Form Rpd-41330 - Application For Alternative Energy Product Manufacturers Tax Credit

ADVERTISEMENT

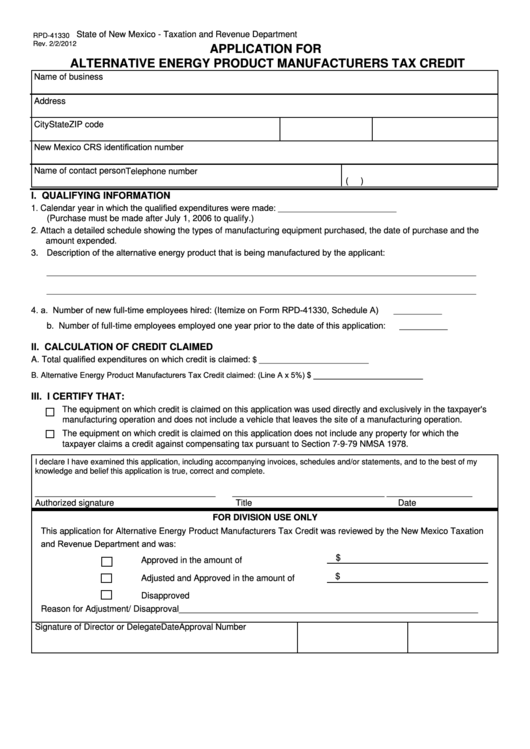

State of New Mexico - Taxation and Revenue Department

RPD-41330

Rev. 2/2/2012

APPLICATION FOR

ALTERNATIVE ENERGY PRODUCT MANUFACTURERS TAX CREDIT

Name of business

Address

City

State

ZIP code

New Mexico CRS identification number

Name of contact person

Telephone number

(

)

I. QUALIFYING INFORMATION

1

Calendar year in which the qualified expenditures were made:

.

___________________________

(Purchase must be made after July 1, 2006 to qualify.)

2

Attach a detailed schedule showing the types of manufacturing equipment purchased, the date of purchase and the

.

amount expended.

3. Description of the alternative energy product that is being manufactured by the applicant:

__________________________________________________________________________________________________

__________________________________________________________________________________________________

4. a. Number of new full-time employees hired: (Itemize on Form RPD-41330, Schedule A)

___________

b. Number of full-time employees employed one year prior to the date of this application:

___________

II. CALCULATION OF CREDIT CLAIMED

A. Total qualified expenditures on which credit is claimed:

$ _________________________

B.

Alternative Energy Product Manufacturers Tax Credit claimed: (Line A x 5%)

$ _________________________

III. I CERTIFY THAT:

The equipment on which credit is claimed on this application was used directly and exclusively in the taxpayer's

manufacturing operation and does not include a vehicle that leaves the site of a manufacturing operation.

The equipment on which credit is claimed on this application does not include any property for which the

taxpayer claims a credit against compensating tax pursuant to Section 7-9-79 NMSA 1978.

I declare I have examined this application, including accompanying invoices, schedules and/or statements, and to the best of my

knowledge and belief this application is true, correct and complete.

______________________________________

________________________________

__________________

Authorized signature

Title

Date

FOR DIVISION USE ONLY

This application for Alternative Energy Product Manufacturers Tax Credit was reviewed by the New Mexico Taxation

and Revenue Department and was:

$

Approved in the amount of

$

Adjusted and Approved in the amount of

Disapproved

Reason for Adjustment/ Disapproval_______________________________________________________________

Signature of Director or Delegate

Date

Approval Number

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6