Instructions For Rct-121 A, B & C Returns

ADVERTISEMENT

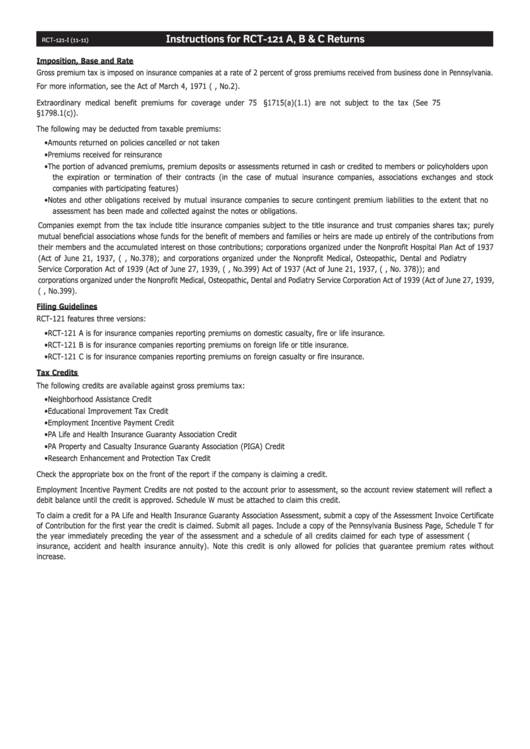

Instructions for RCT-121 A, B & C Returns

RCT-121-I (11-11)

Imposition, Base and Rate

Gross premium tax is imposed on insurance companies at a rate of 2 percent of gross premiums received from business done in Pennsylvania.

For more information, see the Act of March 4, 1971 (P.L. 6, No.2).

Extraordinary medical benefit premiums for coverage under 75 Pa.C. S.§1715(a)(1.1) are not subject to the tax (See 75 Pa.C.S.

§1798.1(c)).

The following may be deducted from taxable premiums:

• Amounts returned on policies cancelled or not taken

• Premiums received for reinsurance

• The portion of advanced premiums, premium deposits or assessments returned in cash or credited to members or policyholders upon

the expiration or termination of their contracts (in the case of mutual insurance companies, associations exchanges and stock

companies with participating features)

• Notes and other obligations received by mutual insurance companies to secure contingent premium liabilities to the extent that no

assessment has been made and collected against the notes or obligations.

Companies exempt from the tax include title insurance companies subject to the title insurance and trust companies shares tax; purely

mutual beneficial associations whose funds for the benefit of members and families or heirs are made up entirely of the contributions from

their members and the accumulated interest on those contributions; corporations organized under the Nonprofit Hospital Plan Act of 1937

(Act of June 21, 1937, (P.L. 1948, No.378); and corporations organized under the Nonprofit Medical, Osteopathic, Dental and Podiatry

Service Corporation Act of 1939 (Act of June 27, 1939, (P.L. 1125, No.399) Act of 1937 (Act of June 21, 1937, (P.L. 1948, No. 378)); and

corporations organized under the Nonprofit Medical, Osteopathic, Dental and Podiatry Service Corporation Act of 1939 (Act of June 27, 1939,

(P.L. 1125, No.399).

Filing Guidelines

RCT-121 features three versions:

• RCT-121 A is for insurance companies reporting premiums on domestic casualty, fire or life insurance.

• RCT-121 B is for insurance companies reporting premiums on foreign life or title insurance.

• RCT-121 C is for insurance companies reporting premiums on foreign casualty or fire insurance.

Tax Credits

The following credits are available against gross premiums tax:

• Neighborhood Assistance Credit

• Educational Improvement Tax Credit

• Employment Incentive Payment Credit

• PA Life and Health Insurance Guaranty Association Credit

• PA Property and Casualty Insurance Guaranty Association (PIGA) Credit

• Research Enhancement and Protection Tax Credit

Check the appropriate box on the front of the report if the company is claiming a credit.

Employment Incentive Payment Credits are not posted to the account prior to assessment, so the account review statement will reflect a

debit balance until the credit is approved. Schedule W must be attached to claim this credit.

To claim a credit for a PA Life and Health Insurance Guaranty Association Assessment, submit a copy of the Assessment Invoice Certificate

of Contribution for the first year the credit is claimed. Submit all pages. Include a copy of the Pennsylvania Business Page, Schedule T for

the year immediately preceding the year of the assessment and a schedule of all credits claimed for each type of assessment (i.e. life

insurance, accident and health insurance annuity). Note this credit is only allowed for policies that guarantee premium rates without

increase.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3