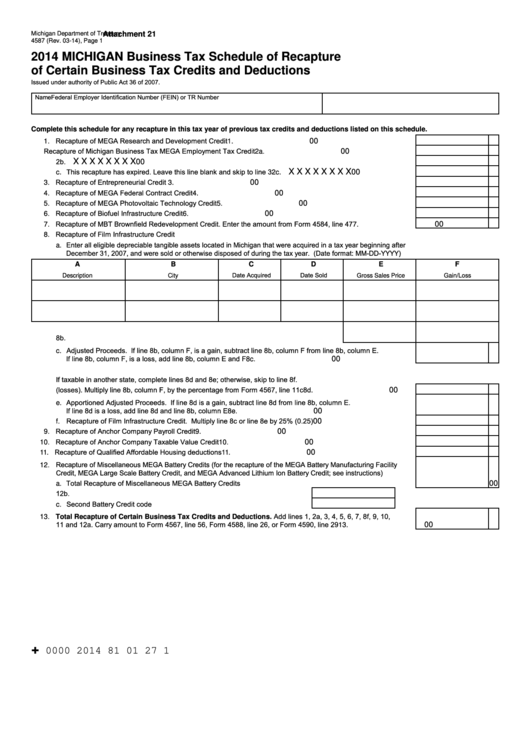

Form 4587 - Michigan Business Tax Schedule Of Recapture Of Certain Business Tax Credits And Deductions - 2014

ADVERTISEMENT

Michigan Department of Treasury

Attachment 21

4587 (Rev. 03-14), Page 1

2014 MICHIGAN Business Tax Schedule of Recapture

of Certain Business Tax Credits and Deductions

Issued under authority of Public Act 36 of 2007.

Name

Federal Employer Identification Number (FEIN) or TR Number

Complete this schedule for any recapture in this tax year of previous tax credits and deductions listed on this schedule.

1. Recapture of MEGA Research and Development Credit ......................................................................................

00

1.

2. a. Recapture of Michigan Business Tax MEGA Employment Tax Credit .............................................................

00

2a.

b. This recapture has expired. Leave this line blank and skip to line 3 ...............................................................

2b.

X X X X X X X X

00

c. This recapture has expired. Leave this line blank and skip to line 3 ...............................................................

X X X X X X X X

00

2c.

3. Recapture of Entrepreneurial Credit .....................................................................................................................

00

3.

4. Recapture of MEGA Federal Contract Credit ........................................................................................................

00

4.

5. Recapture of MEGA Photovoltaic Technology Credit ............................................................................................

00

5.

6. Recapture of Biofuel Infrastructure Credit .............................................................................................................

00

6.

7. Recapture of MBT Brownfield Redevelopment Credit. Enter the amount from Form 4584, line 47 ......................

00

7.

8. Recapture of Film Infrastructure Credit

a. Enter all eligible depreciable tangible assets located in Michigan that were acquired in a tax year beginning after

December 31, 2007, and were sold or otherwise disposed of during the tax year. (Date format: MM-DD-YYYY)

A

B

C

D

E

F

Date Acquired

Date Sold

Description

City

Gross Sales Price

Gain/Loss

b. Total columns E and F. A loss in column F will increase recapture............................

8b.

c. Adjusted Proceeds. If line 8b, column F, is a gain, subtract line 8b, column F from line 8b, column E.

If line 8b, column F, is a loss, add line 8b, column E and F ..............................................................................

00

8c.

If taxable in another state, complete lines 8d and 8e; otherwise, skip to line 8f.

d. Apportioned gains (losses). Multiply line 8b, column F, by the percentage from Form 4567, line 11c .............

8d.

00

e. Apportioned Adjusted Proceeds. If line 8d is a gain, subtract line 8d from line 8b, column E.

If line 8d is a loss, add line 8d and line 8b, column E .......................................................................................

00

8e.

f. Recapture of Film Infrastructure Credit. Multiply line 8c or line 8e by 25% (0.25)...........................................

00

8f.

9. Recapture of Anchor Company Payroll Credit .......................................................................................................

00

9.

10. Recapture of Anchor Company Taxable Value Credit ...........................................................................................

00

10.

11. Recapture of Qualified Affordable Housing deductions .........................................................................................

00

11.

12. Recapture of Miscellaneous MEGA Battery Credits (for the recapture of the MEGA Battery Manufacturing Facility

Credit, MEGA Large Scale Battery Credit, and MEGA Advanced Lithium Ion Battery Credit; see instructions)

a. Total Recapture of Miscellaneous MEGA Battery Credits ................................................................................. 12a.

00

b. Battery Credit code ...................................................................................... 12b.

c. Second Battery Credit code......................................................................... 12c.

13. Total Recapture of Certain Business Tax Credits and Deductions. Add lines 1, 2a, 3, 4, 5, 6, 7, 8f, 9, 10,

11 and 12a. Carry amount to Form 4567, line 56, Form 4588, line 26, or Form 4590, line 29 ..............................

00

13.

+

0000 2014 81 01 27 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4