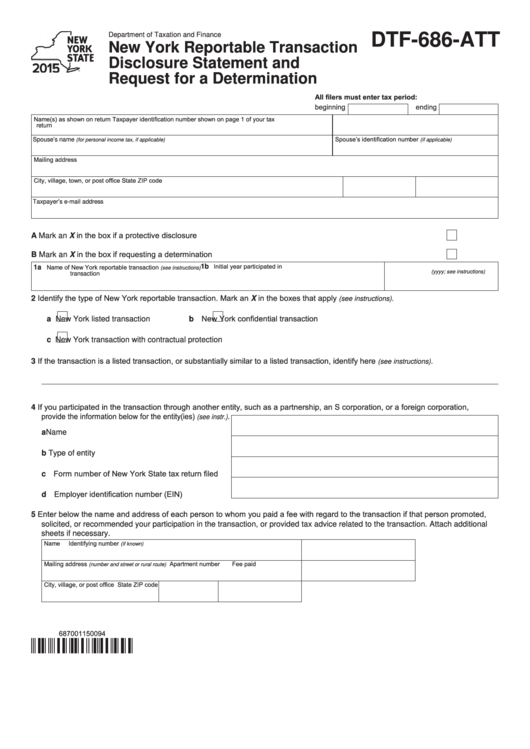

DTF-686-ATT

Department of Taxation and Finance

New York Reportable Transaction

Disclosure Statement and

Request for a Determination

All filers must enter tax period:

beginning

ending

Name(s) as shown on return

Taxpayer identification number shown on page 1 of your tax

return

Spouse’s identification number

Spouse’s name

(for personal income tax, if applicable)

(if applicable)

Mailing address

City, village, town, or post office

State

ZIP code

Taxpayer’s e-mail address

A

Mark an X in the box if a protective disclosure .............................................................................................................

Mark an X in the box if requesting a determination ......................................................................................................

B

Initial year participated in

Name of New York reportable transaction

1b

1a

(see instructions)

transaction

(yyyy; see instructions)

2 Identify the type of New York reportable transaction. Mark an X in the boxes that apply

.

(see instructions)

b

New York confidential transaction

a

New York listed transaction

c

New York transaction with contractual protection

3 If the transaction is a listed transaction, or substantially similar to a listed transaction, identify here

.

(see instructions)

4 If you participated in the transaction through another entity, such as a partnership, an S corporation, or a foreign corporation,

provide the information below for the entity(ies)

.

(see instr.)

a Name ......................................................................

b Type of entity ...........................................................

c Form number of New York State tax return filed .....

d Employer identification number (EIN) .....................

5 Enter below the name and address of each person to whom you paid a fee with regard to the transaction if that person promoted,

solicited, or recommended your participation in the transaction, or provided tax advice related to the transaction. Attach additional

sheets if necessary.

Name

Identifying number

(if known)

Mailing address

Apartment number

Fee paid

(number and street or rural route)

City, village, or post office

State

ZIP code

687001150094

1

1 2

2