General Instructions-Credit Union Tax Return

ADVERTISEMENT

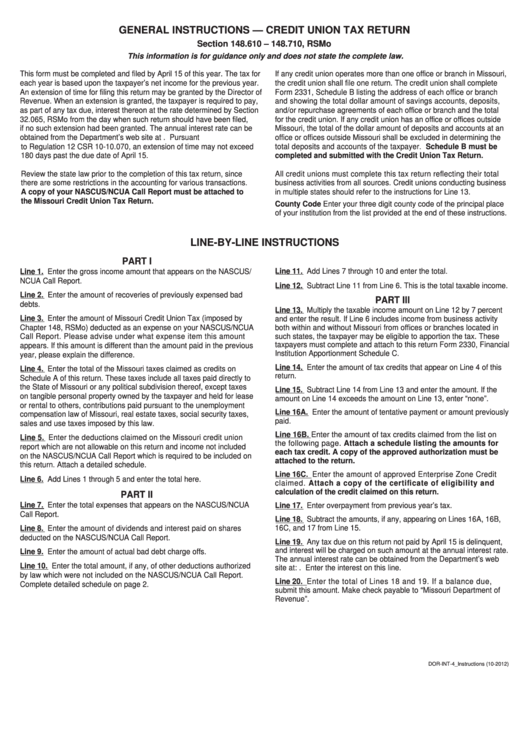

GENERAL INSTRUCTIONS — CREDIT UNION TAX RETURN

Section 148.610 – 148.710, RSMo

This information is for guidance only and does not state the complete law.

This form must be completed and filed by April 15 of this year. The tax for

If any credit union operates more than one office or branch in Missouri,

each year is based upon the taxpayer’s net income for the previous year.

the credit union shall file one return. The credit union shall complete

An extension of time for filing this return may be granted by the Director of

Form 2331, Schedule B listing the address of each office or branch

Revenue. When an extension is granted, the taxpayer is required to pay,

and showing the total dollar amount of savings accounts, deposits,

as part of any tax due, interest thereon at the rate determined by Section

and/or repurchase agreements of each office or branch and the total

32.065, RSMo from the day when such return should have been filed,

for the credit union. If any credit union has an office or offices outside

if no such extension had been granted. The annual interest rate can be

Missouri, the total of the dollar amount of deposits and accounts at an

obtained from the Department’s web site at Pursuant

office or offices outside Missouri shall be excluded in determining the

to Regulation 12 CSR 10‑10.070, an extension of time may not exceed

total deposits and accounts of the taxpayer. Schedule B must be

180 days past the due date of April 15.

completed and submitted with the Credit Union Tax Return.

Review the state law prior to the completion of this tax return, since

All credit unions must complete this tax return reflecting their total

there are some restrictions in the accounting for various transactions.

business activities from all sources. Credit unions conducting business

A copy of your NASCUS/NCUA Call Report must be attached to

in multiple states should refer to the instructions for Line 13.

the Missouri Credit Union Tax Return.

County Code Enter your three digit county code of the principal place

of your institution from the list provided at the end of these instructions.

LINE-BY-LINE INSTRUCTIONS

PART I

Line 11. Add Lines 7 through 10 and enter the total.

Line 1. Enter the gross income amount that appears on the NASCUS/

NCUA Call Report.

Line 12. Subtract Line 11 from Line 6. This is the total taxable income.

Line 2. Enter the amount of recoveries of previously expensed bad

PART III

debts.

Line 13. Multiply the taxable income amount on Line 12 by 7 percent

Line 3. Enter the amount of Missouri Credit Union Tax (imposed by

and enter the result. If Line 6 includes income from business activity

Chapter 148, RSMo) deducted as an expense on your NASCUS/NCUA

both within and without Missouri from offices or branches located in

such states, the taxpayer may be eligible to apportion the tax. These

Call Report. Please advise under what expense item this amount

taxpayers must complete and attach to this return Form 2330, Financial

appears. If this amount is different than the amount paid in the previous

Institution Apportionment Schedule C.

year, please explain the difference.

Line 14. Enter the amount of tax credits that appear on Line 4 of this

Line 4. Enter the total of the Missouri taxes claimed as credits on

return.

Schedule A of this return. These taxes include all taxes paid directly to

the State of Missouri or any political subdivision thereof, except taxes

Line 15. Subtract Line 14 from Line 13 and enter the amount. If the

on tangible personal property owned by the taxpayer and held for lease

amount on Line 14 exceeds the amount on Line 13, enter “none”.

or rental to others, contributions paid pursuant to the unemployment

Line 16A. Enter the amount of tentative payment or amount previously

compensation law of Missouri, real estate taxes, social security taxes,

paid.

sales and use taxes imposed by this law.

Line 16B. Enter the amount of tax credits claimed from the list on

Line 5. Enter the deductions claimed on the Missouri credit union

the following page. Attach a schedule listing the amounts for

report which are not allowable on this return and income not included

each tax credit. A copy of the approved authorization must be

on the NASCUS/NCUA Call Report which is required to be included on

attached to the return.

this return. Attach a detailed schedule.

Line 16C. Enter the amount of approved Enterprise Zone Credit

Line 6. Add Lines 1 through 5 and enter the total here.

claimed. Attach a copy of the certificate of eligibility and

calculation of the credit claimed on this return.

PART II

Line 7. Enter the total expenses that appears on the NASCUS/NCUA

Line 17. Enter overpayment from previous year’s tax.

Call Report.

Line 18. Subtract the amounts, if any, appearing on Lines 16A, 16B,

16C, and 17 from Line 15.

Line 8. Enter the amount of dividends and interest paid on shares

deducted on the NASCUS/NCUA Call Report.

Line 19. Any tax due on this return not paid by April 15 is delinquent,

and interest will be charged on such amount at the annual interest rate.

Line 9. Enter the amount of actual bad debt charge offs.

The annual interest rate can be obtained from the Department’s web

Line 10. Enter the total amount, if any, of other deductions authorized

site at: Enter the interest on this line.

by law which were not included on the NASCUS/NCUA Call Report.

Line 20. Enter the total of Lines 18 and 19. If a balance due,

Complete detailed schedule on page 2.

submit this amount. Make check payable to “Missouri Department of

Revenue”.

DOR‑INT‑4_Instructions (10‑2012)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2