Form Rpd-41341 - Solar Energy Systems Tax Deduction Purchase And Use Statement Seller'S Copy

ADVERTISEMENT

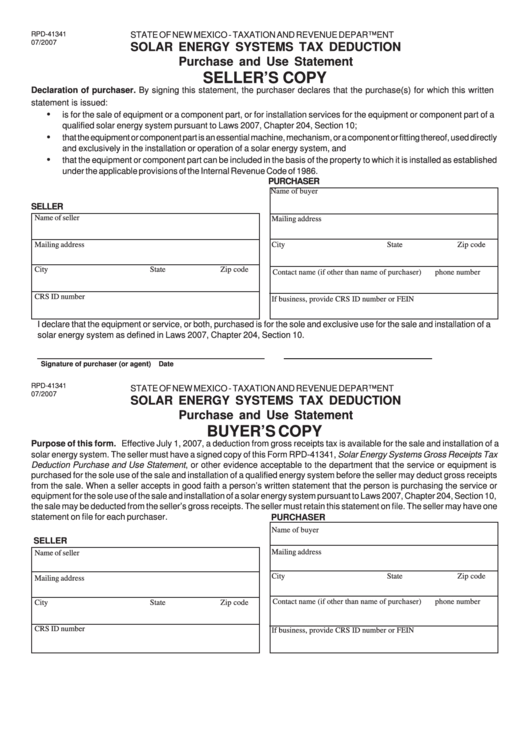

RPD-41341

STATE OF NEW MEXICO - TAXATION AND REVENUE DEPARTMENT

07/2007

SOLAR ENERGY SYSTEMS TAX DEDUCTION

Purchase and Use Statement

SELLER’S COPY

Declaration of purchaser. By signing this statement, the purchaser declares that the purchase(s) for which this written

statement is issued:

•

is for the sale of equipment or a component part, or for installation services for the equipment or component part of a

qualified solar energy system pursuant to Laws 2007, Chapter 204, Section 10;

•

that the equipment or component part is an essential machine, mechanism, or a component or fitting thereof, used directly

and exclusively in the installation or operation of a solar energy system, and

•

that the equipment or component part can be included in the basis of the property to which it is installed as established

under the applicable provisions of the Internal Revenue Code of 1986.

PURCHASER

Name of buyer

SELLER

Name of seller

Mailing address

Mailing address

City

State

Zip code

City

State

Zip code

Contact name (if other than name of purchaser)

phone number

CRS ID number

If business, provide CRS ID number or FEIN

I declare that the equipment or service, or both, purchased is for the sole and exclusive use for the sale and installation of a

solar energy system as defined in Laws 2007, Chapter 204, Section 10.

Signature of purchaser (or agent)

Date

..........CUT HERE.....................................................CUT HERE.................................................CUT HERE..........

RPD-41341

STATE OF NEW MEXICO - TAXATION AND REVENUE DEPARTMENT

07/2007

SOLAR ENERGY SYSTEMS TAX DEDUCTION

Purchase and Use Statement

BUYER’S COPY

Purpose of this form. Effective July 1, 2007, a deduction from gross receipts tax is available for the sale and installation of a

solar energy system. The seller must have a signed copy of this Form RPD-41341, Solar Energy Systems Gross Receipts Tax

Deduction Purchase and Use Statement, or other evidence acceptable to the department that the service or equipment is

purchased for the sole use of the sale and installation of a qualified energy system before the seller may deduct gross receipts

from the sale. When a seller accepts in good faith a person’s written statement that the person is purchasing the service or

equipment for the sole use of the sale and installation of a solar energy system pursuant to Laws 2007, Chapter 204, Section 10,

the sale may be deducted from the seller’s gross receipts. The seller must retain this statement on file. The seller may have one

statement on file for each purchaser.

PURCHASER

Name of buyer

SELLER

Mailing address

Name of seller

City

State

Zip code

Mailing address

Contact name (if other than name of purchaser)

phone number

City

State

Zip code

CRS ID number

If business, provide CRS ID number or FEIN

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2