File pg. 9

SOCIAL SECURITY NUMBER

FIRST NAME

M.I.

LAST NAME

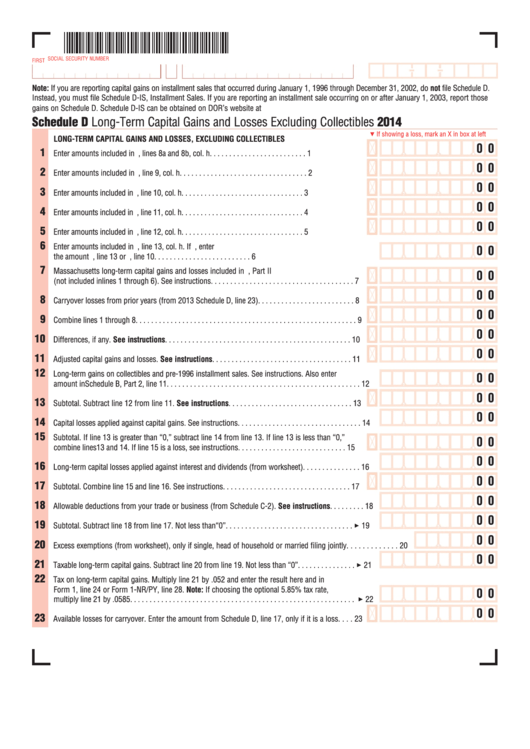

Note: If you are reporting capital gains on installment sales that occurred during January 1, 1996 through December 31, 2002, do not file Schedule D.

Instead, you must file Schedule D-IS, Installment Sales. If you are reporting an installment sale occurring on or after January 1, 2003, report those

gains on Schedule D. Schedule D-IS can be obtained on DOR’s website at

Schedule D Long-Term Capital Gains and Losses Excluding Collectibles

2014

If showing a loss, mark an X in box at left

5

LONG-TERM CAPITAL GAINS AND LOSSES, EXCLUDING COLLECTIBLES

0 0

1

Enter amounts included in U.S. Schedule D, lines 8a and 8b, col. h . . . . . . . . . . . . . . . . . . . . . . . . . 1

0 0

2

Enter amounts included in U.S. Schedule D, line 9, col. h. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

0 0

3

Enter amounts included in U.S. Schedule D, line 10, col. h . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

0 0

4

Enter amounts included in U.S. Schedule D, line 11, col. h . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

0 0

5

Enter amounts included in U.S. Schedule D, line 12, col. h . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6

Enter amounts included in U.S. Schedule D, line 13, col. h. If U.S. Schedule D not filed, enter

0 0

the amount from U.S. Form 1040, line 13 or U.S. Form 1040A, line 10 . . . . . . . . . . . . . . . . . . . . . . . . . 6

7

Massachusetts long-term capital gains and losses included in U.S. Form 4797, Part II

0 0

(not included in lines 1 through 6). See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

0 0

8

Carryover losses from prior years (from 2013 Schedule D, line 23). . . . . . . . . . . . . . . . . . . . . . . . . 8

0 0

9

Combine lines 1 through 8. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

0 0

10

Differences, if any. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

0 0

11

Adjusted capital gains and losses. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12

Long-term gains on collectibles and pre-1996 installment sales. See instructions. Also enter

0 0

amount in Schedule B, Part 2, line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

0 0

13

Subtotal. Subtract line 12 from line 11. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

0 0

14

Capital losses applied against capital gains. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15

Subtotal. If line 13 is greater than “0,” subtract line 14 from line 13. If line 13 is less than “0,”

0 0

combine lines 13 and 14. If line 15 is a loss, see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

0 0

16

Long-term capital losses applied against interest and dividends (from worksheet) . . . . . . . . . . . . . . . 16

0 0

17

Subtotal. Combine line 15 and line 16. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

0 0

18

Allowable deductions from your trade or business (from Schedule C-2). See instructions . . . . . . . . . 18

0 0

19

Subtotal. Subtract line 18 from line 17. Not less than “0” . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 19

0 0

20

Excess exemptions (from worksheet), only if single, head of household or married filing jointly . . . . . . . . . . . . . 20

0 0

21

Taxable long-term capital gains. Subtract line 20 from line 19. Not less than “0”. . . . . . . . . . . . . . . 3 21

22

Tax on long-term capital gains. Multiply line 21 by .052 and enter the result here and in

Form 1, line 24 or Form 1-NR/PY, line 28. Note: If choosing the optional 5.85% tax rate,

0 0

multiply line 21 by .0585 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 22

0 0

23

Available losses for carryover. Enter the amount from Schedule D, line 17, only if it is a loss. . . . 23

1

1