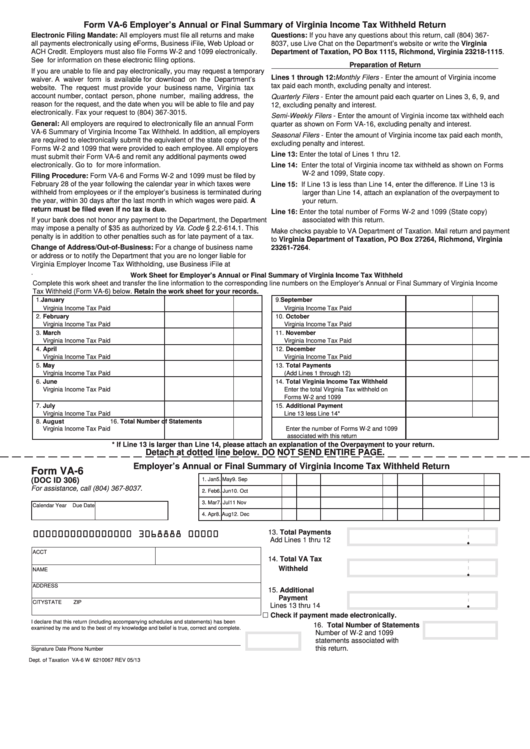

Form VA-6 Employer’s Annual or Final Summary of Virginia Income Tax Withheld Return

Electronic Filing Mandate: All employers must file all returns and make

Questions: If you have any questions about this return, call (804) 367-

all payments electronically using eForms, Business iFile, Web Upload or

8037, use Live Chat on the Department’s website or write the Virginia

ACH Credit. Employers must also file Forms W-2 and 1099 electronically.

Department of Taxation, PO Box 1115, Richmond, Virginia 23218-1115.

See for information on these electronic filing options.

Preparation of Return

If you are unable to file and pay electronically, you may request a temporary

Lines 1 through 12: Monthly Filers - Enter the amount of Virginia income

waiver. A waiver form is available for download on the Department’s

tax paid each month, excluding penalty and interest.

website. The request must provide your business name, Virginia tax

account number, contact person, phone number, mailing address, the

Quarterly Filers - Enter the amount paid each quarter on Lines 3, 6, 9, and

reason for the request, and the date when you will be able to file and pay

12, excluding penalty and interest.

electronically. Fax your request to (804) 367-3015.

Semi-Weekly Filers - Enter the amount of Virginia income tax withheld each

General: All employers are required to electronically file an annual Form

quarter as shown on Form VA-16, excluding penalty and interest.

VA-6 Summary of Virginia Income Tax Withheld. In addition, all employers

Seasonal Filers - Enter the amount of Virginia income tax paid each month,

are required to electronically submit the equivalent of the state copy of the

excluding penalty and interest.

Forms W-2 and 1099 that were provided to each employee. All employers

Line 13: Enter the total of Lines 1 thru 12.

must submit their Form VA-6 and remit any additional payments owed

electronically. Go to for more information.

Line 14: Enter the total of Virginia income tax withheld as shown on Forms

W-2 and 1099, State copy.

Filing Procedure: Form VA-6 and Forms W-2 and 1099 must be filed by

February 28 of the year following the calendar year in which taxes were

Line 15: If Line 13 is less than Line 14, enter the difference. If Line 13 is

withheld from employees or if the employer’s business is terminated during

larger than Line 14, attach an explanation of the overpayment to

the year, within 30 days after the last month in which wages were paid. A

your return.

return must be filed even if no tax is due.

Line 16: Enter the total number of Forms W-2 and 1099 (State copy)

If your bank does not honor any payment to the Department, the Department

associated with this return.

may impose a penalty of $35 as authorized by Va. Code § 2.2-614.1. This

Make checks payable to VA Department of Taxation. Mail return and payment

penalty is in addition to other penalties such as for late payment of a tax.

to Virginia Department of Taxation, PO Box 27264, Richmond, Virginia

Change of Address/Out-of-Business: For a change of business name

23261-7264.

or address or to notify the Department that you are no longer liable for

Virginia Employer Income Tax Withholding, use Business iFile at www.

tax.virginia.gov.

Work Sheet for Employer’s Annual or Final Summary of Virginia Income Tax Withheld

Complete this work sheet and transfer the line information to the corresponding line numbers on the Employer’s Annual or Final Summary of Virginia Income

Tax Withheld (Form VA-6) below. Retain the work sheet for your records.

1. January

9. September

Virginia Income Tax Paid

Virginia Income Tax Paid

2. February

10. October

Virginia Income Tax Paid

Virginia Income Tax Paid

3. March

11. November

Virginia Income Tax Paid

Virginia Income Tax Paid

4. April

12. December

Virginia Income Tax Paid

Virginia Income Tax Paid

5. May

13. Total Payments

Virginia Income Tax Paid

(Add Lines 1 through 12)

6. June

14. Total Virginia Income Tax Withheld

Virginia Income Tax Paid

Enter the total Virginia Tax withheld on

Forms W-2 and 1099

7. July

15. Additional Payment

Virginia Income Tax Paid

Line 13 less Line 14*

8. August

16. Total Number of Statements

Virginia Income Tax Paid

Enter the number of Forms W-2 and 1099

associated with this return

* If Line 13 is larger than Line 14, please attach an explanation of the Overpayment to your return.

Detach at dotted line below. DO NOT SEND ENTIRE PAGE.

Employer’s Annual or Final Summary of Virginia Income Tax Withheld Return

Form VA-6

(DOC ID 306)

1. Jan

5. May

9. Sep

For assistance, call (804) 367-8037.

2. Feb

6. Jun

10. Oct

3. Mar

7. Jul

11 Nov

Calendar Year

Due Date

4. Apr

8. Aug

12. Dec

0000000000000000 3068888 00000

13. Total Payments

.

Add Lines 1 thru 12

ACCT NO.

FEIN

14. Total VA Tax

Withheld

NAME

.

ADDRESS

15. Additional

Payment

.

CITY

STATE

ZIP

Lines 13 thru 14

Check if payment made electronically.

I declare that this return (including accompanying schedules and statements) has been

16. Total Number of Statements

examined by me and to the best of my knowledge and belief is true, correct and complete.

Number of W-2 and 1099

statements associated with

this return.

Signature

Date

Phone Number

Dept. of Taxation VA-6 W 6210067 REV 05/13

1

1