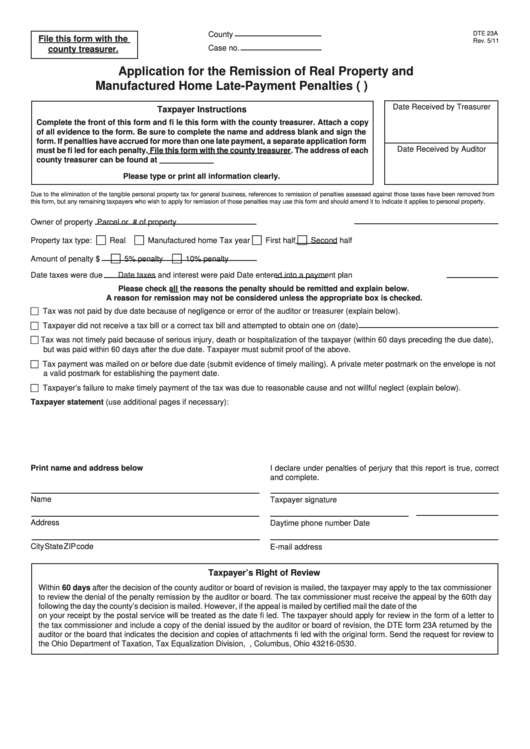

County

Reset Form

DTE 23A

File this form with the

Rev. 5/11

Case no.

county treasurer.

Application for the Remission of Real Property and

Manufactured Home Late-Payment Penalties (R.C. 5715.39)

Date Received by Treasurer

Taxpayer Instructions

Complete the front of this form and fi le this form with the county treasurer. Attach a copy

of all evidence to the form. Be sure to complete the name and address blank and sign the

form. If penalties have accrued for more than one late payment, a separate application form

Date Received by Auditor

must be fi led for each penalty. File this form with the county treasurer. The address of each

county treasurer can be found at

Please type or print all information clearly.

Due to the elimination of the tangible personal property tax for general business, references to remission of penalties assessed against those taxes have been removed from

this form, but any remaining taxpayers who wish to apply for remission of those penalties may use this form and should amend it to indicate it applies to personal property.

Owner of property

Parcel or I.D.# of property

Real

Manufactured home

First half

Second half

Property tax type:

Tax year

5% penalty

10% penalty

Amount of penalty $

Date taxes were due

Date taxes and interest were paid

Date entered into a payment plan

Please check all the reasons the penalty should be remitted and explain below.

A reason for remission may not be considered unless the appropriate box is checked.

Tax was not paid by due date because of negligence or error of the auditor or treasurer (explain below).

Taxpayer did not receive a tax bill or a correct tax bill and attempted to obtain one on (date)

Tax was not timely paid because of serious injury, death or hospitalization of the taxpayer (within 60 days preceding the due date),

but was paid within 60 days after the due date. Taxpayer must submit proof of the above.

Tax payment was mailed on or before due date (submit evidence of timely mailing). A private meter postmark on the envelope is not

a valid postmark for establishing the payment date.

Taxpayer’s failure to make timely payment of the tax was due to reasonable cause and not willful neglect (explain below).

Taxpayer statement (use additional pages if necessary):

Print name and address below

I declare under penalties of perjury that this report is true, correct

and complete.

Name

Taxpayer signature

Address

Daytime phone number

Date

City

State

ZIP code

E-mail address

Taxpayer’s Right of Review

Within 60 days after the decision of the county auditor or board of revision is mailed, the taxpayer may apply to the tax commissioner

to review the denial of the penalty remission by the auditor or board. The tax commissioner must receive the appeal by the 60th day

following the day the county’s decision is mailed. However, if the appeal is mailed by certifi ed mail the date of the U.S. postmark placed

on your receipt by the postal service will be treated as the date fi led. The taxpayer should apply for review in the form of a letter to

the tax commissioner and include a copy of the denial issued by the auditor or board of revision, the DTE form 23A returned by the

auditor or the board that indicates the decision and copies of attachments fi led with the original form. Send the request for review to

the Ohio Department of Taxation, Tax Equalization Division, P.O. Box 530, Columbus, Ohio 43216-0530.

1

1 2

2