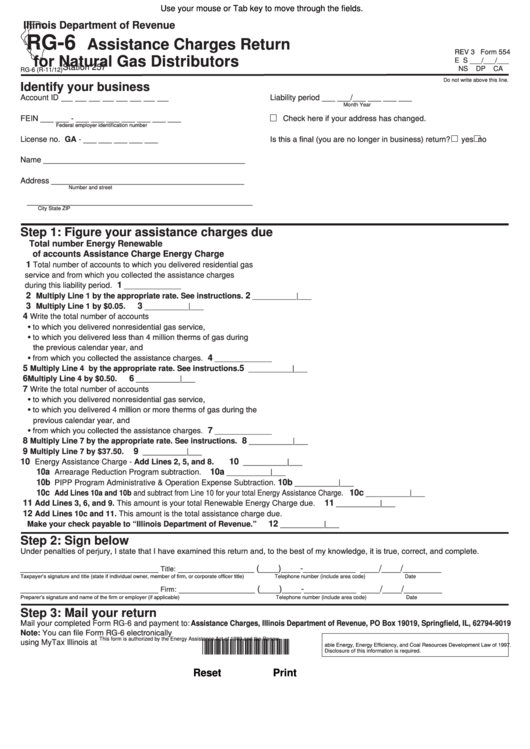

Use your mouse or Tab key to move through the fields.

Illinois Department of Revenue

RG-6

Assistance Charges Return

REV 3 Form 554

for Natural Gas Distributors

E S ___/___/___

Station 257

NS

DP

CA

RG-6 (R-11/12)

Do not write above this line.

Identify your business

Account ID __ __ __ __ __ __ __ __

Liability period ___ ___/___ ___ ___ ___

Month

Year

Check here if your address has changed.

FEIN

___ ___ - ___ ___ ___ ___ ___ ___ ___

Federal employer identification number

Is this a final (you are no longer in business) return?

License no. GA - ___ ___ ___ ___ ___

yes

no

Name

______________________________________________

Address

____________________________________________

Number and street

___________________________________________________

City

State

ZIP

Step 1: Figure your assistance charges due

Total number

Energy

Renewable

of accounts

Assistance Charge

Energy Charge

1

Total number of accounts to which you delivered residential gas

service and from which you collected the assistance charges

1

during this liability period.

_____________

2

2

Multiply Line 1 by the appropriate rate. See instructions.

__________|___

3

3

Multiply Line 1 by $0.05.

__________|___

4

Write the total number of accounts

• to which you delivered nonresidential gas service,

• to which you delivered less than 4 million therms of gas during

the previous calendar year, and

• from which you collected the assistance charges.

4

_____________

5

5

Multiply Line 4 by the appropriate rate. See instructions.

__________|___

6

6

Multiply Line 4 by $0.50.

__________|___

7

Write the total number of accounts

• to which you delivered nonresidential gas service,

• to which you delivered 4 million or more therms of gas during the

previous calendar year, and

• from which you collected the assistance charges.

7

_____________

8

8

Multiply Line 7 by the appropriate rate. See instructions.

__________|___

9

9

Multiply Line 7 by $37.50.

__________|___

10

10

Energy Assistance Charge - Add Lines 2, 5, and 8.

__________|___

10a

10a

Arrearage Reduction Program subtraction.

__________|___

10b

10b

PIPP Program Administrative & Operation Expense Subtraction.

__________|___

10c

10c

Add Lines 10a and 10b and subtract from Line 10 for your total Energy Assistance Charge.

__________|___

11

11

Add Lines 3, 6, and 9. This amount is your total Renewable Energy Charge due.

__________|___

12

Add Lines 10c and 11. This amount is the total assistance charge due.

12

Make your check payable to “Illinois Department of Revenue.”

__________|___

Step 2: Sign below

Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true, correct, and complete.

_____________________________

________________

(____)____-___________

____/____/________

Title:

Taxpayer’s signature and title (state if individual owner, member of firm, or corporate officer title)

Telephone number (include area code)

Date

_____________________________

________________

(____)____-___________

____/____/________

Firm:

Preparer’s signature and name of the firm or employer (if applicable)

Telephone number (include area code)

Date

Step 3: Mail your return

Mail your completed Form RG-6 and payment to: Assistance Charges, Illinois Department of Revenue, PO Box 19019, Springfield, IL, 62794-9019

Note: You can file Form RG-6 electronically

This form is authorized by the Energy Assistance Act of 1989 and the Renew-

using MyTax Illinois at tax.illinois.gov.

*255401110*

able Energy, Energy Efficiency, and Coal Resources Development Law of 1997.

Disclosure of this information is required.

Reset

Print

1

1