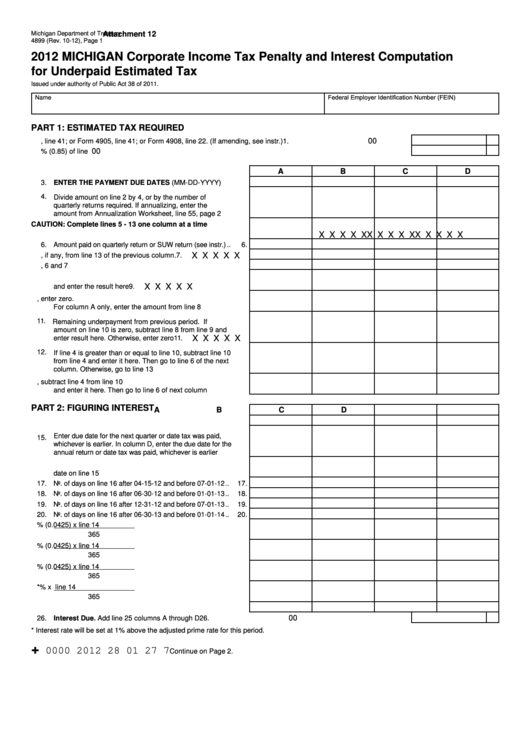

Form 4899 - Michigan Corporate Income Tax Penalty And Interest Computation For Underpaid Estimated Tax - 2012

ADVERTISEMENT

Michigan Department of Treasury

Attachment 12

4899 (Rev. 10-12), Page 1

2012 MICHIGAN Corporate Income Tax Penalty and Interest Computation

for Underpaid Estimated Tax

Issued under authority of Public Act 38 of 2011.

Federal Employer Identification Number (FEIN)

Name

PART 1: ESTIMATED TAX REQUIRED

00

1. Annual tax from Form 4891, line 41; or Form 4905, line 41; or Form 4908, line 22. (If amending, see instr.) ......

1.

00

2. Required estimate amount. Enter 85% (0.85) of line 1..........................................................................................

2.

A

B

C

D

3. ENTER THE PAYMENT DUE DATES (MM-DD-YYYY) ....

3.

4. Divide amount on line 2 by 4, or by the number of

quarterly returns required. If annualizing, enter the

amount from Annualization Worksheet, line 55, page 2 ....

4.

CAUTION: Complete lines 5 - 13 one column at a time

X X X X X

X X X X X

X X X X X

5. Prior year overpayment .....................................................

5.

6. Amount paid on quarterly return or SUW return (see instr.) ..

6.

X X X X X

7. Enter amount, if any, from line 13 of the previous column .

7.

8. Add lines 5, 6 and 7 ...........................................................

8.

9. Add amounts on lines 11 and 12 of the previous column

X X X X X

and enter the result here ...................................................

9.

10. Subtract line 9 from line 8. If less than zero, enter zero.

For column A only, enter the amount from line 8 ...............

10.

11. Remaining underpayment from previous period. If

amount on line 10 is zero, subtract line 8 from line 9 and

X X X X X

enter result here. Otherwise, enter zero ............................

11.

12. If line 4 is greater than or equal to line 10, subtract line 10

from line 4 and enter it here. Then go to line 6 of the next

column. Otherwise, go to line 13 .......................................

12.

13. If line 10 is larger than line 4, subtract line 4 from line 10

and enter it here. Then go to line 6 of next column ...........

13.

PART 2: FIGURING INTEREST

A

B

C

D

14. TOTAL UNDERPAYMENT. Add lines 11 and 12 ................. 14.

15. Enter due date for the next quarter or date tax was paid,

whichever is earlier. In column D, enter the due date for the

annual return or date tax was paid, whichever is earlier ...... 15.

16. Number of days from the due date of the quarter to the

date on line 15 .................................................................... 16.

17. No. of days on line 16 after 04-15-12 and before 07-01-12 ..

17.

18. No. of days on line 16 after 06-30-12 and before 01-01-13 ..

18.

19. No. of days on line 16 after 12-31-12 and before 07-01-13 ..

19.

20. No. of days on line 16 after 06-30-13 and before 01-01-14 ..

20.

21. Number of days on line 17 x 4.25% (0.0425) x line 14 ....... 21.

365

22. Number of days on line 18 x 4.25% (0.0425) x line 14 ....... 22.

365

23. Number of days on line 19 x 4.25% (0.0425) x line 14 ....... 23.

365

24. Number of days on line 20 x *% x line 14 .......................... 24.

365

25. Interest on underpayment. Add lines 21 through 24 ........... 25.

00

26. Interest Due. Add line 25 columns A through D ...............................................................................................

26.

* Interest rate will be set at 1% above the adjusted prime rate for this period.

+

0000 2012 28 01 27 7

Continue on Page 2.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4