FEDERAL IDENTIFICATION NUMBER

CORPORATION NAME

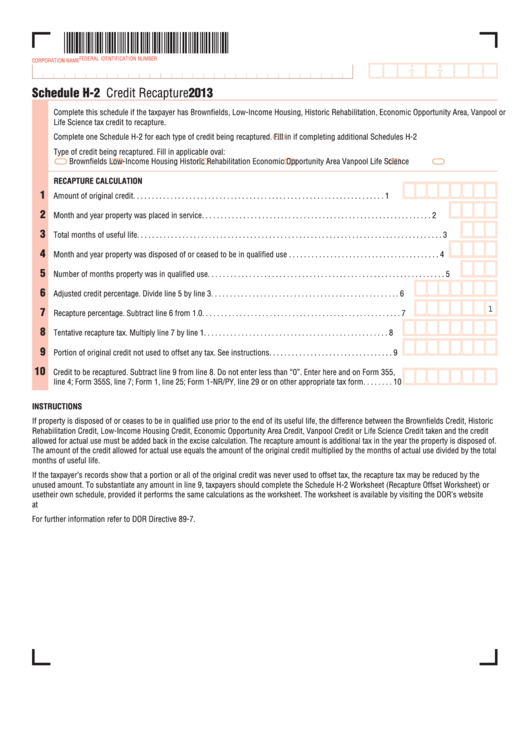

Schedule -2 Credit Recapture

2013

Complete this schedule if the taxpayer has Brownfields, Low-Income Housing, Historic Rehabilitation, Economic Opportunity Area, Vanpool or

Life Science tax credit to recapture.

Complete one Schedule H-2 for each type of credit being recaptured.

Fill in if completing additional Schedules H-2

Type of credit being recaptured. Fill in applicable oval:

Brownfields

Low-Income Housing

Historic Rehabilitation

Economic Opportunity Area

Vanpool

Life Science

REC PTURE C LCUL TION

1

Amount of original credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2

Month and year property was placed in service . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3

Total months of useful life . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4

Month and year property was disposed of or ceased to be in qualified use . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5

Number of months property was in qualified use . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6

Adjusted credit percentage. Divide line 5 by line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

1

7

Recapture percentage. Subtract line 6 from 1.0. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8

Tentative recapture tax. Multiply line 7 by line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9

Portion of original credit not used to offset any tax. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10

Credit to be recaptured. Subtract line 9 from line 8. Do not enter less than “0”. Enter here and on Form 355,

line 4; Form 355S, line 7; Form 1, line 25; Form 1-NR/PY, line 29 or on other appropriate tax form . . . . . . . . 10

INSTRUCTIONS

If property is disposed of or ceases to be in qualified use prior to the end of its useful life, the difference between the Brownfields Credit, Historic

Rehabilitation Credit, Low-Income Housing Credit, Economic Opportunity Area Credit, Vanpool Credit or Life Science Credit taken and the credit

allowed for actual use must be added back in the excise calculation. The recapture amount is additional tax in the year the property is disposed of.

The amount of the credit allowed for actual use equals the amount of the original credit multiplied by the months of actual use divided by the total

months of useful life.

If the taxpayer’s records show that a portion or all of the original credit was never used to offset tax, the recapture tax may be reduced by the

unused amount. To substantiate any amount in line 9, taxpayers should complete the Schedule H-2 Worksheet (Recapture Offset Worksheet) or

use their own schedule, provided it performs the same calculations as the worksheet. The worksheet is available by visiting the DOR’s website

at

For further information refer to DOR Directive 89-7.

1

1