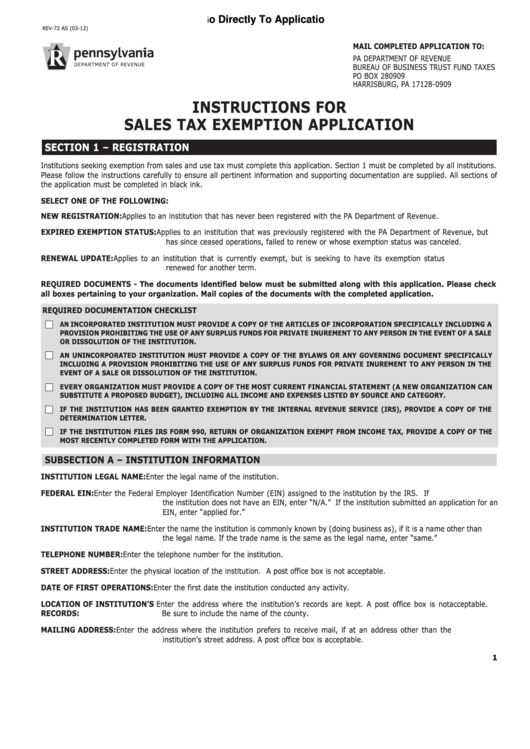

Go Directly To Application

REV-72 AS (03-12)

MAIL COMPLETED APPLICATION TO:

PA DEPARTMENT OF REVENUE

BUREAU OF BUSINESS TRUST FUND TAXES

PO BOX 280909

HARRISBURG, PA 17128-0909

INSTRUCTIONS FOR

SALES TAX EXEMPTION APPLICATION

SECTION 1 – REGISTRATION

Institutions seeking exemption from sales and use tax must complete this application. Section 1 must be completed by all institutions.

Please follow the instructions carefully to ensure all pertinent information and supporting documentation are supplied. All sections of

the application must be completed in black ink.

SELECT ONE OF THE FOLLOWING:

NEW REGISTRATION:

Applies to an institution that has never been registered with the PA Department of Revenue.

EXPIRED EXEMPTION STATUS:

Applies to an institution that was previously registered with the PA Department of Revenue, but

has since ceased operations, failed to renew or whose exemption status was canceled.

RENEWAL UPDATE:

Applies to an institution that is currently exempt, but is seeking to have its exemption status

renewed for another term.

REQUIRED DOCUMENTS - The documents identified below must be submitted along with this application. Please check

all boxes pertaining to your organization. Mail copies of the documents with the completed application.

REQUIRED DOCUMENTATION CHECKLIST

AN INCORPORATED INSTITUTION MUST PROVIDE A COPY OF THE ARTICLES OF INCORPORATION SPECIFICALLY INCLUDING A

PROVISION PROHIBITING THE USE OF ANY SURPLUS FUNDS FOR PRIVATE INUREMENT TO ANY PERSON IN THE EVENT OF A SALE

OR DISSOLUTION OF THE INSTITUTION.

AN UNINCORPORATED INSTITUTION MUST PROVIDE A COPY OF THE BYLAWS OR ANY GOVERNING DOCUMENT SPECIFICALLY

INCLUDING A PROVISION PROHIBITING THE USE OF ANY SURPLUS FUNDS FOR PRIVATE INUREMENT TO ANY PERSON IN THE

EVENT OF A SALE OR DISSOLUTION OF THE INSTITUTION.

EVERY ORGANIZATION MUST PROVIDE A COPY OF THE MOST CURRENT FINANCIAL STATEMENT (A NEW ORGANIZATION CAN

SUBSTITUTE A PROPOSED BUDGET), INCLUDING ALL INCOME AND EXPENSES LISTED BY SOURCE AND CATEGORY.

IF THE INSTITUTION HAS BEEN GRANTED EXEMPTION BY THE INTERNAL REVENUE SERVICE (IRS), PROVIDE A COPY OF THE

DETERMINATION LETTER.

IF THE INSTITUTION FILES IRS FORM 990, RETURN OF ORGANIZATION EXEMPT FROM INCOME TAX, PROVIDE A COPY OF THE

MOST RECENTLY COMPLETED FORM WITH THE APPLICATION.

SUBSECTION A – INSTITUTION INFORMATION

INSTITUTION LEGAL NAME:

Enter the legal name of the institution.

FEDERAL EIN:

Enter the Federal Employer Identification Number (EIN) assigned to the institution by the IRS. If

the institution does not have an EIN, enter “N/A.” If the institution submitted an application for an

EIN, enter “applied for.”

INSTITUTION TRADE NAME:

Enter the name the institution is commonly known by (doing business as), if it is a name other than

the legal name. If the trade name is the same as the legal name, enter “same.”

TELEPHONE NUMBER:

Enter the telephone number for the institution.

STREET ADDRESS:

Enter the physical location of the institution. A post office box is not acceptable.

DATE OF FIRST OPERATIONS:

Enter the first date the institution conducted any activity.

LOCATION OF INSTITUTION’S Enter the address where the institution’s records are kept. A post office box is not acceptable.

RECORDS:

Be sure to include the name of the county.

MAILING ADDRESS:

Enter the address where the institution prefers to receive mail, if at an address other than the

institution’s street address. A post office box is acceptable.

1

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12