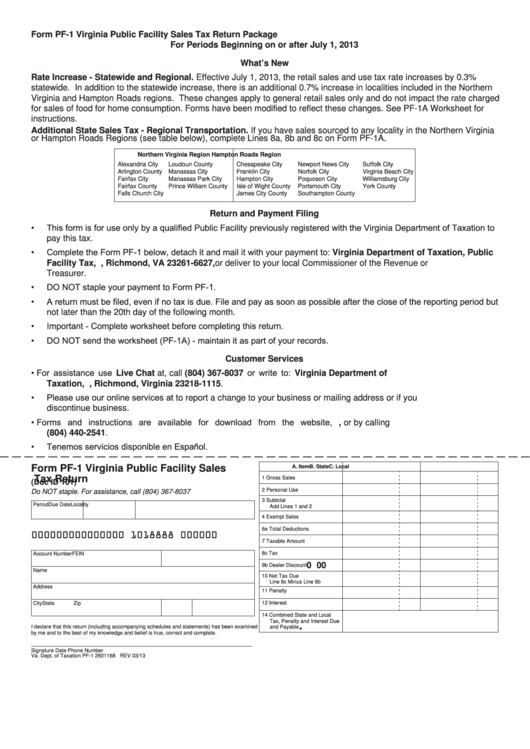

Form PF-1

Virginia Public Facility Sales Tax Return Package

For Periods Beginning on or after July 1, 2013

What’s New

Rate Increase - Statewide and Regional. Effective July 1, 2013, the retail sales and use tax rate increases by 0.3%

statewide. In addition to the statewide increase, there is an additional 0.7% increase in localities included in the Northern

Virginia and Hampton Roads regions. These changes apply to general retail sales only and do not impact the rate charged

for sales of food for home consumption. Forms have been modified to reflect these changes. See PF-1A Worksheet for

instructions.

Additional State Sales Tax - Regional Transportation. If you have sales sourced to any locality in the Northern Virginia

or Hampton Roads Regions (see table below), complete Lines 8a, 8b and 8c on Form PF-1A.

Northern Virginia Region

Hampton Roads Region

Alexandria City

Loudoun County

Chesapeake City

Newport News City

Suffolk City

Arlington County

Manassas City

Franklin City

Norfolk City

Virginia Beach City

Fairfax City

Manassas Park City

Hampton City

Poquoson City

Williamsburg City

Fairfax County

Prince William County

Isle of Wight County

Portsmouth City

York County

Falls Church City

James City County

Southampton County

Return and Payment Filing

•

This form is for use only by a qualified Public Facility previously registered with the Virginia Department of Taxation to

pay this tax.

•

Complete the Form PF-1 below, detach it and mail it with your payment to: Virginia Department of Taxation, Public

Facility Tax, P.O. Box 26627, Richmond, VA 23261-6627, or deliver to your local Commissioner of the Revenue or

Treasurer.

•

DO NOT staple your payment to Form PF-1.

•

A return must be filed, even if no tax is due. File and pay as soon as possible after the close of the reporting period but

not later than the 20th day of the following month.

•

Important - Complete worksheet before completing this return.

•

DO NOT send the worksheet (PF-1A) - maintain it as part of your records.

Customer Services

•

For assistance use Live Chat at , call (804) 367-8037 or write to: Virginia Department of

Taxation, P.O. Box 1115, Richmond, Virginia 23218-1115.

•

Please use our online services at to report a change to your business or mailing address or if you

discontinue business.

•

Forms and instructions are available for download from the website, , or by calling

(804) 440-2541.

•

Tenemos servicios disponible en Español.

Form PF-1

Virginia Public Facility Sales

A. Item

B. State

C. Local

Tax Return

1 Gross Sales

(Doc ID 101)

2 Personal Use

Do NOT staple.

For assistance, call (804) 367-8037

3 Subtotal

Period

Due Date

Locality

Add Lines 1 and 2

4 Exempt Sales

6e Total Deductions

000000000000000 1018888 000000

7 Taxable Amount

8c Tax

Account Number

FEIN

0 00

9b Dealer Discount

Name

10 Net Tax Due

Line 8c Minus Line 9b

Address

11 Penalty

12 Interest

City

State

Zip

14 Combined State and Local

Tax, Penalty and Interest Due

.

I declare that this return (including accompanying schedules and statements) has been examined

and Payable

by me and to the best of my knowledge and belief is true, correct and complete.

Signature

Date

Phone Number

Va. Dept. of Taxation PF-1 2601168 REV 03/13

1

1 2

2 3

3