribution limit set forth in Article II.

Article II

1. For calendar year 2011, the maximum annual contribution limit for an account owner with single coverage is $3,050. This amount increases to

$3,100 in 2012. For calendar year 2011, the maximum annual contribution limit for an account owner with family coverage is $6,150. This

amount increases to $6,250 in 2012. These limits are subject to cost-of-living adjustments after 2012.

2. Contributions to Archer MSAs or other HSAs count toward the maximum annual contribution limit to this HSA.

3. For calendar year 2009 and later years, an additional $1,000 catch-up contribution may be made for an account owner who is at least age 55 or

older and not enrolled in Medicare.

4. Contributions in excess of the maximum annual contribution limit are subject to an excise tax. However, the catch-up contributions are not

subject to an excise tax.

Article III

It is the responsibility of the account owner to determine whether contributions to this HSA have exceeded the maximum annual contribution limit

described in Article II. If contributions to this HSA exceed the maximum annual contribution limit, the account owner shall notify the trustee that there

exist excess contributions to the HSA. It is the responsibility of the account owner to request the withdrawal of the excess contribution and any net

income attributable to such excess contribution.

Article IV

The account owner’s interest in the balance in this trust account is nonforfeitable.

Article V

1. No part of the trust funds in this account may be invested in life insurance contracts or in collectibles as defined in section 408(m).

2. The assets of this account may not be commingled with other property except in a common trust fund or common investment fund.

3. Neither the account owner nor the trustee will engage in any prohibited transaction with respect to this account (such as borrowing or pledging

the account or engaging in any other prohibited transaction as defined in section 4975).

Article VI

1. Distributions of funds from this HSA may be made upon the direction of the account owner.

2. Distributions from this HSA that are used exclusively to pay or reimburse qualified medical expenses of the account owner, his or her spouse, or

dependents are tax-free. However, distributions that are not used for qualified medical expenses are included in the account owner’s gross

income and are subject to an additional 20 percent tax on that amount. The additional 20 percent tax does not apply if the distribution is made

after the account owner’s death, disability, or reaching age 65.

3. The trustee is not required to determine whether the distribution is for the payment or reimbursement of qualified medical expenses. Only the

account owner is responsible for substantiating that the distribution is for qualified medical expenses and must maintain records sufficient to

show, if required, that the distribution is tax-free.

5305-B

Form

(Rev. 12-2011)

Cat. No. 38260U

1

1 2

2