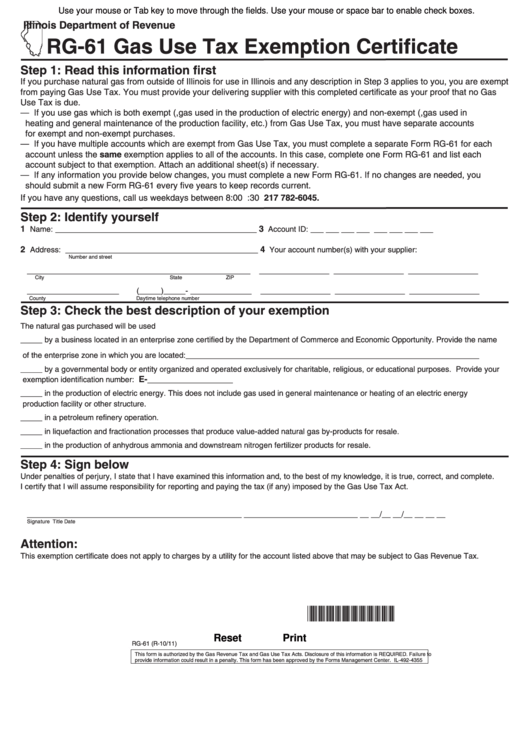

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

RG-61 Gas Use Tax Exemption Certificate

Step 1: Read this information first

If you purchase natural gas from outside of Illinois for use in Illinois and any description in Step 3 applies to you, you are exempt

from paying Gas Use Tax. You must provide your delivering supplier with this completed certificate as your proof that no Gas

Use Tax is due.

— If you use gas which is both exempt (e.g., gas used in the production of electric energy) and non-exempt (e.g.,gas used in

heating and general maintenance of the production facility, etc.) from Gas Use Tax, you must have separate accounts

for exempt and non-exempt purchases.

— If you have multiple accounts which are exempt from Gas Use Tax, you must complete a separate Form RG-61 for each

account unless the same exemption applies to all of the accounts. In this case, complete one Form RG-61 and list each

account subject to that exemption. Attach an additional sheet(s) if necessary.

— If any information you provide below changes, you must complete a new Form RG-61. If no changes are needed, you

should submit a new Form RG-61 every five years to keep records current.

If you have any questions, call us weekdays between 8:00 a.m. and 4:30 p.m. at 217 782-6045.

Step 2: Identify yourself

1

3

Name: ______________________________________________

Account ID: ___ ___ ___ ___ ___ ___ ___ ___

2

4

Address: _ ___________________________________________

Your account number(s) with your supplier:

Number and street

___________________________________________________

________________ ________________ ________________

City State ZIP

_____________________ (_____)_____- ______________

________________ ________________ ________________

County Daytime telephone number

Step 3: Check the best description of your exemption

The natural gas purchased will be used

_____ by a business located in an enterprise zone certified by the Department of Commerce and Economic Opportunity. Provide the name

of the enterprise zone in which you are located:___________________________________________________________________

_____ by a governmental body or entity organized and operated exclusively for charitable, religious, or educational purposes. Provide your

E-__________________

exemption identification number:

_____ in the production of electric energy. This does not include gas used in general maintenance or heating of an electric energy

production facility or other structure.

_____ in a petroleum refinery operation.

_____ in liquefaction and fractionation processes that produce value-added natural gas by-products for resale.

_____ in the production of anhydrous ammonia and downstream nitrogen fertilizer products for resale.

Step 4: Sign below

Under penalties of perjury, I state that I have examined this information and, to the best of my knowledge, it is true, correct, and complete.

I certify that I will assume responsibility for reporting and paying the tax (if any) imposed by the Gas Use Tax Act.

_________________________________________________ __________________________

__ __/__ __/__ __ __ __

Signature

Title

Date

Attention:

This exemption certificate does not apply to charges by a utility for the account listed above that may be subject to Gas Revenue Tax.

*042711110*

Reset

Print

RG-61 (R-10/11)

This form is authorized by the Gas Revenue Tax and Gas Use Tax Acts. Disclosure of this information is REQUIRED. Failure to

provide information could result in a penalty. This form has been approved by the Forms Management Center. IL-492-4355

1

1