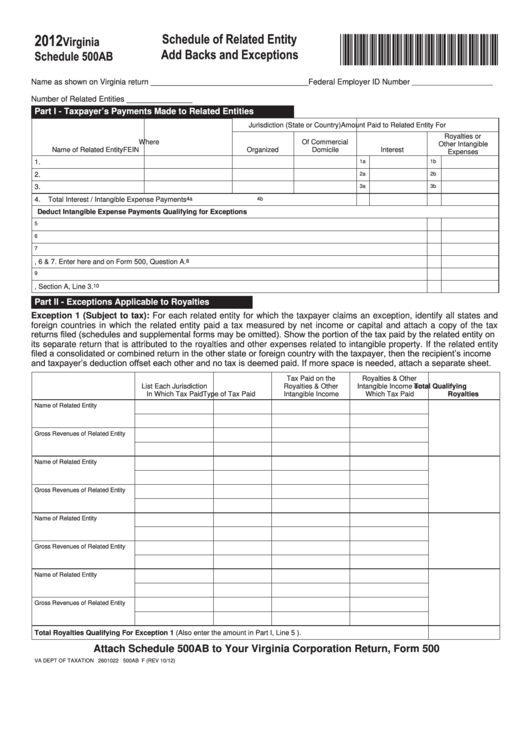

2012

Schedule of Related Entity

*VA0IAB112000*

Virginia

Add Backs and Exceptions

Schedule 500AB

Name as shown on Virginia return ____________________________________ Federal Employer ID Number _______________________

Number of Related Entities _______________

Part I - Taxpayer’s Payments Made to Related Entities

Jurisdiction (State or Country)

Amount Paid to Related Entity For

Royalties or

Where

Of Commercial

Other Intangible

Name of Related Entity

FEIN

Organized

Domicile

Interest

Expenses

1.

1a

1b

2.

2a

2b

3.

3a

3b

4.

Total Interest / Intangible Expense Payments

4a

4b

Deduct Intangible Expense Payments Qualifying for Exceptions

5.

Exception 1

5

6.

Exception 2

6

7

7.

Exception 3

8.

Total Exception Amount - Add lines 5, 6 & 7. Enter here and on Form 500, Question A.

8

9.

Net Addition - Royalties or Other Intangibles - Line 4b minus Line 8.

9

10. Net Addition of Interest and Royalties - Enter the total of Lines 4a plus 9 here and on Schedule 500 ADJ, Section A, Line 3.

10

Part II - Exceptions Applicable to Royalties

Exception 1 (Subject to tax): For each related entity for which the taxpayer claims an exception, identify all states and

foreign countries in which the related entity paid a tax measured by net income or capital and attach a copy of the tax

returns filed (schedules and supplemental forms may be omitted). Show the portion of the tax paid by the related entity on

its separate return that is attributed to the royalties and other expenses related to intangible property. If the related entity

filed a consolidated or combined return in the other state or foreign country with the taxpayer, then the recipient’s income

and taxpayer’s deduction offset each other and no tax is deemed paid. If more space is needed, attach a separate sheet.

Tax Paid on the

Royalties & Other

List Each Jurisdiction

Royalties & Other

Intangible Income on

Total Qualifying

In Which Tax Paid

Type of Tax Paid

Intangible Income

Which Tax Paid

Royalties

Name of Related Entity

Gross Revenues of Related Entity

Name of Related Entity

Gross Revenues of Related Entity

Name of Related Entity

Gross Revenues of Related Entity

Name of Related Entity

Gross Revenues of Related Entity

Total Royalties Qualifying For Exception 1 (Also enter the amount in Part I, Line 5 ).

Attach Schedule 500AB to Your Virginia Corporation Return, Form 500

VA DEPT OF TAXATION 2601022 500AB F (REV 10/12)

1

1 2

2