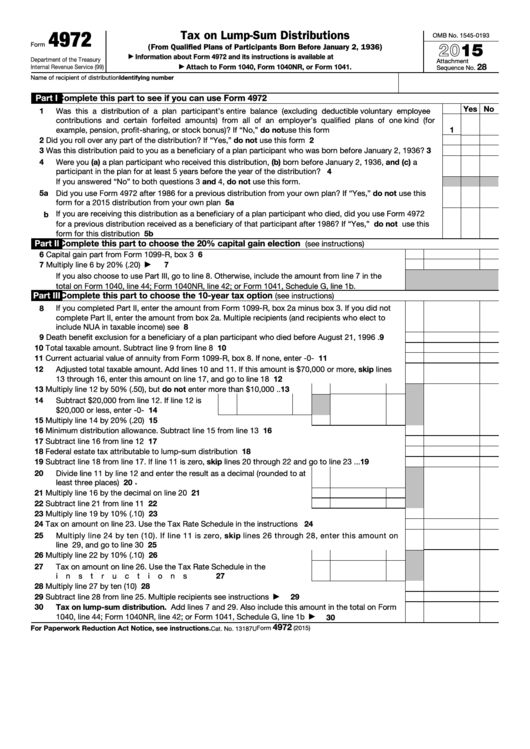

4972

Tax on Lump-Sum Distributions

OMB No. 1545-0193

2015

Form

(From Qualified Plans of Participants Born Before January 2, 1936)

Information about Form 4972 and its instructions is available at

▶

Department of the Treasury

Attachment

28

Attach to Form 1040, Form 1040NR, or Form 1041.

Internal Revenue Service (99)

▶

Sequence No.

Identifying number

Name of recipient of distribution

Part I

Complete this part to see if you can use Form 4972

Yes No

1

Was this a distribution of a plan participant’s entire balance (excluding deductible voluntary employee

contributions and certain forfeited amounts) from all of an employer’s qualified plans of one kind (for

example, pension, profit-sharing, or stock bonus)? If “No,” do not use this form

.

.

.

.

.

.

.

.

.

1

2

Did you roll over any part of the distribution? If “Yes,” do not use this form .

.

.

.

.

.

.

.

.

.

.

2

3

3

Was this distribution paid to you as a beneficiary of a plan participant who was born before January 2, 1936?

4

Were you (a) a plan participant who received this distribution, (b) born before January 2, 1936, and (c) a

participant in the plan for at least 5 years before the year of the distribution?

.

.

.

.

.

.

.

.

.

.

4

If you answered “No” to both questions 3 and 4, do not use this form.

5 a Did you use Form 4972 after 1986 for a previous distribution from your own plan? If “Yes,” do not use this

form for a 2015 distribution from your own plan

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5a

b If you are receiving this distribution as a beneficiary of a plan participant who died, did you use Form 4972

for a previous distribution received as a beneficiary of that participant after 1986? If “Yes,” do not use this

form for this distribution .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5b

Part II

Complete this part to choose the 20% capital gain election

(see instructions)

6

6

Capital gain part from Form 1099-R, box 3 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7

Multiply line 6 by 20% (.20) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7

▶

If you also choose to use Part III, go to line 8. Otherwise, include the amount from line 7 in the

total on Form 1040, line 44; Form 1040NR, line 42; or Form 1041, Schedule G, line 1b.

Part III

Complete this part to choose the 10-year tax option

(see instructions)

8

If you completed Part II, enter the amount from Form 1099-R, box 2a minus box 3. If you did not

complete Part II, enter the amount from box 2a. Multiple recipients (and recipients who elect to

8

include NUA in taxable income) see instructions .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9

Death benefit exclusion for a beneficiary of a plan participant who died before August 21, 1996

.

9

10

Total taxable amount. Subtract line 9 from line 8 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

10

11

11

Current actuarial value of annuity from Form 1099-R, box 8. If none, enter -0-

.

.

.

.

.

.

.

12

Adjusted total taxable amount. Add lines 10 and 11. If this amount is $70,000 or more, skip lines

13 through 16, enter this amount on line 17, and go to line 18

.

.

.

.

.

.

.

.

.

.

.

.

12

13

Multiply line 12 by 50% (.50), but do not enter more than $10,000 .

13

.

14

Subtract $20,000 from line 12. If line 12 is

$20,000 or less, enter -0-

.

.

.

.

.

.

14

15

Multiply line 14 by 20% (.20)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

15

16

16

Minimum distribution allowance. Subtract line 15 from line 13

.

.

.

.

.

.

.

.

.

.

.

.

17

Subtract line 16 from line 12

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

17

18

Federal estate tax attributable to lump-sum distribution

.

.

.

.

.

.

.

.

.

.

.

.

.

.

18

19

Subtract line 18 from line 17. If line 11 is zero, skip lines 20 through 22 and go to line 23

19

.

.

.

20

Divide line 11 by line 12 and enter the result as a decimal (rounded to at

.

least three places) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

20

21

21

Multiply line 16 by the decimal on line 20

.

.

.

.

.

.

.

.

.

.

22

Subtract line 21 from line 11

.

.

.

.

.

.

.

.

.

.

.

.

.

.

22

23

Multiply line 19 by 10% (.10)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

23

24

Tax on amount on line 23. Use the Tax Rate Schedule in the instructions .

.

.

.

.

.

.

.

.

24

25

Multiply line 24 by ten (10). If line 11 is zero, skip lines 26 through 28, enter this amount on

line 29, and go to line 30

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

25

26

Multiply line 22 by 10% (.10)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

26

27

Tax on amount on line 26. Use the Tax Rate Schedule in the

instructions .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

27

28

Multiply line 27 by ten (10)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

28

29

29

Subtract line 28 from line 25. Multiple recipients see instructions

.

.

.

.

.

.

.

.

.

.

▶

30

Tax on lump-sum distribution. Add lines 7 and 29. Also include this amount in the total on Form

1040, line 44; Form 1040NR, line 42; or Form 1041, Schedule G, line 1b .

.

.

.

.

.

.

.

30

▶

4972

For Paperwork Reduction Act Notice, see instructions.

Form

(2015)

Cat. No. 13187U

1

1 2

2 3

3 4

4