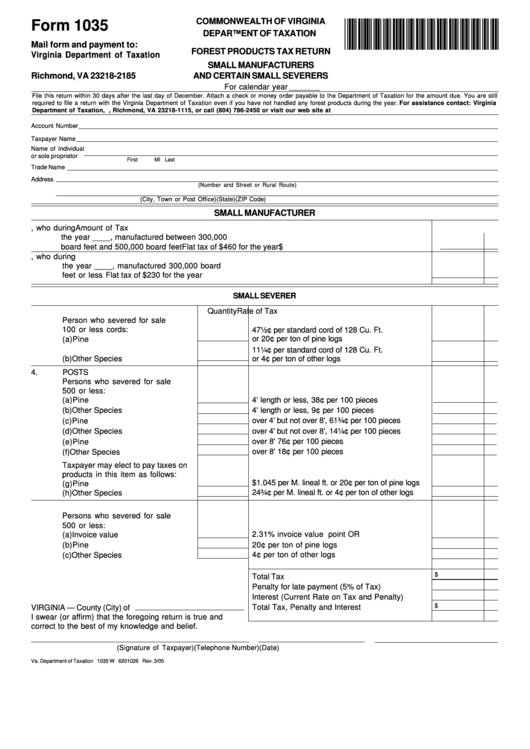

COMMONWEALTH OF VIRGINIA

*VA1035105888*

Form 1035

DEPARTMENT OF TAXATION

Mail form and payment to:

FOREST PRODUCTS TAX RETURN

Virginia Department of Taxation

P.O. Box 2185

SMALL MANUFACTURERS

Richmond, VA 23218-2185

AND CERTAIN SMALL SEVERERS

For calendar year

File this return within 30 days after the last day of December. Attach a check or money order payable to the Department of Taxation for the amount due. You are still

required to file a return with the Virginia Department of Taxation even if you have not handled any forest products during the year. For assistance contact: Virginia

Department of Taxation, P.O. Box 1115, Richmond, VA 23218-1115, or call (804) 786-2450 or visit our web site at

Account Number

Taxpayer Name

Name of Individual

or sole proprietor

First

MI

Last

Trade Name

Address

(Number and Street or Rural Route)

(City, Town or Post Office)

(State)

(ZIP Code)

SMALL MANUFACTURER

1.

Manufacturer of rough lumber, who during

Amount of Tax

the year ____, manufactured between 300,000

board feet and 500,000 board feet ............................. Flat tax of $460 for the year ....................................... $

2.

Manufacturer of rough lumber, who during

the year ____, manufactured 300,000 board

feet or less .................................................................. Flat tax of $230 for the year .......................................

SMALL SEVERER

3.

FUEL WOOD

Quantity

Rate of Tax

Person who severed for sale

100 or less cords:

47½¢ per standard cord of 128 Cu. Ft.

(a)

Pine ........................................

or 20¢ per ton of pine logs ......................................

11¼¢ per standard cord of 128 Cu. Ft.

(b)

Other Species ........................

or 4¢ per ton of other logs .......................................

4.

POSTS

Persons who severed for sale

500 or less:

(a)

Pine ........................................

4' length or less, 38¢ per 100 pieces .......................

(b)

Other Species ........................

4' length or less, 9¢ per 100 pieces .........................

over 4' but not over 8', 61¾¢ per 100 pieces .............

(c)

Pine ........................................

over 4' but not over 8', 14¼¢ per 100 pieces .............

(d)

Other Species ........................

(e)

Pine ........................................

over 8' 76¢ per 100 pieces .......................................

(f)

Other Species ........................

over 8' 18¢ per 100 pieces .......................................

Taxpayer may elect to pay taxes on

products in this item as follows:

$1.045 per M. lineal ft. or 20¢ per ton of pine logs ....

(g)

Pine ........................................

(h)

Other Species ........................

24¾¢ per M. lineal ft. or 4¢ per ton of other logs .......

5.

FISH NET POLES

Persons who severed for sale

500 or less:

(a)

Invoice value ..........................

2.31% invoice value f.o.b. loading point OR ..........

20¢ per ton of pine logs ..........................................

(b)

Pine ........................................

4¢ per ton of other logs ...........................................

(c)

Other Species ........................

$

Total Tax ...................................................................

Penalty for late payment (5% of Tax) ......................

Interest (Current Rate on Tax and Penalty) ............

$

Total Tax, Penalty and Interest

VIRGINIA — County (City) of

I swear (or affirm) that the foregoing return is true and

correct to the best of my knowledge and belief.

(Signature of Taxpayer)

(Telephone Number)

(Date)

Va. Department of Taxation 1035 W 6201026 Rev. 3/05

1

1